I was just 25 years old when I realized what the real power of money was and what FU money meant. And while my experience ended with an employee of a Fortune 500 company escorting me out of the building, I can’t say it wasn’t worth it—and I’ll come back to that story.

That’s what FU money is, having the power and freedom to say:

“No.”

But in more practical terms, what is FU (or F-you) money and why do you need it?

FU Money and Financial Independence

At their core, FU money and financial independence go hand-in-hand. They compliment each other.

Financial independence is the grizzled, battle-torn, scar-laden version of FU money. It’s what happens when FU money is deployed time and again.

FU money is the bright-eyed, hopeful, optimistic one. It (thinks) it knows what the future could be. It’s your financial embodiment of the future life you seek.

Financial independence comes from FU money surviving and maturing—it’s the stability that comes from wisdom earned by taking risks in life.

What is FU money?

Enough with the metaphor. What is FU money? It’s having enough money to survive your financial fears.

It’s subjective.

There’s no fixed amount of money that qualifies as FU money for everyone. It’s about having enough money to feel comfortable taking risks in your job, career, and business without financial fear.

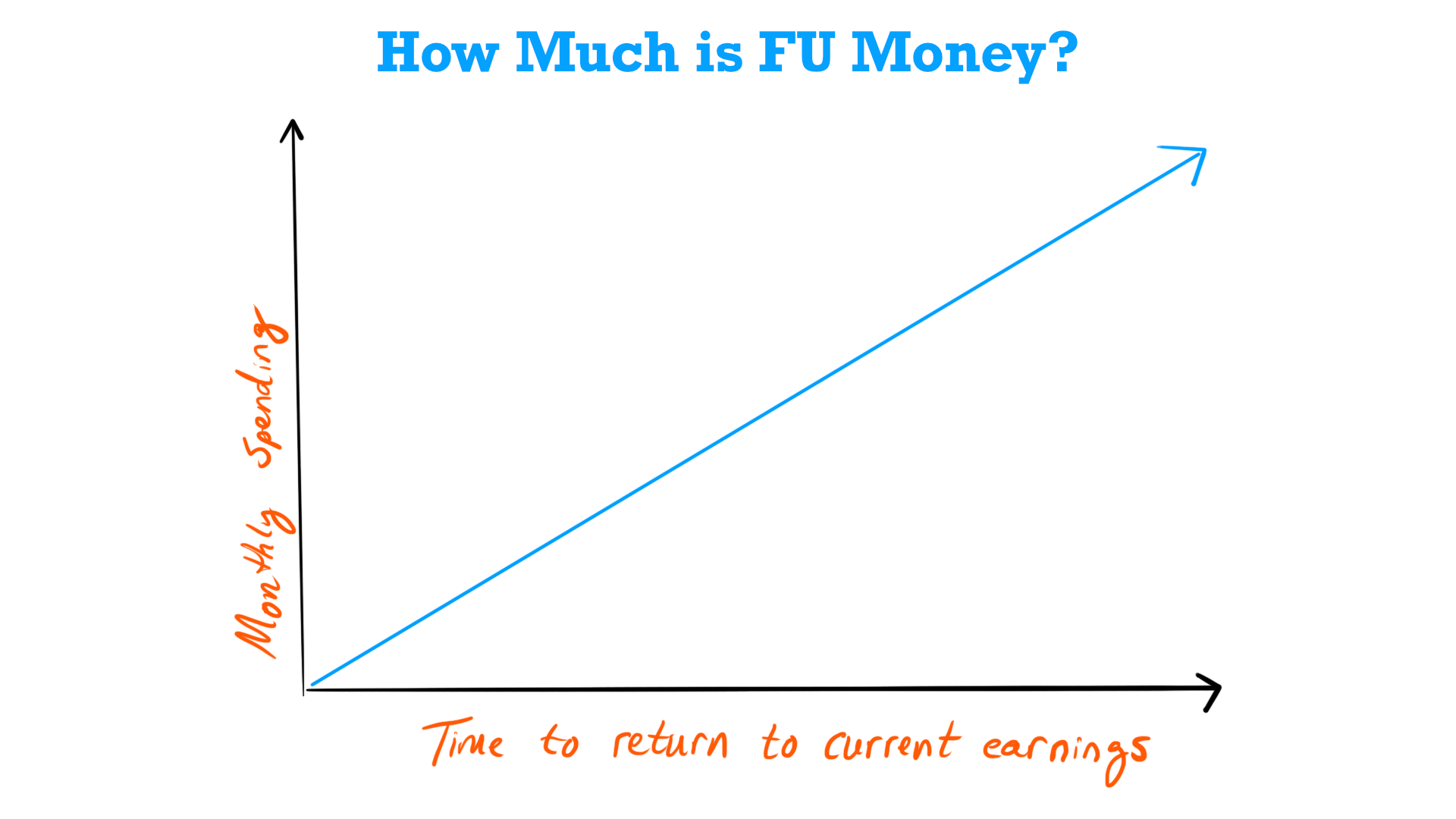

How much is FU money?

But seriously, how much money is FU money? The main variables for defining your own FU money amount are:

- How much would you expect to reasonably keep spending after taking action to wield your FU money?

- In a worst-case scenario, how long would it take you to return to your current earnings if your gamble fails?

If I have to offer you some sort of quantitive figure, I’d use a graph to try to get you to come up with your own number.

Calculate your FU money

For example, let’s say you’re a high-powered attorney. One of the firm’s partners has passed away and you’re jockeying for the position against another candidate.

You’re currently spending $10,000/month.

If your gamble fails and you lose your job, you’re certain you could find another position at a similar firm in a neighboring city within 12 months.

You estimate $50,000 in moving-related expenses.

You’ll need $170,000 set aside to take your gamble, put your ultimatum in with the other partners, and risk your current job without fear of damaging your financial goals and current security.

But this calculation makes some assumptions, like your desire NOT to risk your current step to financial freedom.

So what types of accounts should you exclude from your FU money calculations?

What’s NOT FU money

Continuing with our example, you’re an esteemed high-powered attorney risking your position for a shot at becoming a partner. What’s not included as part of your FU money balance?

Let’s assume you’re already on track with your retirement investments and you have $60,000 in an emergency fund to cover 6 months of expenses.

Neither your emergency fund nor retirement accounts contribute to FU money! FU money is above and beyond. FU money is your gambling money: the extra slack you pick individual stocks with, buy a bunch of crypto, or start that franchise McDonald’s you’ve always wanted.

Be very cautious risking your existing financial security in a moment of “F-you”. You may calculate it’s worth it to (potentially) set yourself back on your goals.

But be sure you’re doing that from a rational point of view, one of calm and calculation.

Not a heated moment of anger, retaliation, or hurt.

- Is it worth losing a month, a year, multiple years, on your timeline to financial independence?

- Are you OK with being in debt longer and paying those interest bills?

- Would you be willing to cut expenses further to continue to live below your means (if possible)?

Depending on the severity of your predicament, you might be willing to risk some of your savings, retirement, or other assets to be able to say “F-you”.

Just do it in a cold-hearted, rational way—just like the boss, company, or client has that’s sending you up the wall enough to say “F’ it, I’m out!”.

Why do you need FU money?

Aside from the general explanations that FU money provides you freedom, there’s a lot of parts of life outside of a job that having FU money changes.

Find justice. It’s FU money in the legal sense. If that rings hollow to you on the first read, it might be because of the privilege you and I both have. I don’t have much fear of the police or wrongful incarceration, but many do. FU money buys you bail and a good attorney when you need it. It’s not the sort of thing most people build into their emergency fund.

Stop abuse. No doubt we all go into our romantic relationships with the best of intentions and most hopeful futures. But, sometimes it doesn’t work out that way. That one time they crossed the line and promised it wouldn’t happen again, turned out to not be the last. The initially cute moments of drunkenness or silly gambling bread more and deeper negative risks. Addiction developed. FU money lets you exit the situation without fear of having enough money to terminate a lease or afford a divorce lawyer. It’ll give you the lead you need to pay child support or care for your children on your own.

Spend money to make money. As the old saying goes, you need capital to be able to start your own business. Even if your business itself isn’t very capital intensive, that doesn’t mean you don’t have to “pay yourself”. After all, you’ve got to have enough money to afford your living expenses when you’re still earning a near-zero profit (or losing money!) in these first months (or years!). When the boss comes up with crazy demands or treats the customer like crap and you think you can do better, you need FU money to be able to jump at that chance.

The Daily Importance of FU Money

An underappreciated aspect of having FU money is the sense of power and control over your own destiny that it affords in your daily decisions.

Financial independence let’s you build a longterm plan for your life.

FU money let’s you define what that life entails. It’s part of figuring out how much money is enough to be the ideal version of yourself.

Getting paid

One of my favorite ways to leverage FU money was to ensure I never needed money in the short term. When I started a consulting company, I never rushed to begin work before having a contract in place and a deposit secured.

I spent a lot of time negotiating with the client and making sure both sides understood what the expectations were.

My desire was to always deliver value and keep to my word—I never once increased an estimate and demanded a higher payment. We worked to properly discover the details of the project ahead of time.

I occasionally ate an unexpected cost. But because our initial planning and contract were always clear, clients would sometimes happily request to increase the scope of work—and pay appropriately to do so.

At the end of the day, it’s a business relationship and your work should be paid for.

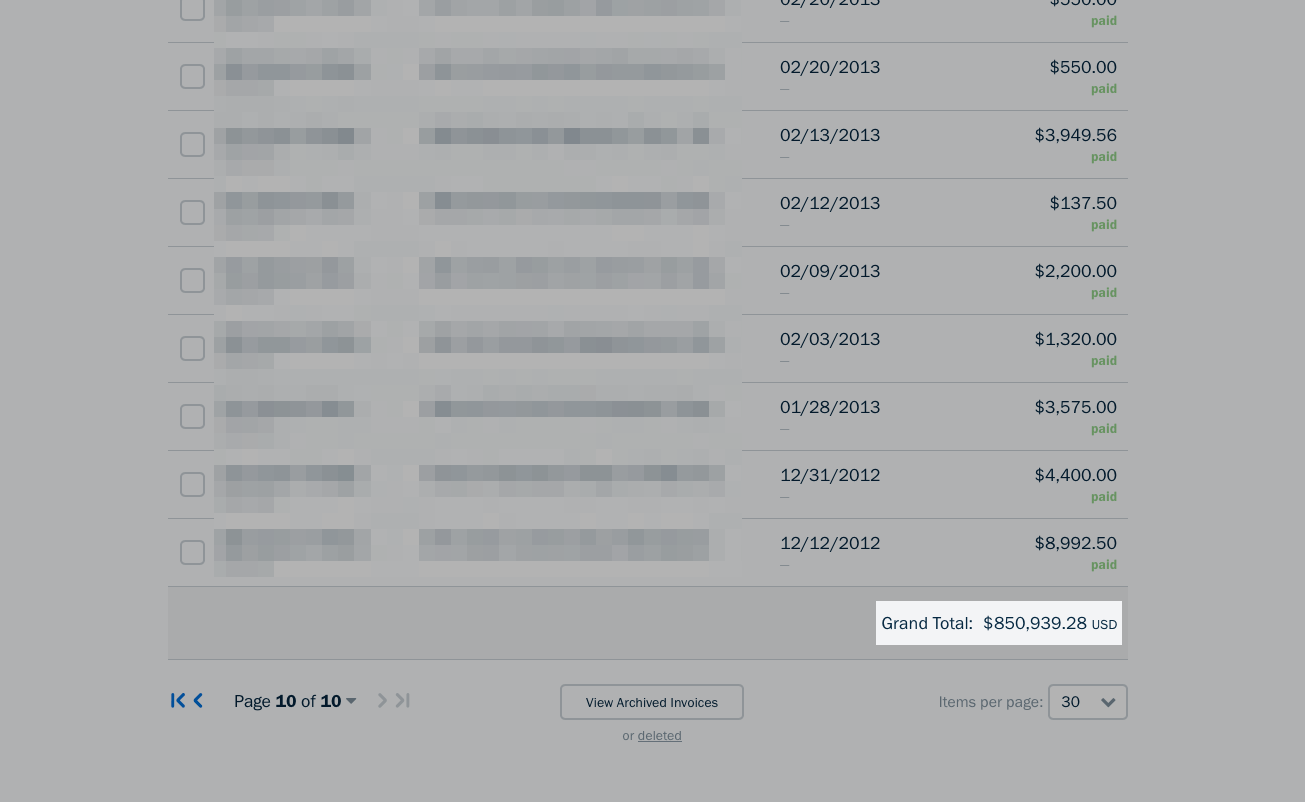

Since my consultancy started using online accounting software, we’ve sent 288 invoices:

Every single invoice has been paid in full.

And I’ve not yet been to court! How?

Having patience

By having FU money, I’ve never felt pressure to accept work or a client I didn’t think was the right fit. The initial meeting with every new client was a little different from what I think most of them expected.

We interviewed them.

There’s always more work to be found, different things we could do to earn a living. But there’s not enough time to spend it doing work you don’t enjoy or meaningless tasks.

After all, why do people work? Having FU money lets you answer that question in a very different way than “to earn money”.

I watched the talk below early in my consulting career and took the focus on having a contract and deposit to heart.

And while you likely don’t work in consulting and don’t run your own business, that doesn’t mean that this mentality can’t be useful.

Removing some of the strength a boss has over you by way of a paycheck lets you level the playing field. It removes some of what can be unhealthy in an unequal power dynamic.

Power over your financial security—money.

When you have FU money, you negate part of that power dynamic.

That time they escorted me out of the building

I started this post off by teasing my story of when I was escorted out of the building at 25 years old. Here’s what happened.

After my stint in the Peace Corps and an attempt at restarting my digital consultancy, I decided I needed a larger corporate experience and more formal structure I hadn’t yet had.

Boy did I get it.

To make a long story short, I moved to the DC area and started working for one of the infamous “Beltway bandits”. I added a closet full of suits and an incredibly lavish apartment for just the right amount of lifestyle creep to boot.

It was the first time I was making over $100K/year. Not a feat I’d thought I’d manage on a liberal arts degree and no certificates to speak of—certainly not at 25 years old.

I had something to lose.

Initially I was working contract-to-hire. After several months of very positive feedback and a generally good experience, I was called in for an earlier-than-expected review.

They offered me a full-time position with a slightly higher salary, performance bonus, and huge benefits package.

I was already saving about 50% of what I earned, but the retirement benefits would greatly speed up my financial independence path.

I had about $50,000 to my name at the time with no debt.

As we were finishing up the meeting, they had one very unexpected caveat to the offer I’d need to accept.

“You’ll need to cease operations of your business.”

Now mind you, at the time, my little side consultancy was basically nothing. I might have earned a few thousand dollars from it in the same year. Just from existing clients—maintaining the service I’d offered them in years prior. These were small organizations in an entirely different sector with tiny budgets.

I certainly didn’t compete with the Beltway bandits.

I said thank you very much. Once I had time to look through the benefits package and consider everything, I’d follow up with my answer.

I sent an email shortly after the meeting asking for clarity about the business:

“In regard to my side business, I haven’t taken on a new client since I started working with the company. It’s hardly active, really just taking payments to continue to offer existing services to fulfill contract obligations. I’m not sure how reasonable it is to cancel those existing contracts.”

The response: “You’ll need to dissolve the actual LLC.”

That night, I spent a lot of time thinking about what was being asked of me. Initially, I thought I might need to cease ongoing operations—but they were asking me to dissolve the entire company. A business I’d started years before and genuinely meant something to me.

At the time, I still had ongoing service contracts with every single client I’d ever had. Sure, it wasn’t much money—but the point was to keep those relationships alive. Remember all those concrete contracts I talked about earlier?

I’d have to break those contracts—it’d hurt my reputation and have some financial consequences. At the same time, it just seemed wrong.

The next day I went into the office like normal. I set up a brief morning meeting with my supervisor.

I explained that I wouldn’t be able to break my existing client contracts, that I was obligated to keep to the terms. Once my client contracts were up for annual renewal, I offered to not renew them. However, the LLC would not be dissolved.

My supervisor thanked me and said he’d follow up shortly. I went back to my desk and awaited the outcome.

Not long after, my supervisor showed up at my desk. He looked upset, apologized, and said that not only was my offer rescinded but that they were canceling my contract.

Right then.

As in—”Get your stuff—we’re walking out right now. Give me your security badge.”

I shut down my workstation, grabbed my bag and a few personal items, then walked out the door with the supervisor right behind me.

I drove home stunned, but happy with my decision.

FU money let me do what I thought was right. And I wasn’t the least bit worried about paying my bills until I found a new job.

This wasn’t the last time I employed my FU money to leave a situation that didn’t feel right. I tell the tale of the second time as part of my description of what a specialist vs generalist is under the “What is a generalist?” section.

What is FU Money to You?

That’s my story of just how powerful FU money can be in your life. And how it could be in yours.

- Offer protection in a time of need

- The confidence to say “no” in work and relationships

- An ability to take risk when it makes sense

But what about you?

Have you used FU money to make a major change in your life or look risk in the eye with a rational prognosis in mind and take a chance?

How did it turn out for you?

Now that you’ve learned what FU money can do to give you freedom and control within your life, what can you change to make it available—and use it?

Let me know in the comments!

![So confident in my FU money, I spent much of late 2010 traveling the world after I was escorted out of the building when I said "no". [Shot from the Cliffs of Moher, Ireland]](https://www.tictoclife.com/wp-content/uploads/2020/11/what-is-fu-money-1200x675.jpg)

16 replies on “This Is the Power of FU Money (and How I Was Escorted Out)”

You stories about working for so-called “beltway bandits” are spot on.

All that money sloshing around up there makes for plenty of fun tales.

Gutsy move for a 25-year-old! I think the world would be a better place if we all had FU money because we could stick to what we think is right more often. There still might be power dynamics in play, but desperation would play less into our overall decision-making. The key thing is that ultimately you were happy with your decision and got to stand by the commitments you made. Proud of 25-year-old you!

Young me: Thank you, thank you. 🙂

Yep, removing some financial dependence from your employer would certainly provide more integrity in decision making—I’d think.

But, the financial dependency an employer wields is pretty core to the whole relationship.

Yeah, that’s really gutsy. I wouldn’t have done that at 25.

Sometimes you roll the dice and they turn your way.

And often times, they don’t.

Amazing article, Chris! The nerve of that company asking you to DISSOLVE your LLC. It wasn’t enough that you offered not to renew contracts. So awesome that you could say no. So many would have been pressured to say yes. Great for you knowing your value AT 25!!! These companies serve their interests only and we have to be more intentional to look out for our own interests. Loved this so much. And your other gems about why the FU money is important. Justice, abuse, I appreciate you commenting on those as well. Bravo to you sir, bravo.

This might be my favorite article of yours yet. I am inspired! Thank you!

Hey glad you enjoyed it!

If it was possible to remove the financial dependency an employer creates for employees, I think we’d have much more integrity in the workplace. It’s unfortunate that’s kind of impossible (unless everyone has FU money, but that’s probably not going to happen). Maybe little by little as more people see financial independence as an important milestone they should incorporate in life, we’ll get to a society with more clear-eyed decision making. Maybe.

Yea—there’s more to FU money and its effects on your decisions than just work. Plenty of personal relationships exist based on money, sadly.

Great article, Chris! I like how you quantified FU money. Considering that I took a year off in 2016, I would say your numbers are accurate. To be honest, I was not prepared enough during my mini-retirement. That is quite the story about being walked out. It’s good that you were prepared and were able to make the decision. Imagine being forced to do stuff you don’t agree with? That’s what FU money is to me, the freedom to say no. Thanks for sharing.

Hopefully that’s a little more helpful way for someone to try to come up with their own amount of FU money. Googling “how much is FU money” has results all over the map. Some saying it’s the same as FI. Some saying it’s a LOT more than FI (and a fixed amount, like $10M). I think it’s very subjective.

And, yea! That’s the scary thing. No FU money and your boss asks you to maybe bend the rules a little. You do it, gotta pay the bills after all. Then next time they ask you to break a tiny law no one will no about.

Gotta pay the bills.

And so on until you’re doing all sorts of crazy stuff. Or you’re forced to work in unsafe conditions. Any number of reasons beyond “I want to take a vacation” that FU money is necessary.

Cheers!

Look at how much power FU money have you. It’s the buffer that also gives you the power to pause and think. Without it you may not have had the confidence to take the time to think about your decision. You may have been too attracted (or forced into) taking the new contract. What a great story of the power of FU money.

Hey thanks, Maria!

Indeed, FU money opens doors to make your own decisions without overweight influence from powers outside of your own motivations, goals, and desires.

I bet you are very happy with your decision! That is an awesome story of the power of FU money thank you for sharing. I know I don’t have any example like that. However, I do have enough to feel comfortable taking calculated risks. I know many people who don’t want to leave a union environment due to the risk but if they had FU money they would have no issue.

I’m certainly happy with where it’s landed me (and us!).

I think anything along the lines of FU money-powered gambling (which might have been what I was doing), probably isn’t a good idea.

But in regard to what you said: FU money let’s you take those calculated risks more confidently. And that’s really important. When you know the odds, eliminate as much uncertainty as possible, and play your best hand with FU money as a fallback plan—that’s calculated risk taking.

What a story! I can’t help but I think I would have bowed down to The Man instead in the same situation. That’s FU money in a nut shell. And, somehow, I had never seen that JL Collins cut up before. Incredible stuff!

JL did a great job with that spoof. I had a good laugh. 🙂

It’s impossible to know if I made the right decision (though I’m happy with what’s come of it)—who knows, maybe bowing down to the man would have been better!