Do you want to invest in the U.S. stock market with low costs and high diversification? Are you wondering which Vanguard fund is better for your portfolio: VTSAX vs VTI? If so, you’re not alone. Many investors face this dilemma when choosing between these two popular total market index funds.

But what are the differences between these two funds? And which one is better for your portfolio?

In this post, I’ll explain what VTSAX and VTI are, how they differ, and how they compare in terms of performance, fees, and tax efficiency. By the end of this post, you will have a better understanding of these two funds and be able to choose the best one for you.

I’ll also share 5 other index funds that you might want to consider as alternatives. Whether you’re a beginner or an experienced investor, this post will help you make an informed decision and achieve your FIRE goals.

- What are Index Funds and Why Should You Invest in Them?

- VTSAX vs VTI: What are the Main Differences?

- VTSAX vs VTI: Which One Has Better Performance?

- VTSAX vs VTI: Frequently Asked Questions

- 5 Other Index Funds to Consider as Alternatives to VTSAX and VTI

- How to Choose the Best Index Fund for Your Portfolio

What are Index Funds and Why Should You Invest in Them?

Before I get to the review and comparison between VTSAX vs VTI, I want to quickly give you a little background on my experience investing and why I love index funds.

I’ve always been a bit of a collector at heart.

As a kid, I had Pogs, baseball cards, and Military Micro Machines.

As an adult, I started collecting companies. Of course, I couldn’t afford to buy an actual company—just like I couldn’t buy a real M1 Abrams tank. But, I could own the tiny Micro Machine version—a share of stock in a company.

I spent hours researching the future potential of companies I would invest in.

I did the same as a kid, reading through Beckett Baseball Card Monthly to find a rookie pitcher card’s value and future potential.

After a few failures in hand-picking individual stocks, imagine my surprise to find I could buy the total US stock market!

A single fund would own a tiny slice of every American company and all I had to do was buy a share of the fund. With one fund I could capture a piece of the wild mania in stocks like GameStop but also level it out with the calmer waters of blue chips.

Here are some of the benefits of investing in VTSAX or VTI:

- Low-cost and diversified exposure to the U.S. stock market

- High historical returns and low volatility

- Tax-efficient and easy to trade

But, which of these total stock market funds is best?

Let’s get on to the comparison of Vanguard’s VTSAX vs VTI. And what about alternative offerings from other investment companies?

How Vanguard revolutionized index funds with John Bogle

Vanguard pioneered low-cost index funds in the 70s as headed by John Bogle. They created passive mutual funds with much lower expenses and fees than active mutual funds from competing banks.

These passive funds simply reflected existing indexes of stocks (such as the S&P500), rather than having investment experts actively research and create mutual funds and manually manage the holdings in an attempt to beat the well-known indexes like the DOW or S&P500.

Investors have since figured out that actively managed funds tend to lose to the underlying index they’re trying to compete with. This is partly because of their higher fees in paying staff to actively manage the funds.

It’s also because most investors simply can’t beat the market over the long term.

Index funds have seen massive inflows over recent years. More people have come to accept that merely keeping up with the average return of the index (near 10% annually from 1926 to 2018, not accounting for inflation/taxes) is enough.

Two of the most popular index funds for the total US stock market are:

- VTSAX: a Vanguard mutual fund

- VTI: a Vanguard Exchange-Traded Fund (ETF)

Both index funds include a portion of all US public companies (as of writing, 3,529 of them). So, what’s the difference between VTSAX vs VTI?

VTSAX vs VTI: What are the Main Differences?

There are really two key differences: VTSAX is a mutual fund with a minimum investment of $3,000 and VTI is an ETF with no investment minimum.

- Ticker: VTSAX

- Mutual fund

- Minimum Investment: $3,000

- Expense Ratio: 0.04%

- Dividend Yield: 1.54% (April 2023)

Vanguard Total Stock Market

ETF

- Ticker: VTI

- Exchange-Traded Fund (ETF)

- Minimum Investment: $0

- Expense Ratio: 0.03%

- Dividend Yield: 1.55% (April 2023)

Mutual fund vs ETF

While there are many technical differences between an ETF and mutual fund, for our purposes, just understand that ETFs tend to be more easily and quickly tradable.

ETFs trade like stocks. You can hop on and make a purchase at a fixed price during the trading day just like you can with any other stock share. The primary difference between an ETF vs stock is that an ETF is a group of securities.

Mutual fund prices are calculated at the end of the trading day and anyone who issued an order that day receives that price.

If you want to be exact with your price execution and want the intraday flexibility of stock trading, VTI may be more appropriate for you than VTSAX.

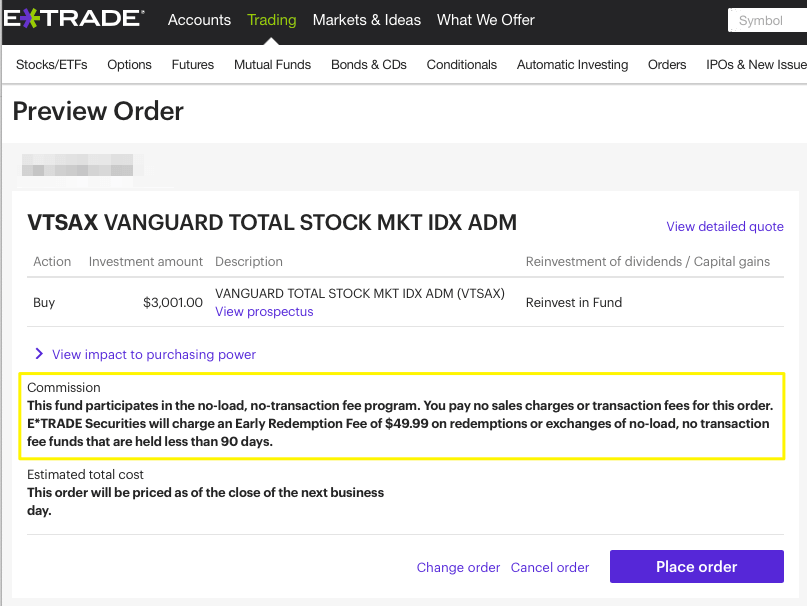

Mutual funds traded outside their originating bank often have additional, sometimes significant, transaction fees. My IRA in E-Trade will let me purchase VTSAX without any additional fees with a caveat: if I hold less than 90 days, there’s a $49.99 fee.

Keep an eye out for transaction fees if you’re buying mutual funds in other brokerage accounts.

VTSAX vs VTI: Which One Has Better Performance?

I’ve attempted to make the argument that there’s very little practical difference in VTI vs VTSAX.

But, what happens when we actually look at the numbers?

Perhaps most importantly, what would $10,000 in each VTI and VTSAX have been worth if you invested ten years prior to the publish date of this article?

How much would you have made with VTSAX vs VTI in 10 years?

According to Vanguard, both VTSAX and VTI have an average annual return of about 11.6% over the past 10 years.

VTSAX

- VTSAX per share 8/30/2010: $26.08

- $10,000 invested $26.08/share = 383.43 shares

- VTSAX per share 8/30/2020: $86.47

- 383.43 shares worth $33,155.19

- Dividends over the decade: $3,807.46

- Total value: $36,962.65

VTI

- VTI per share 8/30/2010: $53.59

- $10,000 invested $53.59/share = 186.60 shares

- VTI per share 8/30/2020: $177.68

- 186.60 shares worth $33,155.09

- Dividends, capital gains over the decade: $3,812.05

- Total value: $36,967.14

Note: In my calculations, I included a fractional share of VTI.

In general, brokerages will only permit you to trade whole integers of ETFs (just like any other stock). However, you can wind up with fractional shares due to Dividend Reinvestment Plans (DRIPs).

Both VTSAX and VTI have grown by about 370% over the last decade. The difference is negligible and can be attributed to rounding plus the minor expense ratio difference (0.01% = $1 on $10,000 by the way).

Tax implications, transaction fees, and the ease of access to either fund should play a greater role than any performance difference between VTSAX and VTI.

VTSAX vs VTI: Frequently Asked Questions

Before reviewing comparable options to VTSAX from other banks, let’s run through a few VTSAX vs VTI frequently asked questions as a little review.

They’re similar. VTI is an ETF traded like a stock and VTSAX is a mutual fund. They are both index funds. Their holdings are the same roughly 3,500 US companies represented on the public stock market. Their investment performance is nearly the same except for some minor tax differences and negligible expense ratio differences.

VTI is not more tax-efficient than VTSAX. Typically ETFs would be more tax efficient. However, Vanguard’s patented heartbeat trading system allows them to treat the ETF as a share class of an identical mutual fund, VTSAX in this case. This permits the mutual fund to gain the tax advantages of the ETF.

There’s not a very good reason to do this, but you technically can. If you have an account with Vanguard, you can contact them to initiate an exchange. If you do not, you can still “convert” manually: sell the VTSAX and purchase VTI. However, you may experience transaction costs and tax implications. Proceed with caution.

Yes, both pay dividends. VTI pays a quarterly dividend. VTSAX pays a quarterly dividend as well.

5 Other Index Funds to Consider as Alternatives to VTSAX and VTI

Vanguard isn’t the only investment company that offers funds that track the entire US stock market, or at least close to it. Vanguard’s dominance of low-fee index funds that started years ago has spurred competition to create similar low-fee, broad market funds.

3 mutual fund alternatives to VTSAX

If you already have an account with one of the significant investment houses, it’s probably best to purchase their VTSAX clone fund rather than pay fees to own Vanguard’s or open an account at Vanguard. Most investment houses don’t charge a fee to acquire their in-house mutual funds. There are good VTSAX alternatives available.

Fidelity and Schwab, two very large investment companies, offer broad market mutual funds that nearly mirror VTSAX.

Schwab (SWTSX) vs Fidelity (FSKAX)

Schwab Total Stock Market Index Fund

- Ticker: SWTSX

- Mutual fund

- Minimum Investment: $0

- Expense Ratio: 0.03%

- Dividend Yield: 1.64% (July 2020)

Fidelity Total Market Index Fund

- Ticker: FSKAX

- Mutual fund

- Minimum Investment: $0

- Expense Ratio: 0.015%

- Dividend Yield: 1.75% (July 2020)

Both SWTSX and FSKAX index funds compare favorably with VTSAX, however, there are some minor differences.

Fidelity FSKAX

Fidelity’s FSKAX is a mutual fund by Fidelity Investments that nearly mirrors VTSAX. The biggest difference is that it has an expense ratio of 0.015%, less than half of VTSAX’s. FSKAX has no minimum investment whereas VTSAX’s minimum is $3,000.

FSKAX’s dividends pay semi-annually while VTSAX pays quarterly.

VTSAX will be slightly more tax-efficient than FSKAX as it occasionally distributes capital gains. This is more relevant if you’re holding either fund in a taxable account rather than a 401(k) or IRA. Still, the difference is minor.

If you have a Fidelity investing account, there’s no great reason to make any extra effort to obtain VTSAX instead of FSKAX.

Schwab SWTSX

Schwab’s SWTSX is a mutual fund by Charles Schwab with a very similar holdings profile and goal to VTSAX but no minimum investment. SWTSX’s expense ratio is 0.03%, slightly less than VTSAX.

TicTocLife’s donor-advised fund is partly invested in SWTSX.

SWTSX’s dividends pay annually while VTSAX pays quarterly.

If you have a Schwab investing account, there’s no great reason to make any extra effort to obtain VTSAX instead of SWTSX.

Vanguard used to offer VTSMX when the minimum investment was $10K in VTSAX. With the lowering of the minimum to just $3K for VTSAX, Vanguard converted VTSMX holders to VTSAX for free.

VTSMX closed to new investors in 2018.

That means you’ll need at least $3K to invest in VTSAX or go with an alternative fund with no minimum investment.

Honorable mention: Fidelity’s FZROX

Fidelity created a new market for mutual funds: those with zero expense ratios. It’s good to think of these funds as loss leaders for big investment banks.

They get you in the door with these funds in hopes of having you as a lifelong customer of their products.

Fidelity’s largest zero-fee mutual fund is FZROX which launched in 2018. It covers about 1,900 US companies and will have a very similar performance to VTSAX as it attempts to emulate the broad US market.

Hypothetically, the zero expense ratio could mean higher returns for investors over the years. We’ll need a longer timeline to get an idea of how historical performance looks. There’s some risk in the lower diversity offered by narrower coverage of the index (which is likely narrower to reduce Fidelity’s costs).

Which index mutual fund is best for you?

Overall, the differences between the three mutual funds we discussed (VTSAX, SWTSX, and FSKAX) are incredibly minor in terms of performance. What matters most is which index fund you have the easiest access to with no transaction fees.

If you’re trading in a non-tax advantaged account, you’ll see a minor performance improvement with VTSAX over other options due to Vanguard’s sneaky way to avoid taxes.

2 ETF alternatives to VTI

There is a large variety of alternatives to Vanguard’s total US stock market mutual fund. There’s a little less choice for ETFs.

What are alternative options for their index fund ETF, VTI?

Schwab’s SCHB and iShares’ ITOT are similar ETFs tracking the broad US stock market.

Both ITOT and SCHB have very low expense ratios like VTI. The downside of ITOT or SCHB instead of VTI is that neither tracks quite as many stocks in their underlying index. VTI has better coverage of the total US stock market.

Ultimately, the effect on your returns for choosing SCHB or ITOT instead of VTI will be minimal.

If you have a Fidelity account and can trade ITOT with no fees as compared to VTI, it might make sense to purchase ITOT.

Similarly, if you’re with Schwab, SCHB could be a better choice than VTI.

And of course, if you’re at Vanguard or have a third-party brokerage that charges fees for any of these ETFs, VTI is likely the best option.

How to Choose the Best Index Fund for Your Portfolio

In summary, VTSAX vs VTI are two great ways of investing in the U.S. stock market with Vanguard.

They are both total market index funds that track the same benchmark, the CRSP U.S. Total Market Index.

They have similar performance, fees, and tax efficiency.

The main difference between the two funds is their investment structure: VTSAX is a mutual fund that requires a minimum investment of $3,000 and trades once a day at net asset value, while VTI is an ETF that has no minimum investment and trades throughout the day at market prices.

Depending on your situation and preferences, you may find one fund more suitable than the other.

There’s also multiple alternative funds that behave similarly to VTSAX or VTI available from other financial institutions which I mentioned.

As I shared, I started collecting and investing in toys when I was a kid, and I still enjoy doing it today. Investing in companies scratches a similar itch to investing in these pieces of nostalgia for me, except that you get to own a part of the U.S. economy and benefit from its growth and innovation!

Once you understand the simplicity and value of owning index funds, you just need to develop the behavior to routinely invest in them.

That’s the investor’s behavior gap: we need to be disciplined investors to earn the underlying performance of our investments.

If you have any questions or comments about VTSAX or VTI — or one of the alternatives from the post, feel free to leave them below!

41 replies on “VTSAX vs VTI: Which Vanguard Fund Wins? (+5 Alternatives)”

Any thoughts on the newer total market fund FZROX?

Hey Eileen!

Thanks for the good question. I actually did look into FZROX specifically when creating the first draft of this post. The idea of a zero expense ratio is pretty appealing!

One key difference between FZROX vs VTSAX is that FZROX doesn’t own the entire US stock market like VTSAX does, though it attempts to emulate the same results. VTSAX contains somewhere around 3,500 stocks while FZROX represents closer to 2,500. Presumably, that thousand company difference is partly how Fidelity has managed to reduce the expense ratio of the index fund.

Ultimately, FZROX and VTSAX should perform almost identically–I wouldn’t fret too much if buying one vs the other means having to open a different brokerage account or pay transaction fees. Stick with what’s easy and least expensive to execute.

The only thing that sticks out a little to me between FZROX and VTSAX is the dividend payment schedule. While FZROX internally reinvests dividends throughout the year, owners only receive the payment once per year. VTSAX pays out quarterly. If you’re planning to retire early and intend to live off dividends, that schedule might matter to you.

Thanks for the question and coming by Eileen!

I had been wondering about the tax implications of VTI vs. VTSAX and whether or not it mattered which I was in. I’m VTSAX throughout my Roth (until I start messing around with a small percentage of individual stocks in there) and brokerage account and see no reason to worry about changing. Great breakdown!

Glad to hear it was useful, IF!

I wouldn’t worry too much. The mental weight of making such decisions is probably greater than any minor tax difference 😉

Chris,

What about VIGAX..

“VIGAX is one of Vanguard’s strongest performers, with a 10-year trailing return of 16.77%. Like other Vanguard index funds, VIGAX is a low-cost option; the expense ratio is just 0.05%. It also has a low holdings turnover ratio of 11%, which could work well for a buy-and-hold strategy.”

I picked that fund over all others due to low expense ratio, historical returns and emphasis on growth. YTD return of 10.28% as of November 23rd during a global pandemic, civil unrest, and everything else 2020 has brought us. I did the research and selected VIGAX but no one seems to mention it very much.. Thoughts?

Hey Bill!

Thanks for your kind email—and of course a good question here in your comment!

So far as VIGAX vs VTSAX (or similar US total market funds—VTI, etc), I think what’s most important is that you understand the differences and are comfortable with them.

In other words, if you’re happy with the way the fund is built, understand the fund’s goals, grasp the related costs of operating the fund, and still want to pour your earnings into—I think you’re good to go.

A lot of investing is just mindset. It’s *really* hard to just do nothing to your investments and let them ride for many years and often, decades. Statistically speaking, one of the worst things amateur retail investors can do is to get jumpy, feel uncomfortable with their investments, and move them around a bunch or go to cash. Time in the market as they say.

So… the details of VIGAX:

– What index does it actually track? CRSP US Large Cap Growth Index (it’s good to understand this since Vanguard doesn’t “do” anything, they just mirror this index created by someone else).

– Type: large cap, growth

– It’s a low cost index fund, 0.05% expense ratio

– Total assets: about $126B

– Number of companies represented: 257

Top 10 holdings:

Apple, Microsoft, Amazon, Alphabet, Facebook, Visa, NVIDIA, Tesla, Home Depot, Mastercard

47% of total assets.

That’s some of the high level stats I’d be familiar with if I was considering investing.

Compared to our benchmarket VTSAX:

– Both invest in large US companies

– VIGAX focuses more on growth companies (e.g. Tesla instead of P&G)

– Expense ratios are nearly the same

– VIGAX is a good bit smaller ($126B vs $921B), but still a very large fund

– VTSAX is significantly more diversified (3590 companies represented instead of 257)

– VIGAX is pretty tilted to its top 10 holdings (47% vs 23.7%)

Both created in 2000, they’re pretty old funds for Vanguard.

Nothing really jumps out at me as a red flag about VIGAX, assuming you diversify into other funds. If it was the only fund for your investments, I’d be concerned. It’s been doing really well this year, and throughout the market runup in recent years.

I don’t think it’d handle a prolonged recession well, sort of by definition since it’s filled with growth companies and not well diversified.

For example, if you look at 2000-2010 where there were multiple recessions, you’ll see that VIGAX ended down about 15% while VTSAX ended down about 4%. Yet from 2010-2020, VIGAX outperforms handidly.

It depends a bit about what your goals are and what your time horizon is in terms of needing the money. There’s more risk with VIGAX, but more upside potential during a bull market.

Hope that’s helpful! Thanks for the interesting question.

What can you say about VTSAX vs VTWAX? The later consist of the world’s market. But I don’t know if VTWAX pays dividends and is it quarterly or yearly if they do pay out.

Hey Ben!

Great question. I don’t consider something like VTSAX alone as being diversified enough, personally. One can argue that the top companies within the US are so globalized that they represent global economic activity, but I think that fails in one key area: the risk to the US itself. If something happened (like a global pandemic for example, with stronger deterioration in a specific region such as the US), it could put those regional companies at risk due to systemic problems within a particular region/country.

For that reason, I do think it’s important to diversify stock AND bond holdings with similar broad stock/bond indexes around the globe.

VTWAX attempts to be both a VTSAX and an international stock index. But, it’s still really heavily weighted in North America.

Here’s the top 10 holdings:

Month-end 10 largest holdings

(14.60% of total net assets) as of 10/31/2020

1 Apple Inc.

2 Microsoft Corp.

3 Amazon.com Inc.

4 Alphabet Inc.

5 Facebook Inc.

6 Alibaba Group Holding Ltd.

7 Tencent Holdings Ltd.

8 Berkshire Hathaway Inc.

9 Taiwan Semiconductor Manufacturing Co. Ltd.

10 Johnson & Johnson

And weighting:

Region allocation

as of 10/31/2020

11.20% Emerging Markets

16.00% Europe

12.30% Pacific

0.10% Middle East

60.10% North America

0.30% Other

I think it’s better than just VTSAX at least in terms of international diversification, but it’s still not enough for my taste.

In terms of dividends: VTWAX pays a quarterly dividend.

The expense ratio is nice and low (0.1%) when you consider the fund holds 8,816 stocks as of writing.

VTWAX tracks the FTSE Global All Cap Index. It’s available as an ETF (VT).

I’m thinking of going VTSAX or VTWAX 100%. Than maybe in a year or two moved onto VTSAX 70%, VTIAX 20%, and VBTLX 10%. I know it’s not as diversify but I like it simple and it would still give a good return. I still have like 25-30 years till retirement so I can bare the ups and down of the market.

Thank you for the info. Have a great day!

Sure thing, Ben!

Indeed, the riskiest investment years for your portfolio should be in the earliest stages. If you’ve got 25-30 years until retirement, that’s plenty of time to either recover from an unexpected loss or capitalize on a big gain.

Hello Chris,

thanks for the great post. What will you recommend? VTSAX or VTI?

Thank you

Arrey

Hi Arrey!

Thanks for your question. In general, as mentioned throughout the post, VTSAX and VTI are pretty much interchangeable. Whichever one you have more access to is likely the best choice. For example, the minimum investment for VTSAX might dictate that you go with VTI.

Hello, I’m 37 and want to open up a Roth with the right diversified portfolio. What’s the difference with choosing QQQ, DIA, & SPY vs just VTI?

What should I choose to be completely diversified and with the maximum growth ROR?

Hey André! Thanks for the question.

If you’re deciding between a portfolio of:

QQQ, DIA, SPY

vs

just VTI

– DIA tracks the big DOW 30 stocks.

– QQQ covers about 100 stocks (the largest of the NASDAQ), mostly tech-related, but has a pretty strong mix of other sectors

– SPY covers the S&P 500 (and its 500 stocks), which are pretty broad and represent the economy well

Of course, there’s some overlap between these. If you owned all three, for example, each would hold AAPL since it appears in all those indexes.

As far as I see it, if you owned QQQ, SPY, and DIA equally, you’d wind up with a more tech-focused portfolio than if you owned just VTI. VTI is a very broad mix of the whole set of public US companies, covering somewhere around 3,500 stocks/companies. It’s more diversified than QQQ+SPY+DIA.

I can’t offer you investment advice or predict which investment choices will offer the greatest growth.

However, in terms of diversification, owning just VTI is more diversified than SPY+QQQ+DIA in terms of the basket of stocks those funds all hold.

Hope that’s helpful and thanks for the question!

That helps a lot! Thank you.

Would it make sense for me to equally invest in all 4? Should I add an international stock etf to be even more diversified?

I have 25-30 years before retirement. Would I have enough growth if I choose VTI, QQQ, and SPY in my Roth portfolio? Or should I include exclude any?

André,

Glad to hear you’ve got a long time horizon! Going with a broad, diversified basket of index funds will almost certainly get you where you need to be—even if you were saving just 30% of your income over a 28 year period (check out this calculator example to see what I mean)!

JL Collins’ Simple Path to Wealth book is a great read to give you a sense for a simple portfolio that generally performs well. He’s a big VTSAX believer and aims for a simple portfolio. While his book is excellent, you can get most of the information for free on his site. Here’s the post that gives you a good outline of his portfolio recommendations.

Within the FIRE community, another popular approach is the “Three-fund Portfolio“, which has been popularized by Bogleheads. It’s a little more diversified than the typical “VTSAX is enough” approach as it usually includes some bonds.

There’s a video spoof by JL Collins I featured in my “FU Money” post that you might enjoy watching which summarizes his investment approach for reaching retirement early. 🙂

André,

Happy to help!

An international fund like Vanguard’s VXUS ETF might make sense as a way to internationally diversify. It covers a wide selection of international companies and purposely removes US companies from the index, so it works well alongside an index fund like VTI. An ETF like VT is similar but includes US companies. So if you were to own VTI and VT you would have some overlap in US companies, whereas VXUS removes some of that overlap.

It’s hard to predict what direction the US market will go, much less the entire world’s market—but historical reviews of market performance suggest that including international exposure is a wise decision.

Hi Chris,

Very nice & informative article explained in the simplest way possible perhaps. I’ve just started to read up about investing into Total Stock Market Index Fund and came across this article.

I am in my early 50s, mortgage paid off, no other debt, but will have some upcoming college expenses for my daughter who’s currently a Freshman in school. Do have 401(k) through my employer, a Roth IRA account where I can’t contribute any more as the combined salary with my spouse exceeds the limit. Got a few stocks through my Schwab account that I had opened long time ago before tech bubble burst happened.

So I’ve not into investing at all as you can see. But as the retirement age is slowly but surely approaching, thinking about investing my money into some TSM Index funds. Got a few questions for you.

a) Should I invest in multiple funds like SWTSX & VTSAX or stick to just one? Since I’ve got a Schwab brokerage account, it’ll be easier for me to go with SWTSX. But VTSAX seems to be more popular amongst the FIRE community.

b) I am also a Chase Private Client and I was reading on another forum that one can buy these funds on Chase without any fees if you are a Private Client with Chase. Is that true? I’ll obviously be contacting my Chase local customer service rep. But wondering if you know. Assuming that’s true, I can probably buy VTSAX from there or even open a separate brokerage account with Vanguard. I did note on your article that having just one account is fine. Is there any drawback of holding accounts with multiple brokerage companies and holding multiple TSM Index funds?

c) Will you recommend investing in both TSM and ETF and split the investment between multiple funds? Pros and cons?

d) Any other suggestion considering my current situation where probably I shouldn’t be investing aggressively but rather be conservative?

/D

Hey D!

Sounds like you all are on very solid footing in your financial situation! Nuking the mortgage and having no consumer debt is great. For your daughter’s college expenses, don’t forget about 529 plans to juice the value of those funds.

So far as your specific questions, bear in mind I’m not a financial advisor. This isn’t advice.

I’ll tell you what I’d do and share my experience.

a) I’ve got Schwab, Fidelity, Etrade, Vanguard and a few other brokerage/401k/HSA/IRA custodian accounts. I tend to invest in total stock market funds that are near mirrors of VTSAX that are available at the lowest fees within the respective brokerage offering. While VTSAX is super popular in the FIRE community, it’s just because it was the first (and now the biggest). The near exact clones of it I mentioned in the article (like SWTSX) are perfectly great alternatives. We’re invested in SWTSX in our Schwab Donor-Advised Fund (DAF) for example. The most important thing is that we avoid per-trade fees for mutual funds which are often $40+ for other brokerage’s funds.

b) I’m familiar with Chase’s Private Client service. It can be valuable, but don’t forget that a lot of what they do with the service is attempt to sell it as a premium offering which also means they want you to use premium services once you’ve got your foot in the door. Nonetheless, there’s some good value to be had with it. As far as investing, I believe they offer free trades—which isn’t terribly uncommon. But that’s typically for stocks. Mutual funds (VTSAX for example) often carry their own separate fee schedule. That’s also how I read the footnote on Chase’s detail page here. It likely means you could buy VTI for no fee though since that’s an ETF. Really, that savings is probably only worth a couple bucks per trade at most though considering typical fees these days. Like you suggested, check with Chase though.

c) Well, total stock market funds can be Mutual Funds or Exchange-Traded Funds. There’s no particular reason to go with either one, for the most part, aside from fees/availability within your specific brokerage. That was the summation of this article where VTSAX is the mutual fund version of VTI (which is an ETF). They both carry the same total stock market diversification and have near identical fees. In general, I’ve tried to follow some combination of JL Collins’s Simple Path to Wealth stock series approach mixed with Boglehead’s Three-fund Portfolio. JL is great and I think you might really appreciate his writing. He was in a similar boat as you when he got started, writing out his advice to his daughter and wound up creating a cornerstone piece of the FIRE community.

d) I’d tag on here with a suggestion to check out some of JL’s writing at the aforementioned link. So far as aggressive/conservative investing, I’ve tended toward less aggressive investments as we’ve gotten closer to retirement. Even though we’re young, we want to protect the assets we already have. Growing them is much less important once you have enough (and as you get closer to that point). $1M more than we have now would make hardly any difference to our lives, but losing $1M would suck quite a bit. Because of that, we’ve shifted more of our investments into a mixed portfolio of around 80% broad total stock market funds (generally split between the US and the world) as well as 20% broad bond funds (again split US/international). Or at least, that’s what we aim for. We probably have around 5-10% in cash at any given time as well, though that’s more laziness than anything.

BONUS) Make sure you and your family are having discussions about all this—figure out what you’re investing for and where you want to be…and when! That’s a tough discussion but it’s not one you want to have where one person might be ready to quit and stick their toes in the sand while the other is ready to take the next big promotion and knuckle down for 12 hour days on the day they’re considering the promotion.

Sounds like y’all are doing great. Feel free to followup with any other questions.

You say that the index funds from Vanguard, Schwab and Fidelity are so similar it’s not worth changing the site you use. I just found out Fidelity has firearm companies and tobacco. I thought picking these criteria was for wealthy investors with advisors. I didnt think I could invest to defund school shootings and cancer, but I can-and make the same returns! Schwab is gun-free.

I am switching from Fidelity. Discovered all this from researching your statement. THANK YOU!

Hi Dave,

In general, the three “total market funds” from Vanguard (VTSAX), Schwab (SWTSX), and Fidelity (FSKAX) attempt to achieve the same goal: provide a bit of ownership of all public companies in the US. Each has over 3,000 companies represented.

While I think your comment was a little tongue-in-cheek thanking me, I do hope it’s useful for you to identify any specific differences between the funds (since there are indeed some differences as they don’t hold exactly the same companies) that are meaningful to you.

If you’re indeed referring to SWTSX and suggesting it’s “gun-free”, the fund doesn’t seem to specifically avoid weapons. Here’s a link to the total holdings of SWTSX as of the end of January 2021.

You’ll find these holdings associated with weapons production:

– LMT (Lockheed Martin)

– SWBI (Smith & Wesson)

– RGR (Sturm, Ruger & Co.)

– BA (Boeing)

– NOC (Northrop Grumman)

These holdings are also included which deal in tobacco:

– MO (Altria)

– PM (Philip Morris)

I believe FSKAX and VTSAX would both hold these companies as well since they represent (relatively) large portions of US public companies.

If you’re interested in avoiding specific sectors of the economy in your investments, you might want to look into “Socially Responsible Investing” (SRI). In general, this is employing strategies to avoid investing in specific vices, environmental damaging production, socially questionable investments, etc. From these ideas, ESG (Environmental, Social and Governance) funds have started to become popular. For example, Vanguard has a fund that is similar to VTI (with a goal to represent all US public companies) but screens out companies that don’t meet its ESG criteria.

They describe it as:

You can find more details on the fund’s profile page: ESGV.

Schwab, Fidelity, and many other large investment banks have come up with similar funds and strategies.

My mother in law has a lump sum of $30,000 from a sale and is about 4-5 years away from retiring. What are some ideas for investing. Would it make sense to go with VTI or should it be something more “safe”

Hey Abiola,

Sounds like mom earned some downtime soon 🙂 Awesome.

If I was 4-5 years from retiring and just got a $30K windfall, I’d certainly invest it but pretty defensively. VTI is well diversified and isn’t a bad choice, but you do open yourself up to the risk of a sudden market drop that you might recover from in time for the time horizon ahead of you. A friend had a podcast episode that pretty directly addresses this topic—what to do with savings that are intended to be used in the “short term” (which 4-5 years is on the edge of in my opinion). Here’s my Twitter post about where to invest short term savings, you might be interested.

So if I was in that position with a 4-5 year time horizon and really just wanted to put the money somewhere relatively safe but that could produce a decent return—I’d consider a Target Date Fund that matches the timeline. They automatically rebalance as the target date gets closer to more defensive assets (so often increasing the proportion of bonds). By using a 2025 fund like VTTVX (though plenty of companies other than Vanguard offer target date funds), I could relax a little and focus on getting my retirement plans together—and enjoying life!

If I have currently have 70% VTI and 30%VXUS, does it make sense to convert to 70%VTSAX and 30%VTIAX now that I have enough money for the minimum investment or leave as is? My income is volatile so I won’t be contributing the same amounts regularly. My partner’s income is stable so she will contributing regularly to her accounts (similar 70/30 portfolio as mine). Also, is it to redundant or unwise for my girlfriend and I to have identical 2 fund portfolios? Thanks

Hi Bryan,

There’s so little difference between the ETF and mutual fund variation on each of those index-tracking funds that it basically doesn’t matter. I’d be more concerned about the effort required to make the actual transfer, the ease of investing/trading in either the mutual fund or ETF variation, access to them, etc. Basically, whatever is easier for you to manage or lower friction to invest in—is what I’d go with. The actual expense ratio difference between them is so little that we’re talking about dollars on five-digit figures.

So far as you and your partner’s investments… well, if you’re looking at them holistically (“ours” instead of “mine” and “theirs”), just evaluate the totals together and ensure that the balance of investments matches your strategy. There’s nothing wrong with you both carrying the same two funds as long as your strategy is, as a whole, to have a two fund portfolio.

As far as your actual choices—

US total stock market (70%) + total international (30%) makes sense. Investment advisors might recommend a small mix of bonds in there, too, but if you guys are pretty young and have a long time horizon to needing to use those funds—stocks historically offer better growth (but more volatility).

It’s also good that you’re not overlapping with your international fund (often folks will buy a total world fund plus a US fund where the total world fund is also made up of a large portion of US stocks).

Thanks, Chris! I really appreciate your thoughts and sage advice. Your blog content is awesome!

Chris, thank you for such succinct and clear writing about index investing! I’m nearing retirement and am looking to stop being an active trader, so your suggestion of 70/30 (US total/international) is looking very good. Adding a small bond position sounds perfect. Is there a bond fund you’d recommend to complement the first two? Thanks for your timely replies – this is the best read I’ve had about overall investing.

Hey, thanks, Freda! Those are some very kind words. 🙂

Personally, I’m pretty big on passive index funds (as opposed to active investing like you mentioned)—especially as it helps me sleep at night. Sure, you can’t beat “average” results that way–but maybe that’s all you need!

So far as bond funds, VBTLX (or its ETF counterpart BND) is very popular within the community. It’s designed to provide broad exposure to US investment-grade bonds. BNDX has similar goals but is international, avoiding US bonds. BNDW is the popular internationally mixed fund which is about 50/50 BNDX and BND—an easy way to get a fairly even split between the US and the rest of world for bond investments. You might want to look into a Bogleheads “Three Fund Portfolio” for some higher-level strategy that might match your direction.

Let me know if you’ve got any follow-up questions!

Given those three bond funds, would you say it’s better to split between the US VBTLX and the International BNDX (is there a mutual fund equivalent? or only ETF?), to be able to adjust the amounts for domestic and international bonds depending on the world situation? My only thought with BNDW is that you have no control over the ratio – which of course, is what makes it a simpler and easier investment.

Also, that Bogleheads information was really useful, thanks!

Awesome! Yeah, the Boglehead forums are a great resource to deep dive on investment analysis for various funds and portfolio allocations.

It might be smart to use BNDX + BND (or VBTLX) if you want to have more granular control over the US / international allocation in your bond investments than what BNDW offers. That’ll depend on how much control you want.

I don’t believe there’s a mutual fund equivalent for BNDX (or even a mutual fund that tracks the same index as BNDX does — “Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index”).

Personally, I’ve tended toward BNDW for simplicity.

The whole point is to make it simpler, right? So BNDW it is! Thanks for all the thoughts and for sharing your lives on this site. Really an inspiration.

Hello, I plan to retire in 20 years. i was thinking of investing into VTI 100%. Should I do 70% VTI and 30% VXUS.

Hey Tracey!

Congrats on thinking about your future retirement and trying to financially plan for it! That’s awesome.

I can’t offer you direct financial advice, but I can say that this conversation with Freda (on this same post) might be useful to you—especially in regard to the Bogleheads three-fund portfolio strategy.

I am 38 hope to retire by 50 or so. I max out my Roth and 401k with S&P 500, Mid Cap, Reit, Growth, and Intl funds. Leftover cash I dump into my taxable account with VTSAX. Do you think I should continue using this one fund in my taxable or start splitting it in to two or three different funds?

Hey Jeff! Congrats on the great start to reaching financial independence! Sounds like you’re on the right track for 50 with those maxed-out accounts and diverse funds.

It’s hard to recommend specific funds, as it so heavily depends on your goals and financial-emotional ability to withstand varying degrees of market change. VTSAX is generally regarded as the “set it and forget it” one-size-fits-all choice, and perhaps for good reason.

That said, the Bogleheads Three-fund Portfolio generally comes well recommended within the FIRE community.

At the limits, there is some strategy around carrying certain funds in your taxable account and others within your tax-advantaged accounts because of how dividends or capital gains are treated by each fund type. It won’t make a huge difference, but it might make sense to look into to squeeze every bit of net return out of your investments.

Thanks. I’ve re evaluated my situation and I think I have it where it needs to be.

Wow, I haven’t heard about FZROX! I guess I don’t really mind if it covers only 2500 instead of 3500 companies. I feel like you’re not really going to get much more diversification with the additional 1k companies.

However, almost anything is a step up right now compared to my portfolio which is mostly just the QQQ and SP500.

Full coverage of the S&P 500 is really quite diverse! QQQ is of course industry-focused, so less diverse in so far as it being sector dependent…but still, a big variety as compared to going all-in on a single tech company.

FZROX is certainly an innovative idea.