Listen, we all make mistakes. It’s alright. What’s not good is to beat yourself up about them rather than learn from them. With that top of mind, here’s our personal greatest financial mistakes from 2020 to avoid in order to create a more wealthy 2021 for yourself.

1) Uninvested Cash

Throughout most of 2020, we’ve had a significant cash cushion spread out amongst our accounts. This is beyond savings/checking accounts (where we generally aim to keep a handful of months of living expenses available). I quickly totaled up uninvested cash sitting in HSAs, IRAs, 401(k)s, brokerages, and checking/savings accounts beyond our emergency fund.

We have beyond $100K of uninvested cash.

Apparently this is uncommon for those on a path to financial independence. Justin (of Root of Good) did a little Twitter survey of his followers and found that about a quarter of his audience is in a similar boat as us.

Considering that broad market index funds like VTSAX are up about 18% for 2020, we’ve left about $18,000 in gains on the table.

That’s a costly mistake.

What caused this mistake?

2020 wasn’t the year we planned for. We’ve been working toward executing our early retirement plan for years. Despite the pandemic, Jenni pulled the trigger back in May to leave her full-time position.

I’ve cut out a significant amount of business.

Putting all this together, we’ve been a little more fearful with our money than we might otherwise. Having more cash around leaves us feeling a little more comfortable.

These emotional decisions create a behavior gap in our investment returns. Was it worth the theoretical $18K opportunity cost?

Feeling comfortable is expensive.

What’s our plan to fix this?

Even as I write this, the cash remains uninvested. We’ll work to invest this money early in 2021.

It can be tough to do so when the market is near its peak, but statistically, the best time to invest free cash is today. Lump-sum investing beats out timing the market and even dollar-cost averaging more often than not.

2) Missed Mortgage Refinance

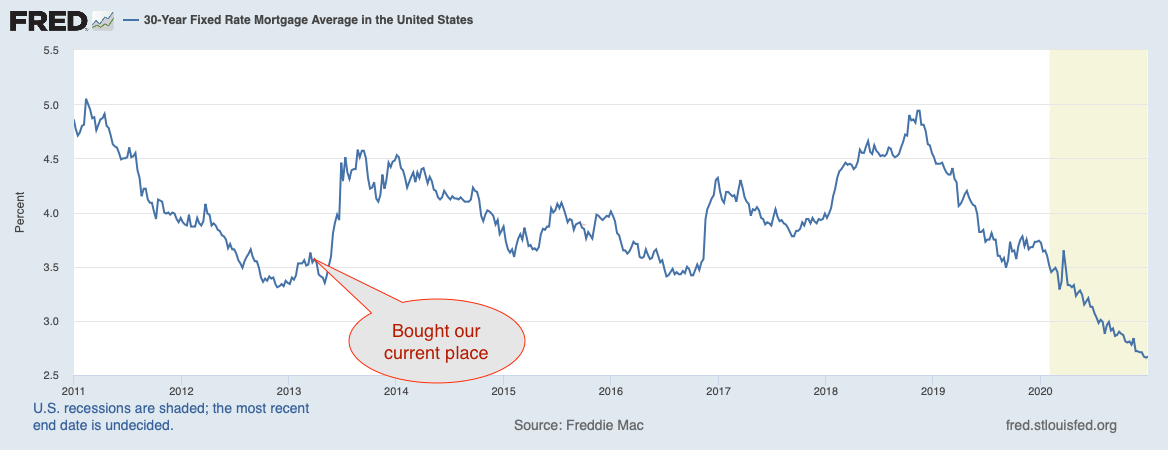

We bought our current place in Spring of 2013. The housing market was still recovering from the Great Recession. Housing prices were low, interest rates hovered near record lows.

We signed the contract on a 30-year fixed-rate mortgage with a 3.625% APR after putting 20% down to avoid PMI.

Despite buying at a favorable time, mortgage interest rates throughout 2020 have been even lower.

Hypothetically, we should be able to secure a refinance at just below 3%. Using a mortgage refinance calculator, that should free up about $177/month in cashflow for us.

Rather than having that $177/month invested in our property, we’d divert it to stock market investments. Investments that should earn a higher return over time.

When accounting for reduced equity in our property and refinance costs, over 10 years, refinancing our mortgage and investing the free cashflow difference should yield a $4.3K increase to our wealth.

What caused this mistake?

Primarily, laziness. Refinance rates have hovered around 3% since the FED instituted interest rate stimulus throughout much of 2020.

We’ve had plenty of opportunities to refinance and earn the free money we’d get from the interest reduction.

But, there’s a lot of work that goes into refinancing a mortgage. We’ve got to see if our current lender would be willing to match refinance rates from competitors, potentially find a new lender, and process all of the required paperwork to make the change.

What’s our plan to fix this?

The pressure is on to get our mortgage refinanced sooner rather than later. As we transition to semiretirement with both of us earning significantly less income, we run the risk of a lender being unwilling to refinance at lower rates.

That pressure should help us get this done early in 2020. It’s been on my personal research task list now for months and I’ve taken a few stabs at identifying potential lenders.

Missing out on these potential savings, which are inherently reflected in rental rates (assuming proper competitive local market economics are at play), sometimes make it more expensive to own your place.

Renting and investing your downpayment instead of buying often makes more sense when you don’t keep up well with your house maintenance or bank shenanigans like refinancing.

3) DAF Excess Contribution

We started a public donor-advised fund (DAF) a few months ago to support the mission of TicTocLife. As a way to reflect the importance that FIRE played in our personal financial success, we set a goal to donate one year of our FIRE budget to the fund.

That equated to about $41K.

With the year closing, we’re right on track with that goal. But, we have more than one DAF and we’ve contributed more than $30K for 2020.

That’s a problem so far as tax efficiency.

The IRS institutes a 30% of adjusted gross income (AGI) limit for DAF contribution deductibility for appreciated stock.

As Jenni and I file taxes separately and this contribution technically came from my shares, my AGI would need to exceed $100K for 2020 to maximize the value of the tax deduction.

I’ll be surprised if my AGI exceeds $50K this year.

Fortunately, the IRS allows for a five year carry forward of unused deductions in this case.

Despite this, there’s good chance that about half of our DAF contributions this year will have zero tax deduction value. With our income further decreasing, there’s a good chance that 2021 and beyond will have near zero tax implications for us due to how the new higher standard deduction and progressive tax brackets work.

Mr. 1500 did a good job explaining how a married couple could have over $100K of income and pay no capital gains tax.

By not investing in our DAF earlier in our careers where we could have maximized the deduction value (when we were in 32%+ tax brackets), we’ve likely missed out on at least $16,000 of reduced taxes.

What caused this mistake?

Charitable giving in more significant ways like our DAF hasn’t been top of mind in recent years. During that time, we were both concerned with maximizing our income and reaching FI. We blew past our FI number in 2018 as we became millionaires.

Still, we didn’t pull the plug on work and kept earning more than “enough”.

By not thinking more about what giving would look like in our post-FI life, we missed out on significant tax savings that would increase our giving contributions. Earlier contributions to charitable causes could have gone to making a better life for others, sooner.

We failed to plan.

What’s our plan to fix this?

This mistake is a little tougher to fix. Where possible, we’ll try to ensure we use as much of the carry forward deduction as possible. It’s possible to do this by maximizing income on my tax returns (rather than Jenni’s) wherever possible.

In addition, it might make sense to frontload my income over the next few years—which is achievable when you own a business. While the total tax implication might be the same, income may be earned sooner which can then be put to work in investments sooner.

And of course, part of the purpose of this blog post is to get you to consider how you might be making similar mistakes—and to avoid them. Incorporate giving into your future plans, if a DAF is part of your future post-FI plan, consider donating to it while you’re still earning a higher income.

Mistake Runner Ups

This post has covered our three greatest financial mistakes of 2020 that you should avoid in 2021.

However, we made a lot more than three financial mistakes throughout the year. Here’s our smaller mistakes and some tips to avoid them in the future.

4) EIDL Business Stimulus.

Early in 2020, the CARES Act passed and included significant support and stimulus for small business. Part of that package was the Economic Injury Loan & Grant (EIDL).

To make a long story short, my business would have qualified for a grant to support one employee. I’ve been far too concerned with other pandemic-related things throughout the year and never got around to digging into the details for this grant until it was too late.

I was lazy.

Cost? $1,000 in grant money.

5) Excess contributions to 501(c)(3) charitable organizations.

As part of the CARES Act, cash donations of up to $300 made in 2020 are tax-deductible. What’s special about it is that it’s an “above-the-line” deduction, meaning you don’t have to itemize to take advantage of it.

We planned to max out this deduction for each of us, making $600 in direct donations over the year.

Due to some poor communication on our parts, Jenni greatly exceeded $300 and I only donated a little over $100. While we donated over $30K to our DAF, we still wanted to maximize the value of our donations through this one-time tax deduction.

Cost? About $50 in excess tax.

6) Missed 401(k) match.

Jenni earns a 401(k) investment contribution match from her employer. It’s up to 6% of her income contributed per paycheck.

While trying to plan for her semiretirement, she maxed out her $19,500 annual contribution before the end of the year. That means her last few paychecks couldn’t have any 401(k) contribution and so she lost out and some free matching contributions.

Cost? About $359 in missed matching contributions.

7) Paid twice for a vacation.

This one was more intentional than most of the other financial mistakes. We booked a beach trip with family early in the year. The safety of gathering together by the time the trip rolled around was too unclear for us to proceed. As Jenni works in a pharmacy, we didn’t want to expose family to the inherit risk of us gathering with them.

We opted to book our own place nearby and only visit with family outside. With hindsight, it was unnecessary—but that’s impossible to truly know at the time you decide to gather with someone else.

Of all the financial mistakes on this list for the year, this is the one we’re most happy to have made.

Cost? About $466 paying for one vacation, twice.

Avoid Financial Mistakes in 2021

Ultimately, almost all of these financial mistakes come down to poor planning. In some cases, it was poor planning years in advance (like with our charitable giving strategy). In other cases, we could have corrected these mistakes the moment they happened by being more prepared.

This post’s financial mistakes total is $40,175.

That just so happens to be about what we spend every year, meaning, we blew about an entire year’s budget through our cockups over the year.

But still, we’re on track with our investments and high level financial plan. We both hope this goes to show you that, even if you make some financial mistakes on your path to FIRE, it’s possible to recover—and even thrive.

Don’t beat yourself up over every dollar. Keep an eye ahead on the bigger picture, and 2021.

Happy New Year!

What sort of financial mistakes have you made in 2020? What’s your plan to fix them, and what advice would you give others to avoid them in 2021?

10 replies on “Our 3 Greatest Financial Mistakes to Avoid for a Wealthy 2021”

Happy New Year, Chris. I love how transparent you are with comments like “I was lazy” or “we failed to plan”. Sometimes that just happens and we beat ourselves up. But the reminder that we can recover and correct the errors moving forward is always a needed reminder.

“ Feeling comfortable is expensive.” is one I struggle with. There’s no long term benefit to an oversized emergency fund but that comfort is just reassuring. We don’t have a large EF right now but I could foresee overdoing it when we start focusing on that. But missing out on all those gains would be keeping us further away from our goals. That’s the best way for me to think of this when the time comes. Thanks for that perspective.

Happy 2021 to you and the family! 🙂

Indeed, once you’re beyond the point of “enough” it can become a little too easy to get comfortable and perhaps a little less efficient. To a degree, that’s okay. But at least the way I look at it, I feel like we’re doing a disservice to projects/goals/causes we tend to contribute those “extra” potential funds to—and will in the future. It’s harder to maintain that “external motivation” for those causes outside yourself, or at least, it is for me. And indeed, partly causes those moments of laziness. Ah well, have to keep learning and aiming to improve.

Having uninvesting cash is a big mistake that a lot of people make. Earlier this year I had more than $30k sitting in a savings account, barely earning anything. Since then I’ve been focused on putting my cash to use as soon as possible, and my net worth has thanked me!

Yep, with interest rates the way they are—those checking/savings/CD accounts aren’t going to earn much! Makes it all the more important to try to keep funds beyond necessity checking and emergency invested.

Happy New Year!

I think it’s okay to have some inefficiency. We have a lot of cash uninvested and I’m okay with that. Last year, everything was so uncertain. It’s good to have some cash in that situation.

This year, things are looking much brighter so I’m going to invest some of that cash.

We still did quite well in 2020 so I don’t worry about it.

Mrs. RB40 also made a mistake with her 401k. In an effort to get all the matching, she didn’t max out. She contributed $19,490. That’s $10 short. No big deal. 🙂

Good luck in 2021!

Yea, for sure—aiming for perfection only sets you up for failure. The Pareto principle applies here (80/20 rule), like in many things in life. Getting your core investments right, hammering out living expenses that you can sustain over a long period, and being consistent with your earnings/savings/investing is what gets you to FI.

Although, like many of us min-maxing FIRE folks, missing those matching dollars kind of bites. 🙂

And happy new year to you and the fam!

We also kept a pretty large stash of cash. We are not at FI quite yet and have young kids so layoff was a concern. Not gonna lie though, I looked at what it could have grown to and it definitely made me second guess my decision. Even with that, it was totally worth the peace of mind.

I think the best thing to do for the uninvested cash inefficiency is to have a clear plan ahead of inevitable negative macro- and micro-economic events (pandemic, losing a job). That way you’re not trying to make decisions when in an emotional, reactionary state. Perhaps you keep 5% of assets in free cash during economic expansionary periods and switch to 10% during broad recessions—whatever floats your boat.

What lets you sleep at night is going to be different from what does it for me, and I think people tend to undervalue a healthy mental state when it comes to finances. You really need it to withstand the long haul of FI.

For the past couple of months the market has seem to catch an upwards trend. Do you think it is still okay to invest the uninvested cash in the equity market or do you think there is a correction coming and we should wait. We would really like your advice on this.

Hello Himanshu!

I don’t think I could offer a clear answer to that—anyone who tells you they can predict the market is probably selling you something other than their supposed crystal ball.

In general, statistically, and historically, the best course of action has been to keep your free investable assets invested as soon as possible. I brought in some statistical analysis in an article here to confirm this (lump sum investing vs DCA vs timing the market).