Growing up in suburbia, my parents’ financial focus was often paying down their mortgage as fast as they could. Jenni and I have our own mortgage, should we try to pay it off as fast as we can? Is it better to pay off the mortgage or invest when you get a surprise a bonus, raise, or other lump sums? Should you pay off your mortgage as fast as you can or invest the extra money?

This article builds upon my buy vs rent and invest article which is recommended reading.

Debt Lessons From My Parents

To be clear: my parents couldn’t always make extra payments toward the mortgage. I can remember several Christmases as a kid where they struggled to present me with the childhood they thought I should have.

My parents both worked, one with a high school degree and one with a GED. My mother put herself through night school to earn an associate’s degree when I was growing up.

A decade later, she earned her CPA and commands respect as an expert in her field at the twilight of her career.

My father has earned multiple IT technical certificates and in his later years, a real estate license.

Growing up with frequent moves

Over time, once their careers were established, they had access to 401(k)s to invest in. They’ve built up a solid nest egg. Still, most of their net worth resides in their home to this day.

I remember moving around the country several times as a child, each time to a slightly nicer neighborhood. Each move meant equity was unleashed. They always rolled the equity over into the new home, maximizing their downpayment and stretching for something a bit more expensive.

But, each move meant another load of realtor fees, transfer taxes, and general transaction costs. It’s so easy to forget these hidden costs when calculating the value of real estate investments, not to mention their opportunity costs.

Most of my teenage years were spent in a townhouse. At the end of my high school experience, they moved into a standard suburban single-family home in a nicer area.

A big single-family detached house just as I went off to college.

I remember it was the first time I’d had access to broadband internet instead of a dial-up modem in my last summer “home”.

Should You Pay Off Your Mortgage or Invest?

Deciding whether you should pay off your mortgage debt or invest extra capital into the stock market will depend mostly on what your goals are.

Let’s first look at the simple goal of having the highest net worth at the end of either decision.

We’ll use my parents as an example:

- Home purchased in 2002 for $350K

- Paid a downpayment of $70K (20%)

- Debt on the property was $280K

- 30 year fixed rate mortgage, 6% avg interest (refinanced)

Paying off the mortgage with no additional payments

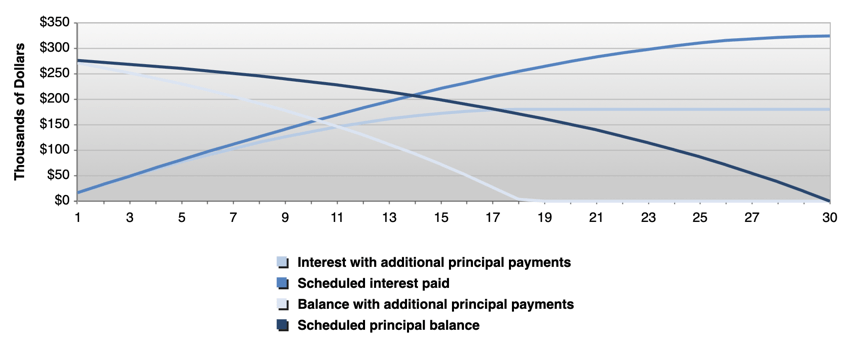

In the first scenario, we’ll assume they follow the standard 30-year pay off schedule. The table below illustrates the mortgage pay off summary.

| Mortgage Pay Off | |

|---|---|

| Original term | 30 Years |

| Annual interest rate | 6% |

| Payment (PI) | $1,679 |

| Total scheduled payments | $604,348 |

| Total interest paid | $324,348 |

Their $350K home ends up costing them a total of $604K in additional payments beyond their initial $70K downpayment. They’d have it paid off by 2032.

Of course, there are many other costs to homeownership but they’re irrelevant for our comparison here.

Making extra payments to pay off the mortgage faster

Now let’s look at the second scenario, which is much closer to reality. They’ve made frequent additional payments over the years in order to get the debt paid off faster.

Let’s add some new assumptions for this scenario:

- Extra payments would otherwise be invested

- Goal is to pay off mortgage in 18 years

- Extra monthly payment of $435

We’ll assume they followed our guide to saving money at the grocery store to free up $435 each month. Making an extra payment of $435 every month would let them reach their desired 18-year pay off goal.

How does this affect our pay off summary table?

| Mortgage Pay Off | |

|---|---|

| Original term | 30 Years |

| Annual interest rate | 6% |

| Additional principal payment | $435 per month |

| Payment (PI) | $1,679 |

| Accelerated payment (PI) | $2,114 |

| Total scheduled payments | $604,348 |

| Total accelerated payments | $460,123 |

| Total interest paid | $324,348 |

| Savings | $144,225 |

| Mortgage shortened by | 11 yrs, 10 mons |

That extra $435/month of payments creates a whopping $144K worth of debt interest savings in just 18 years! If you’re curious, the total value of all those $435 payments would be just $94,830! That’s nearly a 50% return on investment.

It’s certainly a great decision compared to blowing that extra $435/month on a depreciating asset like a new car loan or consumer goods.

But how does it compare to investing that $435/month in the stock market over the same 2002-2020 timeline?

Investing extra capital instead of paying off the mortgage

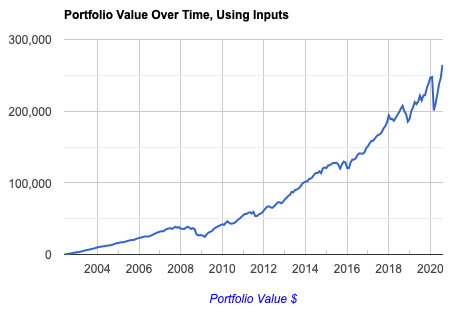

Let’s assume my parents would make the smart decision of investing their extra $435 monthly payment in index funds. For this scenario, we’ll assume they use a tax-advantaged account such as an IRA, HSA, or their 401(k) to make these investments.

We’ll also assume there are no transaction fees for each monthly investment since they’re investing in index funds instead of trading individual stocks.

While I’m a fan of total market index funds like VTSAX or VTI, for simplicity’s sake we’ll calculate returns with an index fund that mirrors the S&P 500.

The chart below depicts the portfolio value when simply investing $435 per month consistently over their 18 year timeline.

The final portfolio value is $264,630. That’s a return on investment of about 280% with the same $94,830 in extra payments!

Without making any extra mortgage payments, their debt balance at this point in year 18 would be $162K. They could pay off the mortgage balance with their investment portfolio and have about $102K leftover.

Investing in an S&P 500 index fund instead of making extra payments toward their mortgage would increase their net worth by about $102K in 2020. That’d put them 10% of the way to becoming millionaires!

So What’s Better: Extra Payments or Investments?

Some people treat extra mortgage payments as a form of savings. They could access the equity later with a home equity line of credit or refinancing, for example. For others, they just want to make the decision that will earn them the best return. However, there are times when it makes sense to pay off your mortgage in ways you don’t expect.

When to invest extra payments

Most people will do better with index funds (I like VTSAX or VTI) than with paying off their mortgage. That’s simply a function of the difference between the debt interest rate and investment return rate.

The longterm CAGR of the stock market is about 9.2% with dividends reinvested. Your debt interest rate would need to exceed market returns for making extra mortgage payments to make financial sense. That’s certainly happened before, but on average, it’s unlikely.

When to pay off your mortgage

When you’re on a path to financial independence and retiring early, you’ll likely want to limit the amount of taxable income you produce each year. That’s doubly true once you’re actually in early retirement.

Why?

If you eliminate the need to make monthly mortgage payments by paying it off early, you also reduce how much income you need. Without the associated housing costs, you’ll no longer need to earn as much money.

Lowering your taxable income (as an early retiree, this likely means selling less of your investments) could lower your tax bracket.

For example, did you know that in 2020 you could earn about $100K of capital gains as a married couple and not pay any taxes on this income? Each buck above that combination of the tax bracket and the standard deduction will cost you 15% in taxes.

There are lots of other reasons you may want to limit your income in order to qualify for various programs or deductions:

- ACA subsidies

- Medicaid

- Nutrition assistance

- IRA or Roth IRA income limits

- Avoiding the AMT

Eliminating a mortgage payment you need to make can give you more flexibility in reducing your income in order to make your remaining income more efficient.

Finally, when you’re on the path to FIRE, one day you might just ask yourself “how much money is enough?” Our desire for income shouldn’t be limitless.

What about my parents?

My parents’ decision to buy instead of rent and invest has proven to be quite beneficial to their personal finances. Still, that doesn’t always mean that extra debt payments beyond the minimum monthly payment are smart.

Every extra dollar put into my parents’ mortgage over their minimum payment was a poor investment, financially speaking. That doesn’t mean they haven’t gained significant value from reducing their debt load.

The emotional and mental value of cutting debt out of your life is unquantifiable.

Jenni and I carry a mortgage on our primary residence and we thoroughly enjoy our city life experience—we don’t plan to move anytime soon. Still, I don’t think we’ll be paying down the balance of our mortgage any faster than we need to.

In what situations do you think it makes more sense to pay your mortgage off early rather than investing?

Is it ever financially more prudent to do so in the low interest rate environment of today?

7 replies on “When to Pay Off Your Mortgage or Invest Extra Capital”

Hey Chris-Nice post here, especially your break down of all the costs associated with real estate.

The one challenge with investing is the fact that equity multiples are so high right now and interest rates are effectively at 0%, so there aren’t any great investment options in my opinion. Ultimately I think you need to expect to earn 2-3% higher than the interest rate on your debt to invest rather than getting a guaranteed rate of return by paying down your debt.

Just my two cents.

Thanks for the supportive comment!

You’re right that it’s often a pretty simple mathematical question when it comes to deciding to pay down a mortgage or invest extra money. At least, that’s the case when it’s a simple case!

Some folks need to consider the impact that paying down debt will have on their taxes, how much income they’ll need generate in order to make payments (more income = potentially higher tax brackets on that income), and plenty of oddball things like subsidy cliffs as it relates to income levels.

It’s surprising how much these housing decisions affect your plan for financial independence.

Great post! My take on it is if the interest rate on the debt is less than 7% then it would benefit you to continue putting that extra money in the stock market (I love VTSAX too!) based on average returns you can expect over the long run. But I also don’t discount the psychological need to eliminate all debt for some people. So really, it comes down what works best for you and what your goals are – like you said. But nonetheless, always good to consider both options!

I really like your perspectives. I especially liked your original take on comparing the $94K of additional payments to saving interest as a ROI. That’s a great point that I haven’t seen considered or brought up before, so great catch there!

But I do have some hesitations whenever people use the past 20 years as reasons to invest over pay off debt. While 2000-09 was a horrible decade 2010-19 was one of the top 4-5 best ever. So while they kind of average out two average decades of returns would look different.

Another consideration is that the mortgage payment is set today but you can use future dollars to pay it off. However, the money invested will have a lower purchasing power by the rate of inflation which makes long-term comparisons of investing vs. paying down mortgages a little sticky. It’s a hard comparison since the mortgage payment is steady and inflation is not, but just a consideration.

Honestly, this post and your last one on rent vs. buy are great. I’ll be recommending them!

Hey Dan! Thanks for coming by and the kind words.

Yea, there’s a surprisingly large number of variables involved with the rent vs buy equation, and even in the decision to pay off the mortgage faster than required or to invest extra funds.

“But I do have some hesitations whenever people use the past 20 years as reasons to invest over pay off debt. While 2000-09 was a horrible decade 2010-19 was one of the top 4-5 best ever. So while they kind of average out two average decades of returns would look different.”

Although the purpose of this particular post (along with its sister post on buy vs rent and invest) was to use a specific anecdote and scenario to build an analysis distinct to one set of circumstances, 100% agreed with your point. Over the very long term the math can look pretty different.

While we talked a bit about appreciation in stocks vs real estate, that doesn’t account for interest rates’ variability.

For example, if we look at FRED’s data on 30 year fixed rate mortgages (alter the graph to max length, going to 1971), things could look VERY different for our mortgage pay off analysis!

In 1981-82, you can see that the AVERAGE rate was OVER 15%! That’s bonkers! Stocks would have to perform incredibly well to beat out paying down a mortgage at that rate.

Really, anytime between 1978 and 1992, per FRED’s data, you’d probably be better of paying down your mortgage ASAP. Interest rates were commonly above 10% in that period.

We’re definitely in a different time and hopefully my analysis in either the mortgage pay off case or the more general buy vs rent and invest case doesn’t suggest any sort of blanket statement on what is “better”. Rather, the goal is to help readers perform their own analysis and make an informed decision.

Thanks again for the great point, too, Dan! Hope to see you around more often.

Do note, that the ability to invest in a periodic way into “low fee” instruments is a recent phenomena. Plus, how was one to do research ?

Discount Brokers/Etfs were essentially non-existent pre 2005.. Infact, Vangaurd started in 2001 !! Discount brokers weren’t really common until 1990s. Minimum Schwabb fees in 1988 were still $39…

Given no cheap alternative, its no wonder that most people pre 2000 concentrated on paying off their homes as opposed to investing !!!

Hey Max! You’re absolutely right: the world of investment knowledge/research and financial instruments have changed pretty dramatically with the advent of the internet. I think what drove people to pay down their mortgages pre-2000 more than than $39 trade fees were the exceptionally high interest (and mortgage) rates. Just before the turn of the millennium, 30 year mortgage rates were around 8% (source)!