You may have fallen back to lower financial freedom steps if you’ve experienced a life-changing event with the pandemic. The coronavirus pandemic has caused many a layoff, furlough, or pay-cut during the current unemployment catastrophe. A staggering number of people—nearly 30 million—have entered the unemployment system in the US1. This shatters the previous record, just shy of 7 million, established during the Great Recession. That doesn’t mean it’s the end of your financial freedom steps!

As bad as it is in the US, it’s not just here. Triggered by a global problem, the effects are felt worldwide as supply chains are disrupted and demand craters.

We’re in an economic plunge at the depth of the Mariana Trench. How can we make the best of the situation while we, hopefully, float our way back to the surface? How can we resume our path to financial independence by taking fresh financial freedom steps?

The Resilience of Financial Independence

I’d like to acknowledge something before we proceed further: Jenni isn’t unemployed (she’s intentionally part-time), and I don’t have any desire to exchange my labor for money.

In fact, I’ve answered the question of why do people work by choosing to work to create instead of for money.

My workweek borders on something out of The 4-Hour Workweek. We’re coming to the COVID-19 induced coma in our economy from a very different perspective than that of a family fighting to make ends meet. It’d be foolhardy and utterly lacking in self-reflection to suggest I know directly what you’re experiencing if you’re not sure whether you can make the coming month’s rent payment.

More importantly, families and individuals have been torn apart by this pandemic that knows no boundaries. The tremendous toll on human life around the planet is a cost we will not soon recover from.

Jenni and I have been lucky to personally avoid any serious disruption to our lives. I worry a little about her work as a pharmacist, but it is her duty at this point. Work is optional when it comes to money as we’ve achieved financial independence.

As an outsider looking in, I hope that I can offer a fresh perspective and one of optimism. There’s an opportunity to come out on the other side of this with a stronger financial freedom step in the making.

Most importantly, don’t let the successes you’ve achieved be made small by way of comparison to others (especially us!). Our goal is to help you along the way, to be a guide and teacher. Comparison is the thief of joy if you let it.

How will you turn this recession into a chance to plan for a future of financial independence with small steps to financial freedom?

The Economy vs. Stock Market

Where is the economy and market in 2020? As an early retiree (along with the other half of this duo switching from full-time to part-time work), I tend to keep an eye on the stock market. I remember the 2008-2009 Great Recession well as my personal net worth (around $30-40k at the time) was cut in half and I ran for the fences due to a dependence on my ability to pick individual stocks.

I’m not sure I’d trade being that much younger to be that weak-handed, again.

Let’s take a look at the two recent economic indicators always being touted by the media. Unemployment and the stock market, as represented by the US S&P 500 index and continuing unemployment claims.

The chart depicts the S&P 500 value from the year 2000 to May 20202. It contrasts this indicator with the ongoing unemployment claims in the US.

The chart uses the seasonally adjusted continued unemployment claims as provided by the Fed1. Basically, this is the tally of workers filing for unemployment and still actively using unemployment. I’ll just refer to this number as “continuing unemployment”.

Ignoring this year, continuing unemployment has generally hovered around three million people throughout the 2000s. The Great Recession produced a big spike, peaking just below seven million in the summer of 2009. The chart also makes it apparent that the S&P saw its lows a bit ahead of the unemployment peak, in the spring of 2009.

S&P 500 vs. Unemployment Claims in 2020

Let’s take a bit of a closer look at that chart, focusing on just this year, 2020.

Comparing the Great Recession to the current collapse—which I’d like to call the Great Trench, due to the absolutely massive, sudden dip (and hopefully sudden rebound)—a similar narrative seems to be playing out. So far, the S&P bottomed out earlier in the spring of 2020.

Ongoing unemployment is still increasing as claims continue to pile in, but the acceleration has slowed. Unemployment data is still coming in for the rest of May, as of writing2, but this trend has continued in the preliminary data. The S&P is up just a bit and unemployment claims, while still rising, are decelerating.

If the indices wind up leading unemployment claims as they did in the Great Recession, we may be past the worst of the effects on stock investments.

There’s a lot of factors involved here, including a lot from the Fed’s involvement that is really beyond the scope of this article. I simply intend to offer a bit of hope in the form of “we’ve never seen anything like this, but there’s a little light at the end of the tunnel.”

Of course, as the old saying goes, past performance is no guarantee of future results.

So, how can we be ready to capitalize on an economic recovery, when it happens?

7 Financial Freedom Steps

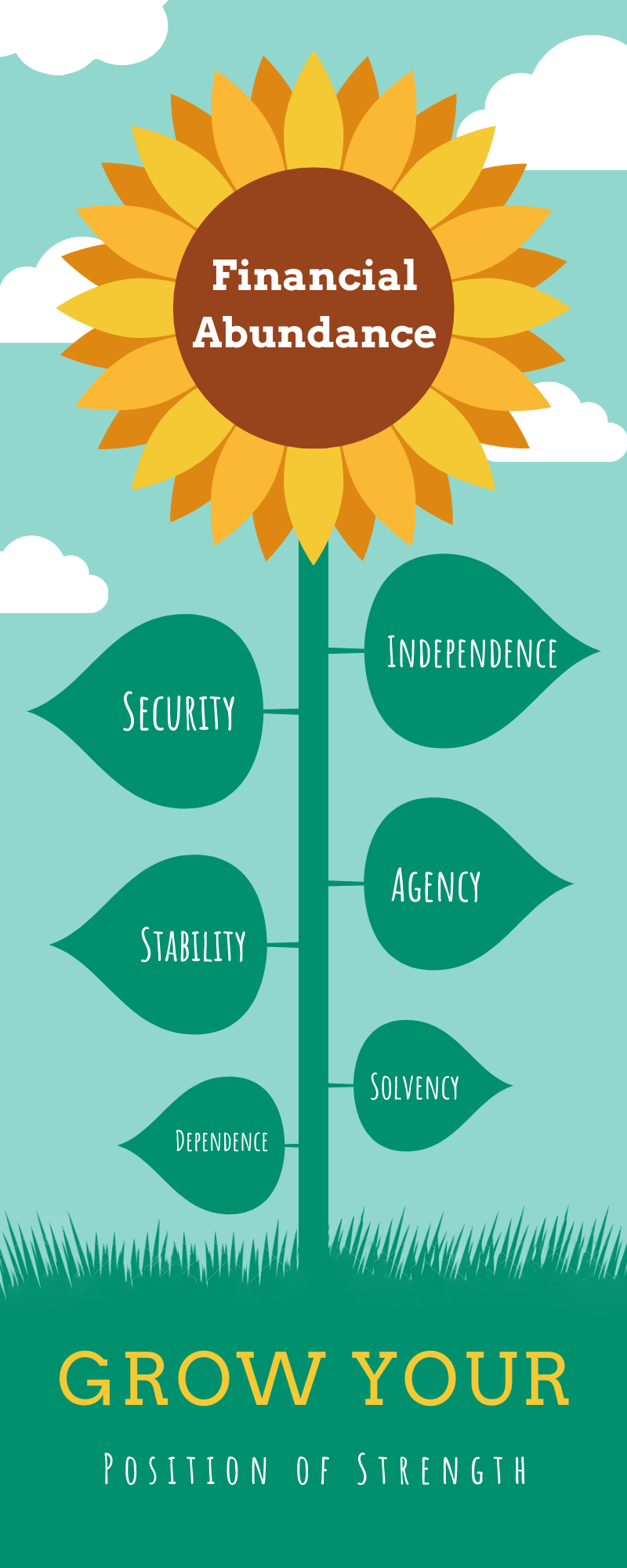

No matter which of the steps to financial freedom you were on when this pandemic-induced recession started, there are ways to make the best of the situation. You can reach a new position of strength in your financial life. You’re growing financial independence from one of these financial freedom steps:

- Dependence: In debt, jobless or underworked

- Solvency: In debt, have a job

- Stability: Staying afloat, working

- Agency: Building savings, working

- Security: Making money work for you, flexible work

- Independence: Financially independent, work is optional

- Abundance: Retired, self-actualizing

If you’re in debt you can’t manage or recently lost a job and have debt, you have an emergency. You need to work to live within your means. See the Resolving Debt section below.

If you’re making ends meet, but inconsistently, it’s time to buckle down and work to cut expenses. During a recession, we’d all like to find a better source of income but sometimes the most actionable way to build agency into your financial situation is in your own spending. See the Reducing Expenses section below.

Finally, if you’ve got debt and expenses under control, then you’re ready to have your money work for you. Throughout the history of the US, recession preceded economic expansion. Check out the Building Wealth section below.

Resolving Debt

Alright, I’m not going to sugar-coat this. This is bad. If you were swimming in debt when the economy was humming along quite well, then got smacked with a job loss, it’s not going to be pretty. That’s doubly true if you’re single or the single-earner within a family. Still, you’ve got options.

Consolidate debt

Wherever possible, move debt to the lowest interest rate line of credit you have access to. For example, it makes more sense to pay down your high APR credit card and make the minimum payment on student loans, your mortgage, or car payment. Refinancing can go a long way to consolidating your debt to lower rates.

Lowering the average interest across your debt will help lower your total minimum monthly interest payments, freeing up cash flow.

Delay debt payments

Contact your debt holders and ask to delay payment. Landlords and mortgage holders are offering to delay collection in most states. Taking the time to contact every bill collector you can and asking to delay payments can go a long way.

Most credit card and utility companies have facilities available to delay payments but you have to ask.

Use your emergency fund

If you had the fortune and foresight to build an emergency fund prior to the catastrophe outside your door, now may be the time to use it. After all, how many emergencies that outweigh a global pandemic really come along in a lifetime?

Plan to spend it down judiciously and work to rebuild out once this passes, and it will pass.

Have you spent days chasing unemployment yet?

The CARES Act set a minimum federal contribution to weekly unemployment checks at $600. If you’ve lost your job through no fault of your own, I hope you’re already working through the massive state unemployment queues. The state systems are absolutely overwhelmed, but hang in there. The civil servants behind the phone lines really do care.

Ask for help

Aside from the more obvious help: friends and family, if you have questions, ask us. Leave a comment below or reach out on Twitter. We’ll do our best to point you in the right direction.

If you have questions, someone else probably has the same question. Your questions can help others. Check out our reader case studies.

Reducing Expenses

Our strongest piece of advice for reducing expenses is to simply track them. Not unlike a food journal, you can’t know where you’re making mistakes if you’re not keeping track.

If you’re intimated by getting started, do whatever is comfortable for you to begin. Throw all your receipts into an envelope if that’s how you’ll begin. Print out your credit card statements monthly and put them in a folder. Whatever you have to do. Simply start tracking.

Once you’ve taken that tiny step, we generally recommend going to a digital solution to automate the process. Software can automatically analyze your check and credit card spending, classifying transactions for you.

We like and use Mint.com but many other folks love Personal Capital and YNAB (You Need a Budget).

Once you’re tracking, you can start looking at where your spending is out of line. Take a look at our annual FIRE budget review from last year, where we lived on $41k (with a mortgage!). We feel like it’s quite a luxurious existence!

Go minimalist

An economic contraction, while you’re still working, is a great opportunity to test your ability to reduce your spending. One day, you’ll no longer be working and effectively be living on a fixed income. You won’t have room to add to the income side, and when there’s another contraction, you may need to ride the wave down and reduce your expenses.

Try living a simpler life. With less stores and entertainment venues open, you’re naturally forced to consider other things to do. Parks are free and fun. Find creative ways to entertain yourself at home, get into DIY projects.

Test your metal, get a little uncomfortable, do it when you still have income coming in as a fallback.

You might just find you enjoy parts of your changed routines and continue them even after the economy starts growing again. That gives you an opportunity to lower your ongoing living expenses, bringing your financial independence and retirement a little bit closer.

Turn food into a source of income

We went on a deep-dive analyzing our 2019 annual FIRE budget where we had a focus on cutting our food expenses the past few years. Our guide to saving money on groceries revealed just how much of an effect this had.

At one point, we actually earned more money from buying food in a month than we spent. Of course, it was just delayed rebates coming in but technically it happened. We made money eating.

The guide isn’t about eating rice and beans (though they’re tasty and efficient!). It’s an expert level guide to saving money at the grocery store, beyond the basics of simply switching to store brands or cutting individual luxuries. We ultimately reduced our grocery expenses by about 40% without sacrificing food quality or health. You probably can, too.

Building Wealth

You’ve rid your family of parasitic debt and trimmed your expenses to a level that allows you to save money for the future. You’ve chosen to live below your means. Now it’s time to work to build long-term wealth. While wealth-building generally is a topic beyond the scope of this post, there are some strategies to keep in mind during a recession that will protect your wealth and your ability to maintain it.

Practice a Rental Mindset

I wrote about the mentality “everything is for sale, always” when analyzing Frugal vs. Cheap. If you’ve gained a work-from-home situation recently, you probably have more flexibility in your schedule to leverage apps & websites to sell stuff locally.

We’ve had surprisingly great luck selling odds-and-ends around the house during the pandemic on local forums like Craigslist, Nextdoor, and Facebook Marketplace. With stores closed, you have less competition to unload your wares. Follow local ordinances for social distancing. Collect money via Venmo or PayPal if you’re comfortable with the buyer.

Use plain cash with a very suspicious-looking drop from the buyer on a bench, let them inspect your wares, then come pick up the cash with your sneakiest drug deal impression once they’ve cleared out.

Keeping your belongings on rotation frees you from becoming attached to them and lets you try new things in your life. It’s been a key component of how we became millionaires in 10 years.

Rebalancing Investments

Adherents to the FIRE movement don’t necessarily prescribe a particular investment allocation or strategy. That said, Jenni and I have followed general investing wisdom especially prevalent from the wise Bogleheads that advocate a balanced, index-focussed portfolio (perhaps with VTSAX or VTI).

Most of our net worth is tied up in broad index funds that track the entire world market, US market, target retirement funds, and bond markets. We hold these assets in 401ks, IRAs, HSAs, and brokerage accounts.

Managing asset allocation with new money

We generally attempt to keep our asset allocation set at a certain ratio of more aggressive funds to more conservative funds. Think stocks versus bonds. As the market has contracted, growth-oriented investments like stocks have shrunk disproportionally to the broader market. We wind up overweight on more conservative investments like bond funds.

With our allocation being out of whack, we’ve had the opportunity to rebalance our portfolio: we get to load up on cheaper stock funds. Companies have gone on sale. We’ve been fortunate enough to still add to our investments during this time, so we can rebalance by simply investing in the underweighted part of the portfolio. If you don’t have the cashflow available to do this, that’s okay, you can simply sell the overweight conservative parts of your portfolio and use the proceeds to purchase the underweight portions.

A balanced portfolio as a key to success with the 4% rule

Maintaining a balanced portfolio is a key tenet of how the original Trinity study identified strategies to reduce risk when following the 4% rule. For example, you may recall that a 100% stock portfolio was less likely to survive a very long retirement period than a more balanced 75% stock, 25% bond portfolio from this study.

Rebalancing your portfolio becomes more important as the underlying assets become over- or under-weighted. Have you checked in on your asset allocation lately?

Giving back with abundance

If you’ve surpassed the financial freedom steps necessary to reach financial independence, you may be taking the final step to abundance. At this point, you may start asking yourself questions like why do people work, you might evaluate negotiating pay from a very different perspective.

If you’ve been fortunate enough to be able to stop fending for yourself and your family, your position of abundance is more important than ever in a time of need. Jenni and I are working hard to figure out ways we can make a difference, even very small. This very blog is a great example, and we hope you find some solace or join our push to give with our Reader’s Choice FIRE Fund.

Don’t hesitate to leave a question or catch us on social media, your question is likely on the lips of someone else that needs the same help.

Taking Financial Freedom Steps

These weak hands of mine may have even learned something from their shaky experience over a decade ago: we’re still holding onto our investments. Coming from higher financial freedom steps, we’ve managed to add to our investment positions throughout this Great Trench of 2020.

No matter the position of strength you’ve come from before this recession, you can leave at one of the higher financial freedom steps. If you’re on the first financial freedom step—dependency—or you’ve reached the pinnacle—abundance—there’s still an opportunity to grow.

FOOTNOTES

- Seasonally adjusted continued unemployment claims data is provided by the St. Louis Fed for more recent data: https://fred.stlouisfed.org/series/CCSA

Historical data going back to 1967 available from the Department of Labor: https://oui.doleta.gov/unemploy/claims.asp - S&P 500 values provided by Google Finance.

- Mr. Money Mustache and J.D. Roth coined the idea “Position of Strength” and the levels of financial independence, respectively. I’ve shaken them up and combined them.

2 replies on “7 Financial Freedom Steps: Reaching Financial Independence”

Lots of wisdom in here! Especially selling stuff via risky drug-deal style Craigslist deals, har. We’ve found that giving back post-FIRE evolved slowly with lots of trying different avenues (giving money, giving time, hiding in a basement playing Warcraft 8 for a year). Balancing that with living a fine life is a worthwhile challenge to spend the rest of our days on, I’d say! (Maybe not Warcraft.)

Thanks, Dakota! Haha, despite all the questionable deals over the years, none have turned out bad. 🙂

Nothing wrong with Warcraft! Thanks for the kind comments.