Attempting to make a case for early retirement in the midst of a pandemic and the worst economic collapse since the Great Depression1 isn’t such a hot idea. Alas, here we are with a novel coronavirus and an early retirement plan. Jenni and I have been planning our transition to early retirement for a very long time. The next phase of that plan began months ago and the genie was already out of the bottle.

This past week, something hit pretty hard, making early retirement feel like it’s finally begun. Jenni received a letter from her employer that read like a “goodbye”—in fact, the email attachment was even titled “Jenni bye.doc”. I get the feeling the author was using a pre-existing template for departing employees.

Executing Our Early Retirement Plan

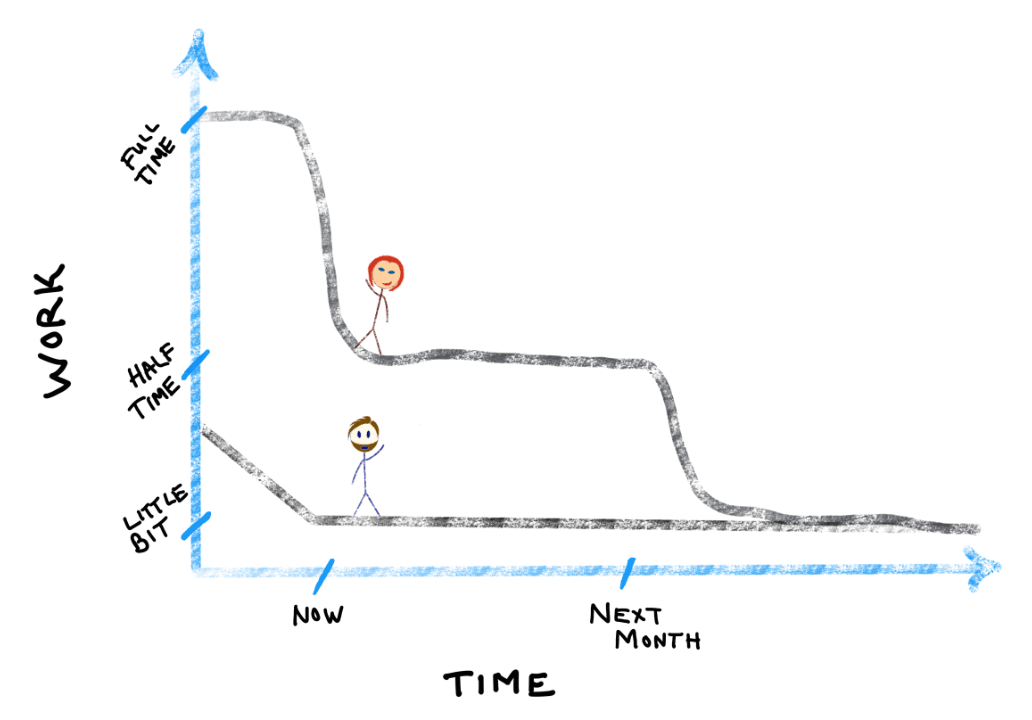

Despite that attachment title, Jenni has simply transitioned from a full-time 9-5 schedule (really: 8:30-6:30, some weekends, and being on-call) to a part-time schedule through mid-June.

It still hasn’t hit me that we’re really doing it.

A slight tangent, but it’s a funny thing: I had to re-write the previous sentence, changing “will transition” to “has transitioned”. It still hasn’t hit me that we’re really doing it. That’s despite having coffee and breakfast with her at 9:30 am today, followed by an afternoon walk around the neighborhood. She headed off to work a bit after 2:00 pm and should be back by dinner.

She’s still in that “half time” phase until mid-June. I suppose a pandemic is a good reason to delay things a little as she works in healthcare.

The real-time progress highlights something that I think is a bit different about our writing on TicTocLife compared to other places. We’re telling the story of the transition, as it happens, into early retirement. Our mistakes thought processes, and wins will all be exposed as they happen. It’s valuable to us to have a record, at the moment, of our expectations and unknowns—to see how this early retirement plan shapes up to reality.

Moving from full-time to part-time work

I asked myself “why do people work?” long ago, moving my focus to creation rather than money. Technically, I left my last full-time position late in 2011, closing in on nine years ago. While I’ve certainly had days stretching into the wee hours operating a couple of businesses since then, it looks more like The 4-Hour Workweek2 in the past year.

The wheels were set in motion for Jenni months ago. Her current employer was looking for a “PRN”—or “as needed”—pharmacist. Jenni offered herself up to the altar. It took some time for her position to wind down and be filled by a replacement. In March the murmurs of a pandemic-starting coronavirus, COVID-19, reached a scream. The company Jenni works for, a local pharmacy, was roiled by the shift in demand and procedural changes. Her employer has since found their footing with some reorganization and many late nights for the employees. She’s now back on the downward trajectory of retirement.

Jenni negotiated to remain in a position with a near half-time schedule through mid-June (June update: the full-time to part-time transition started a little early!). She’ll retain her health insurance and benefits until then. Even at half-time, we’ll have many more late morning strolls and leisurely breakfasts together while things continue to wind down. After that, I assume it’s nothing but pajamas, cheerios, and video games (mostly the video games that are good for you, I hope!).

Trading compensation for work that matters

Once Jenni’s schedule shifts to PRN in June, she’ll be working on projects that pique her interests. She’ll provide relief when other colleagues are out sick or on vacation. It’ll be her turn to enter that “4-hour workweek” phase. She’ll also lose her benefits.

Our short-term plan is to switch to COBRA (spoiler: that’s what happened), maintaining her current health insurance plan (and deductible use) at significant expense. During Open Enrollment later this year, we plan to evaluate switching to an ACA Marketplace health insurance plan. As it stands, the Marketplace plans are only slightly less expensive and with generally worse coverage. It’d also cause a deductible reset. COBRA gives us an 18-month window to resolve the health insurance question for Jenni. For now, I’ll remain on a grandfathered individual health insurance plan that I’ve been on since 2011. Neither of us is in perfect health. I expect health expenses and insurance to be a perennial topic on TicTocLife.

Not Running out of Money

So, what’s next for us? More importantly, how did we get here? And doesn’t it seem likely that we’d run out of money if we live for another 40, 50, or 60 years without many millions of dollars? Did we win the lottery or have some major windfall? Wait, what if there’s some major emergency—like a pandemic that cut the value of our home off our net worth!—how will we survive?

Well, that’s a lot of questions going in many directions. Give us some time to write, find some comfy pjs, and we’ll answer them all. There’s a lot more to this early retirement plan of ours. Fortunately, we already work with a pretty frugal FIRE budget, if 2019 was any indication.

FOOTNOTES

- I think there’s room to argue, at least right now, that the Great Recession 2008-2009 (and perhaps other recessions) was worse. That’s primarily if the 2020 COVID-19 crisis recovers fairly quickly, as we all hope. Still, there’s not been unemployment in the US at this level since the Great Depression. [Source]

- At some point, I’ll have to delve into Tim Ferriss’ The 4-Hour Workweek (referral) and the overlap with financial independence / early retirement that still applies.