|

|

|

|

Hello Subscriber, we're thinking about our younger selves!

|

Personal Finance in Your 20s

I just finished up writing a post that forms a retrospective on myself in 2008. I uncovered some old notes about why increasing income isn't necessarily always worth it. It works as a prescient precursor to my post about turning down a $175K salary.

|

While writing it, I started looking through old photos from that time period in our digital archive. It's fun to see those old shots and remember a different life. Jenni and I were just 23 or 24 years old, living in a rented house and making foolish purchasing decisions like a used Mercedes. But, we also spent on more worthwhile stuff too: flights to friends around the country, adventures overseas.

|

|

It was the year I entered the Peace Corps, too.

|

|

|

Switching from that rented house to a tin roof in Nicaragua was a pretty drastic change. I went on a trip with a buddy that year throughout Central America, hiking volcanoes, and busing across the region. Our hostels had dirt floors and rarely AC. We saw exceptional poverty in our journey, at least, relative to our suburban lifestyle experiences in the US.

|

All the memories from those photos had me wondering if maybe experiencing life first-hand in these places helped offer a picture of what life could be for me while still young and impressionable. Perhaps it helped reset expectations and offer a broader spectrum of what the middle-class is in America relative to the world at large.

|

Even today, our close friends and family live pretty different lives from us in terms of spending. I don't think Jenni or I feel like we're missing out on much, but we value certain aspects of life in a way that isn't always congruous with our peers' views.

|

I wonder how much of the point of view we have on standards of living and our natural spending tendencies were influenced by our travel and volunteerism around the globe in our 20s?

|

Check out that latest post on the Marginal Utility of Income and leave a comment about your experience with personal finance in your 20s. We're both quite curious!

|

Reader’s Choice Charitable Fund

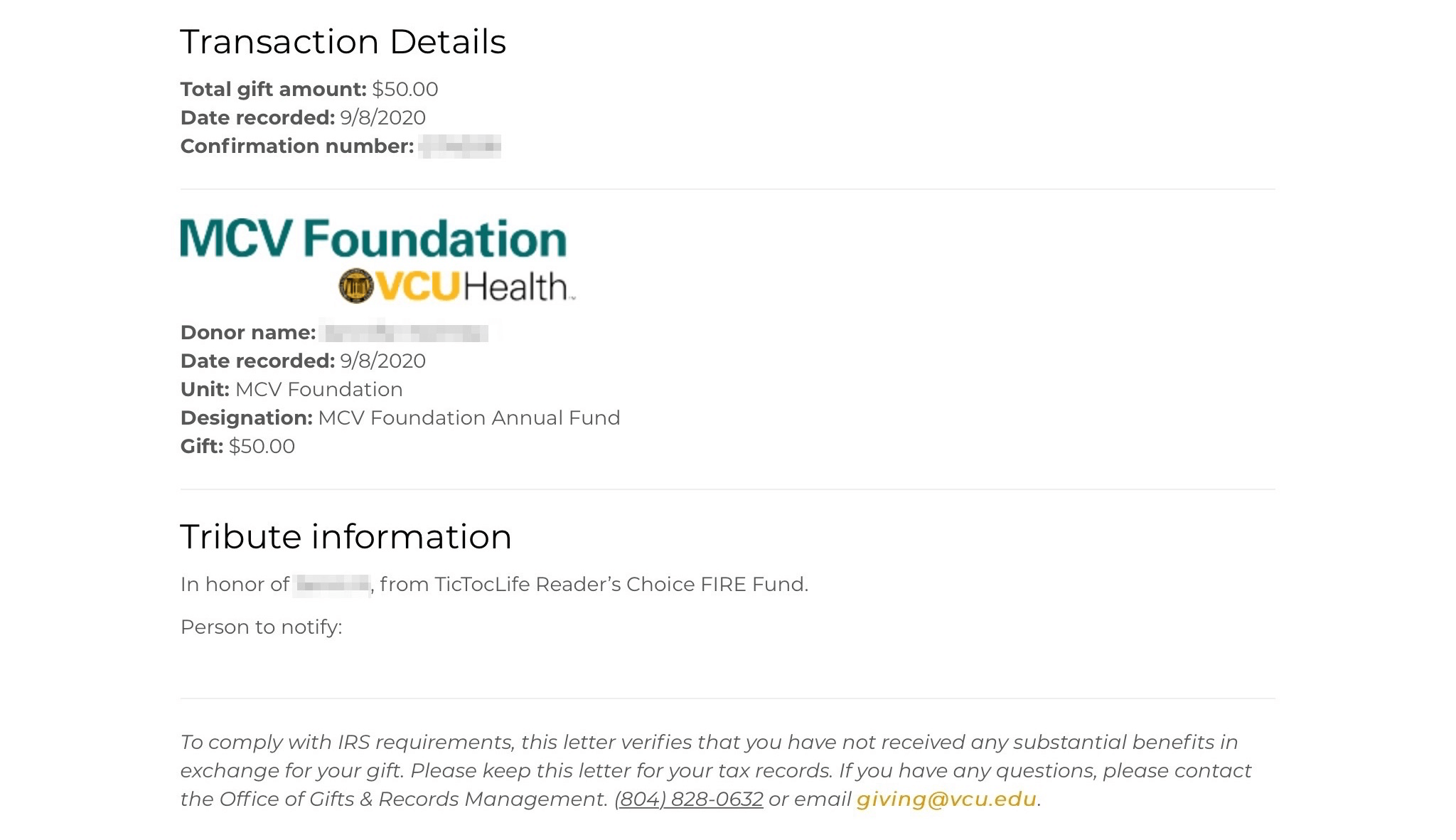

We posted our monthly budget update for August last week. We run through our income and expenses, net worth changes, and a few general financial updates. We also revealed the winner of last month's charitable fund poll.

|

|

It was the Medical College of Virginia! Jenni made the donation directly to MCV in order to take better advantage of some charitable tax changes in the CARES Act. We've updated the charitable fund's donor-advised fund (DAF) balance with our monthly contribution and this payment as well as a balance check-in.

|

|

|

|

But, perhaps most importantly, we started a new poll for our next donation. For our September donation, we're focusing on "back to school" and the needs of children during this challenging time. Even if you're uninterested in our monthly budget updates, take a moment to review our three children's education charities and vote for which one will receive our monthly grant.

|

|

|

|

|

|

|

Personal Finance Favorites on the Web

- Early Retirement in One Lesson (or How I Retired at 30)

Mr. Money Mustache republished his talk at the World Domination Summit from 2016 about how his family retired at 30 on his own YouTube channel. If you happened to miss it, it's a great intro to FIRE and Mustachian ways. It's an ideal, easy to consume introduction to becoming more rational with your spending. A great one to share with your friends and family who aren't into FIRE as it's very approachable.

- Let's Celebrate Quitting

|

Sometimes quitting is just what you need to do: step back, reset, approach from a new angle. Failure is undervalued. Dave says we should "Celebrate Quitting".

|

- They Retired at the Worst Time

We listened to Leif and Rayce's (Physician on FIRE) retire early story on the Earn & Invest podcast while on a bit of a road trip recently. Doc G does a great job of surfacing their experience with FIRE and decision to move from an exceptionally high cost of living (as physicians tend to have) to much simpler living in Rayce's hometown. They moved into a $90K house in Michigan! They've got a great story as they've moved into a more serious retirement phase during the pandemic just like we have.

- Early Retirement Blogs for Everyone

Joe highlights some great side hustle ideas you may not have thought of and a large selection of FIRE blogs out on the web, including some newer entrants. There's a ton of great resources listed and there's a good chance you can find one that fits your demographic, age, and interests to join another FIRE journey or have your questions answered. The palette of choices can be a good way to get friends or family hooked into the FIRE idea.

|

|

|

See an article from our favorites a friend might like? Forward this newsletter onto them!

|

|

|

|

|

|

Our Latest Posts

|

Incase you missed one, here's our latest posts since our last newsletter:

|

|

|

|

|

Animal Shelters in Virginia and Our September 2020 Budget

|

|

|

We review animal shelters in VA for our monthly donation, detail last month's budget, and award a charitable grant to a children's education non-profit!

|

|

|

|

|

|

|

|

Buy vs Rent and Invest: Planning for Financial Independence

|

|

|

Here's how to analyze your own buy vs rent and invest scenario, deciding to invest in either needs to be part of your financial independence plan!

|

|

|

|

|

|

|

|

When to Pay Off Your Mortgage or Invest Extra Capital

|

|

|

Should you pay off your mortgage or invest extra money? Besides the return on investment difference, sometimes you want to reduce your income.

|

|

|

|

|

|

|

|

If you found an article we wrote that a friend might like, forward this newsletter to them!

|

|

|

|

|

|

We're most active on social media here:

|

|

|

|

|

|

Thanks again for subscribing to our infrequent newsletter. We both hope you're enjoying TicTocLife as much as we are. If you have feedback about this newsletter, you can reply directly or use our Contact form.

|

|

|

|

|