|

|

|

|

This Is What FI Is to Us

We've been working "behind the scenes" on a couple of interviews/guest posts the past few weeks that reveal a lot about how we reached financial independence and what it means to us. Our entry in Financial Mechanic's series on "How Financial Independence Changed Our Lives" just went live. Check it out, you might be surprised to hear how we think FI didn't change a thing—at least from the perspective of others!

|

We covered a lot of topics, but here are some highlights:

|

- What happened the day we reached FI

- Our FI timeline (2011 to today)

- What it means to "work" now

- How FI gave us the freedom to choose to be healthy

- What happens when the structure of your life (through work and career progression) is thrown out the window and you have to manage your own time

- The value of confidence—both in calculations, but also in mentality

We think you'll enjoy the story if you follow our journey.

|

|

|

And for a more general overview of how we got to where we are and our personal histories, Personal Finance Blogs showcased our "Know Your Blogger" series entry for a week in late January.

|

We answered lots of questions, but here are some highlights:

|

- What makes you and your blog unique?

- What does “being good with your personal finances” mean to you?

- What are some habits you practice to keep your personal finances in order?

- For someone looking to improve their financial situation, what’s your best advice?

- What’s an area of your life which has benefited from improving your personal finances? Have there been any areas of your life that have suffered?

- In your opinion, what’s better? Focusing on increasing your income, or focusing on decreasing your expenses?

- Do you have any financial mistakes you’d like to share, and how have you grown from these mistakes to improve your personal finances?

- What’s a non-money related interest you have and what do you love about it?

- Why do you believe learning about money and caring about personal finance is important?

|

|

Recent Writing Recap

In our latest blog posts, we write about our concerns for the stock market, recap our annual FIRE budget for 2020, and deliver January's monthly budget review. Be sure to cast your vote in this month's donation poll for racial equality organizations! It only takes a moment and helps us get the word out (direct link)!

|

Our latest blog posts include:

|

- FIRE Budget In-Depth: Unusual Ways We Spent $40,862 in 2020

- GameStop Stock: Why I Worry About the Mania (And VTSAX)

- 4 Charities for Racial Equality (and Our January 2021 Budget Review!)

|

We'll run through a little summary of each of these three posts below before proceeding with our monthly donation update and several article/podcast recommendations from the last few weeks around the web!

|

|

Our $41K FIRE budget

How a mid-30s couple managed to spend just under $41K in 2020 without feeling like they were skimping—all while that'd mean an equivalent SWR of just 2.2%. Plenty of spending-category-related tips/inspiration to help you manage your own expenses and little bits of wisdom.

|

|

|

|

2020 may not have been the year we expected within our FIRE budget, but that doesn't mean we didn't make the best of it!

|

|

|

|

GameStop Mania

It's a David and Goliath story. Individual investors vs Wall Street institutions! But what's going to happen at the end of this? Is this Tulipmania 2.0? Or are we seeing amateur investors wage a successful war against normal market forces in an effort to show hedge funds what's wrong with activist short selling?

|

|

|

|

Chris grew up with GameStop as the place to go to find a deal on used video games. Now the stock is on a tear as amateur investors wage war against hedge funds. What's going to happen?

|

|

And it's all happening over the shadow of a company known for selling video games, collectibles, and game hardware riding a wave of nostalgia and memes.

|

|

|

Starting 2021 off with a 52% savings rate

|

January was over in the blink of an eye. We recap what we have been up to, how we spent our money, and Chris's update on his yearly theme, discomfort.

|

Some highlights:

-Using an AMEX Biz Plat to turn a $317 expense into a $255 profit

-Paying for all groceries expenses with Chase points on an excellent redemption

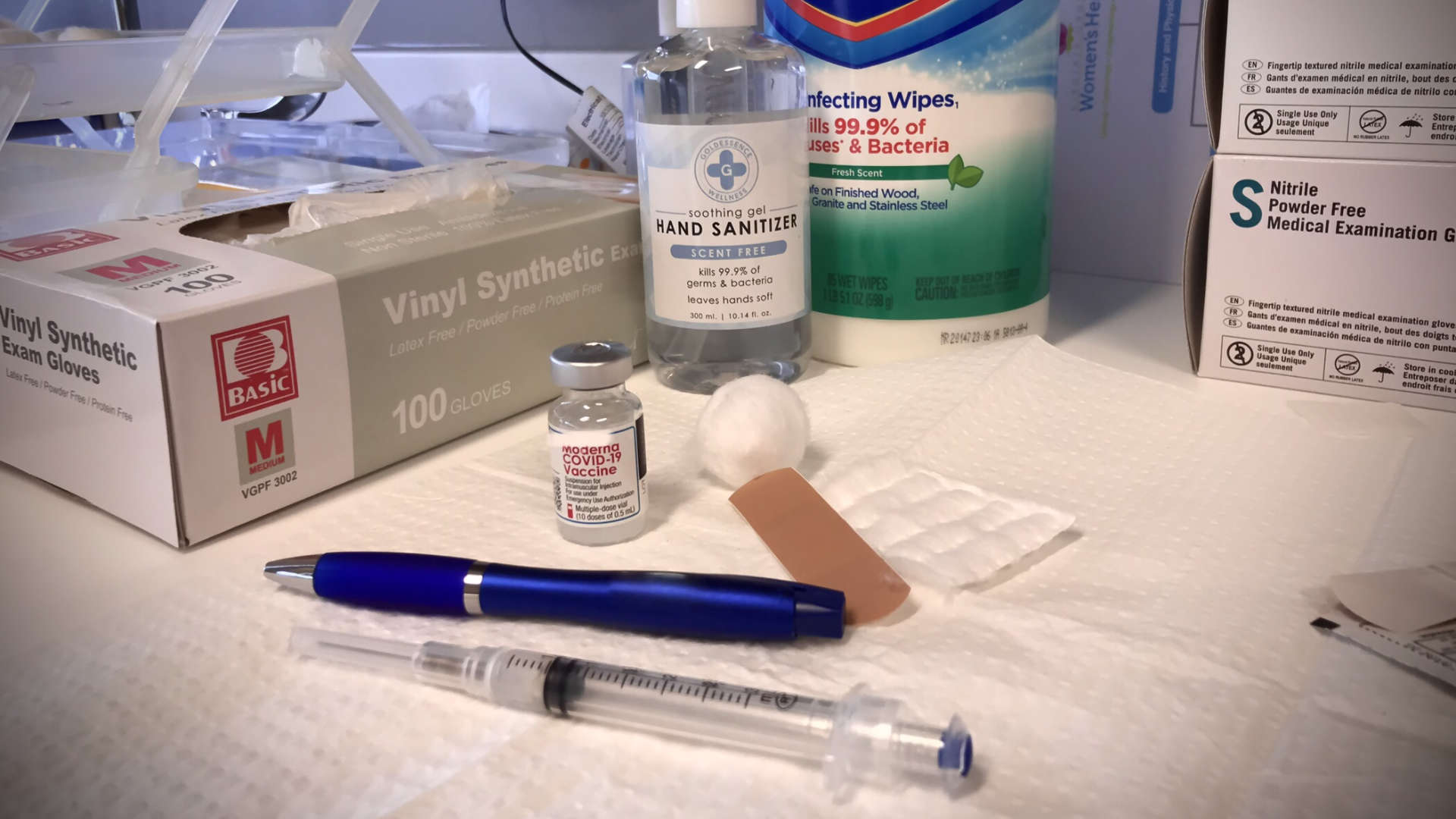

-A revealing look at semiretirement whether hunting down just the right couch or vaccinating our citizenry

|

We celebrate Black History month with our monthly poll highlighting four charities for racial equality. Each organization has excellent profile ratings on Guidestar. We hope that you will take a few minutes to learn about these organizations and cast your vote.

|

The winner will receive our first monthly donation for 2021.

|

|

|

|

|

|

Jenni is happy to give her time to help administer the COVID-19 vaccine in her extra time.

|

|

Take a few minutes to review these organizations and cast your vote. We want our reader's voices to be heard as we try to give back to end inequalities.

|

|

|

Get to know the writers behind TicTocLife

This interview just went live today!

|

INTERVIEW → Tell Us About TicTocLife

We were featured on Personal Finance Blogs in their "Know Your Blogger" series for the week of January 25. The newsletter campaign has brought us some new readers and shed light on our money backgrounds!

|

|

|

|

|

|

Monthly Giving through our Reader's Choice DAF

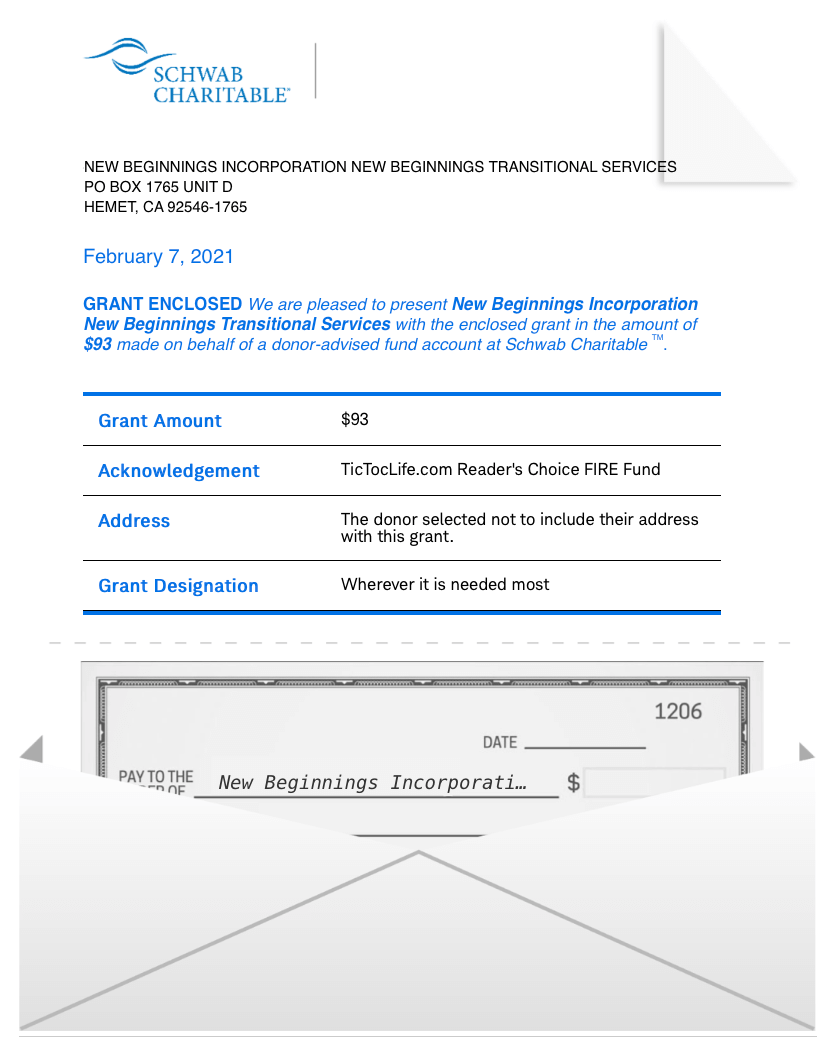

Our readers voted and choose to support New Beginnings Incorporation. There are more than 40,000 homeless veterans in America. This organization helps struggling veterans find secure housing and feed their families.

|

It’s neat to see our monthly donation growing, now closing in on triple digits! February's donation should be the first one over $100. By the time we’re near normal retirement age, it’s easy to see how the fund could grow to $250K and donations would be in excess of $800/month! That’s the power of FIRE and compound interest!

|

|

|

|

|

|

Personal Finance Favorites on the Web

Below are the articles we've read since the last newsletter that really struck a chord with either of us. Give them a read, check out the authors, expand your information sources with these quality creators.

|

- Raising kids in the developing world

Cutting Through Chaos

Have you ever thought about making a huge leap and leaving the luxury of the developed world for the developing?

And what about your kids?

- Grease The Groove To Financial Independence

Accidental FIRE

What does a strength-building technique have to do with reaching financial independence? More than you might think. 5 pull-ups won't make you Mr. Universe any more than a $5 Starbucks is going to break the bank, but it's the routine and process over the longterm the builds true strength...and true wealth.

- Short Term Madness Vs. Long Term Winners

Mr. Tako Escapes

We've run into a couple of market bubbles that are (at the time of writing) in some state of inflation or deflation. It's a little ugly out there. Or maybe it's been a fantastic run—depending on which side you're on. Either way, Tako gives us a little perspective and shares an old post (which I think is even more timeless: Farmers, Hunters and Investing for FI) that has him arguing the market is working just as it should.

- 3 Reasons Why I Don’t Have a New Car Fund

Retire By 40

Do you like the idea of a "new car fund"? Joe shares three reasons it might not be such a hot idea if you're a typical Mustachian. Then again, if you're still just dipping your toes in, we think specific savings funds (like a car fund) can be smart mental constructs to help keep your savings protected from fun money spending! What do you think?

- When rules bring freedom

Get Rich Slowly

This post from J.D. isn't really long or even really focused on money, but it does offer a pretty critical insight from the rules wrapped around poetry that J.D. discusses:

Sometimes limits and rules can be a source for creativity. Lots of people do "no spend" months or weeks. It's not really my cup of tea, but the real value that comes from them is in the forced challenge of finding novel ways to complete a task, fill a need—to get things done. That might just reveal a pathway you never would have thought of before.

- The Margin Loan: How to Make a $400,000 Impulse Purchase

Mr. Money Mustache

MMM figured out a way to get access to some very cheap margin to buy the house next door to help out some friends in their purchasing process. It's a pretty novel approach and might be smart in some very specific situations.

- Scared to Death of Early Retirement, No More. An Update.

Go Curry Cracker!

GCC brings us an update on "The Bobs"—a couple that was scared to death of early retirement 6 years ago. But they pulled the trigger. How's that played out?

- The GameStop Short Squeeze Explained: 10 Questions and Answers

The Best Interest

If you're curious about what's been going on with GameStop and haven't kept up, here's a solid summary. Just the facts, ma'am.

- Is There Really Such A Thing As Bad Luck?

Happily Disengaged

Has luck (good or bad!) created surprising forks in the road on your path to success? Noel shares his experience in the building trades with luck and surprising fortune.

- Make Your Money Conversations less Awkward

Earn & Invest (Podcast)

Doc G talks with Erin Lowry about prenups, salaries, and estate planning with your parents. It's all the awkward money conversations we all try to avoid rolled into one discussion about ways to avoid problems and tips to minimize the awkwardness.

|

|

|

|

|

|

|

As always, thank you for joining us on our journey! We both hope that our little interviews and guest posts offer more insight as to what it's like to transition from financial independence to early retirement.

|

We're still in that semiretirement phase as we both feel a need to support vital initiatives during the pandemic. But, our hope is that we have exciting travel adventures to share later this year!

|

And of course, we've got more writing related to FIRE and our journey coming to you this month so keep tuned. You might even see us in an upcoming feature! ;-)

|

|

|

|

See an article from our favorites a friend might like? Forward this newsletter onto them!

|

|

|

|

|

|

Our Latest Posts

|

Incase you missed one, here's our latest posts since our last newsletter:

|

|

|

|

|

4 Charities for Racial Equality (and Our January 2021 Budget Review!)

|

|

|

We review four charities for racial equality for our donation, Chris gives an update on his Yearly Theme, and we review our January 2021 monthly budget!

|

|

|

|

|

|

|

|

GameStop Stock: Why I Worry About the Mania (And VTSAX)

|

|

|

What does GameStop stock mania mean for the future of individual investors vs Wall Street? And do you own GME via VTSAX, VTI, and Vanguard?

|

|

|

|

|

|

|

|

FIRE Budget In-Depth: Unusual Ways We Spent $40,862 in 2020

|

|

|

Our FIRE budget reveals how we live a luxurious lifestyle on about $41K/year as two 36-year-olds in an MCOL city on a coast! Steal our tricks to reach FIRE!

|

|

|

|

|

|

|

|

If you found an article we wrote that a friend might like, forward this newsletter to them!

|

|

|

|

|

|

We're most active on social media here:

|

|

|

|

|

|

Thanks again for subscribing to our infrequent newsletter. We both hope you're enjoying TicTocLife as much as we are. If you have feedback about this newsletter, you can reply directly or use our Contact form.

|

|

|

|

|