|

|

|

|

Hello Subscriber, this Sunday we're thinking about time!

|

Evaluating the Cost of Time

|

We're in the dog days of summer, having just returned from a trip to North Carolina's Outer Banks. We had our first pandemic hotel experience and recharged on the beach. We had family staying nearby at a beach house that we were able to visit and enjoy the sun and sand outdoors with, socially distanced.

|

|

|

|

A little time away sparked a discussion between us about how we value time. While moseying down the beach, we entertained the idea that it seems a little weird how traditionally society thinks of the value of time as based on hourly wages. It makes sense from a labor standpoint, but what about from a retirement standpoint?

|

If you don't make money anymore, does that make your time worthless? That doesn't make much sense. In the world of FIRE, we focus a lot on spending (savings rate) since it dictates your retirement horizon more so than absolute income. Why don't we value time from a similar perspective?

|

|

We muddled through this idea traversing the ocean's edge with biplane skirting by us drawing an ad behind it for the local Brew Thru. The idea percolated while we hiked up the massive dunes of Kitty Hawk and chased family bounding down the other side.

|

|

|

Eventually, it became our latest post--complete with a Google Sheet calculator--about the value of time. We plugged in our own numbers ($77K average income per person, a 35-year-old retirement age, etc.) and compared it to a more typical retirement route. A person who saved 15% of the same income and retired at 65. What would the difference be in terms of how much they spent over their adult careers and retirement? How much more time, freed from work, would the early retiree have?

|

You'll have to give the post a read and plug in your own numbers to see what it'd look like for your scenario! It ties in very nicely with our recent post about Jenni's quest for personal fulfillment and how success at work is merely a component part.

|

From Our Readers

Reader Mike reached out last week to ask a variety of questions about reaching FIRE through real estate investing. We ended up building our first reader case study and a few folks have offered some great feedback to Mike about ways to accelerate his family's path to financial independence. If you're in the real estate investing world, check it out and maybe add a comment with your own advice. Mike is actively watching the post for more feedback!

|

And lastly, we've been very happy to see interest in our Reader’s Choice FIRE Fund! As of writing, the Medical College of Virginia is winning out (barely!) for our first reader directed monthly non-profit donation. Help us decide which non-profit we should give to on September 1, 2020, by voting on the fund's page! Stay tuned in early September to see the finalists for who we're giving a grant to next month!

|

On Preparedness

|

|

|

Murphy's law was in full force when a nail found its way into Jenni's tire during our beach trip.

|

Before we left, we went over the dozens of ways we could potentially wind up interacting with locals and spreading COVID. We tried to think ahead to avoid stopping for gas, food, etc. We also checked the spare's air and had a plug kit handy.

|

|

Thankfully. A 5 minute plug fix avoided potential catastrophe. Always be prepared, now more than ever!

|

|

|

|

|

|

|

Personal Finance Favorites on the Web

- Socially Responsible Investing: Is It Also More Profitable?

Mr. Money Mustache has yet another new post out (a recent record as he's not been writing much!). This time, he focuses on how to use your investments to support (or, avoid) causes you agree with through socially responsible investing.

- Boring But Big

Backpack Finance talks about what is known as the "boring middle" in FIRE terms. That's the period of time after learning about FIRE, making changes to your spending habits, and automating your investments. But before you actually reach financial independence. This is the bulk of your FIRE timeline: following a routine of building your portfolio and, hopefully living the life you've built! It might seem a little boring, but it's this routine (and your ability to sustain it) that leads you to financial freedom.

- It's the Perfect Time for DIY Haircuts!

For something a little lighter, our friend Chrissy talks about how to up your DIY haircut game. We're still struggling through the pandemic in the US, and it might be a while still. Get your practice in with at-home haircuts so you'll look a little better for the winter holidays.

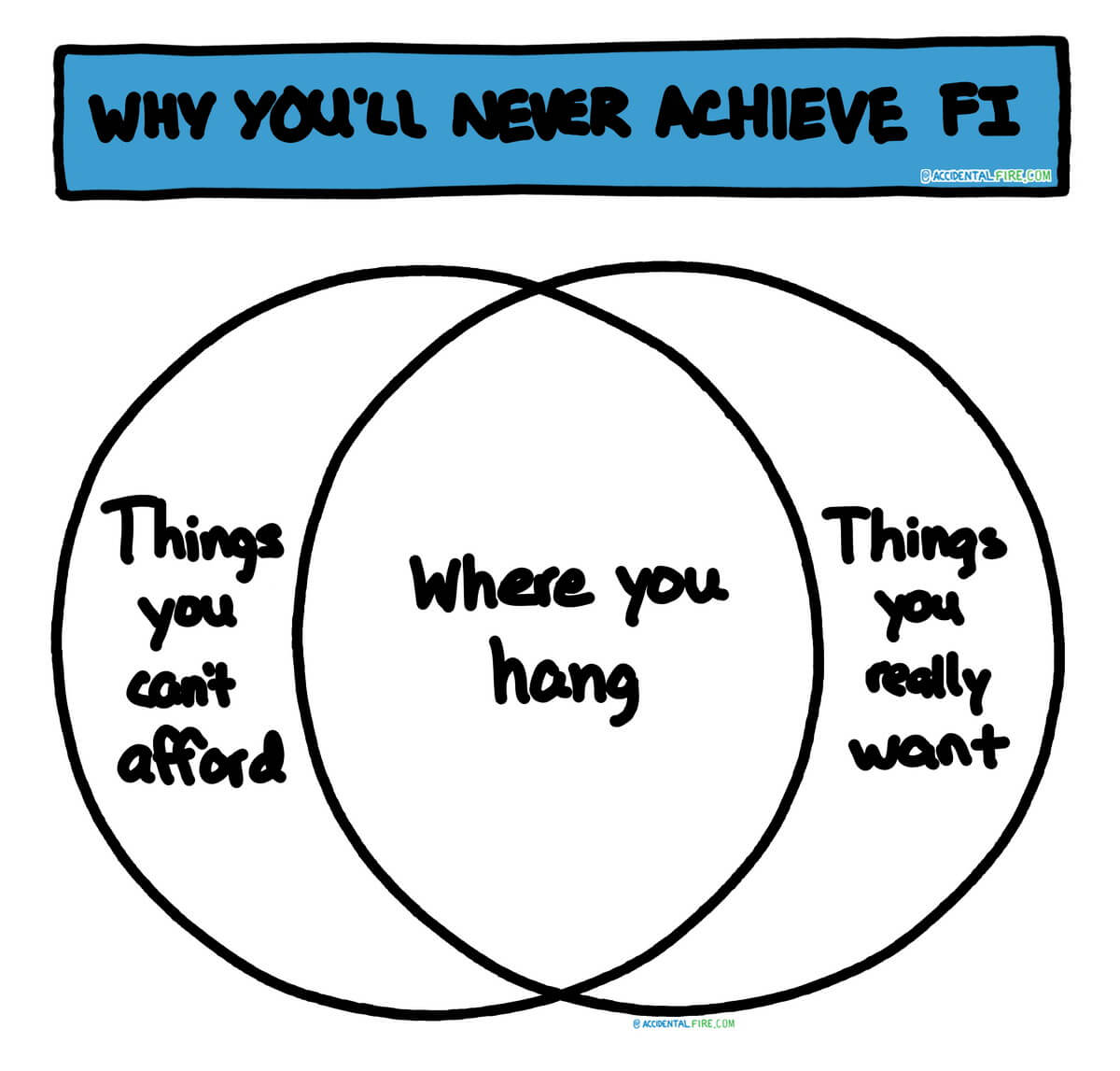

- Why You’ll Never Achieve Financial Independence

Dave continues his series of poignant FIRE sketches. It'll take a moment to realize what the point is, but we think you'll like it:

|

|

|

|

See an article from our favorites a friend might like? Forward this newsletter onto them!

|

|

|

|

|

|

Our Latest Posts

|

Incase you missed one, here's our latest posts since our last newsletter:

|

|

|

|

|

Marginal Utility of Income and How to Build Wealth in Your 20s

|

|

|

In my 20s I wrote about different standard of living levels and diminishing returns as my salary increased. Could understanding the marginal utility of income help you build wealth?

|

|

|

|

|

|

|

|

Children’s Education Charities and Our August 2020 Budget

|

|

|

We review children's education charities for our October donation, report our August budget, and award a charitable grant to a university!

|

|

|

|

|

|

|

|

VTSAX vs VTI: Buy the Total US Stock Market & Alternatives

|

|

|

We've been collecting tiny slices of thousands of companies over the years. Let's compare frugal ways you can too with low-cost index funds: VTSAX vs VTI, SWSTX, FSKAX.

|

|

|

|

|

|

|

|

If you found an article we wrote that a friend might like, forward this newsletter to them!

|

|

|

|

|

|

We're most active on social media here:

|

|

|

|

|

|

Thanks again for subscribing to our infrequent newsletter. We both hope you're enjoying TicTocLife as much as we are. If you have feedback about this newsletter, you can reply directly or use our Contact form.

|

|

|

|

|