Steal our staycation ideas to make the most of vacation during the pandemic. Healthy, safe ways to have fun and explore home like tourists!

Author: Chris

Chris began his financial independence pursuit in 2007 as he learned basic personal finance from Get Rich Slowly as an aspiring web designer and novice investor. After several missteps, he learned the secrets of financial independence and began his pursuit of freedom.

He reached financial independence in 2018 with $1.2M and two businesses. He began the process of transitioning to early retirement in 2020.

Learn more: Meet Chris.

Wondering how much money is enough for you as inflation rages in 2023? Don’t fall for common traps. Learn how to find your “enough” and live a happier life.

Our thirteen-year saga from student loan debt, to graduate school, shifting careers, and starting two businesses. At the lowest point, we went from a negative $107K net worth to $1.2M in nine years. This is how we became millionaires and reached financial independence.

Wondering whether to live in the city or the country? Learn about the pros & cons of city life vs country life from our personal experiences plus financial insights.

Our second monthly balance sheet update: with dividends added our savings rate ballooned. See the details for a little financial voyeurism!

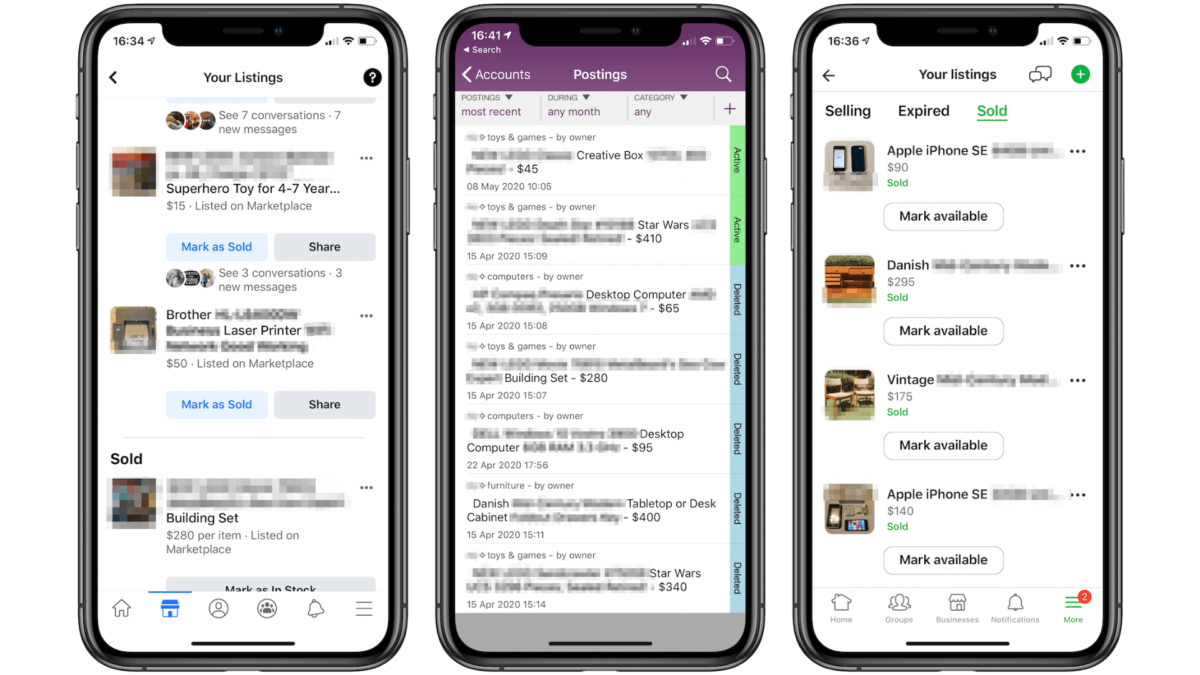

Part of our method of becoming millionaires was to constantly leverage apps & websites to sell stuff locally, here’s our step-by-step guide and tools!

Follow us in learning how to define your FIRE number! Our infographic shows that building wealth and picking a date is only the start!

Discover the risks of individual stocks vs index funds. Learn from my costly mistake and make fruitful investment decisions to help you reach FIRE!

With one month under our belts writing about FIRE, what’ve we thought about the experience so far? We’ve also shared TicTocLife’s blog stats!

Learn to adopt the notion “everything is for sale”. When considering a purchase, analyze expected future value. Buy quality instead of limit yourself by a budget.