May felt like a crescendo of a month for us. Of course, the big thing wasn’t our income/expenses this month—even as that’s probably what you’re interested in reading—it was our wedding! And, we just finished a post on the proposal/engagement story with a cost breakdown.

For our monthly donation, our theme is LGBTQIA+ community nonprofits. You can read more about them and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Our part-time work income was pretty limited and we were a little busy with other priorities this month.

Aside from our usual monthly income, here are some interesting anecdotes:

Gifts Received

May is our birthday month! For the big 40, some family members wanted to gift us *something* so we received a few checks. Then, with the wedding—despite our very clear “please don’t give us gifts”—we received some checks and cash. We warned our attendees that any such gifts will be donated so a good chunk of our gifts received are being forwarded on to our Donor Advised Fund (DAF) this month.

We received $1,170 in gifts.

Credits

Several of our credit cards offer statement credits for purchasing with certain companies.

- Chris’s AMEX gold earned $10 back for Grubhub which he used on a local bakery pickup.

- Our Chase cards earn back $10/15 per quarter from Instacart which we use on local grocery pickups.

We received $25 in statement credits.

Expense Summary

From our $11,167 monthly budget, we saved and invested about $413.

After subtracting our credits, savings, donations, and one time expenses (wedding!)—we spent about $3,117 on living expenses.

That’s 65% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details.

Food & Dining

Food saw a bump in costs this month primarily due to a credit card renewal.

Groceries

At $165, our grocery spending this month was exceptionally low. This was partly because of higher spending in previous months—which we ate this month—and a series of discounts from GoPuff that brought our food expenses down. Our dining-out expenses dwarfed our groceries, unfortunately.

Restaurants, Fast food, Alcohol & bars

We had one big evening out that broke this budget area. In one night, we spent about $250 at a local restaurant. Why? Jenni turned 40 years old! As it was so close to our wedding day, we had several friends in town that we took out to dinner with us to celebrate the big 40. That made for a steep—though very worthwhile—bill.

Chris also bought coffee and treats for visiting friends at an amazing local coffee roaster—about $28 worth.

We spent $475 on food & dining this month.

Shopping

This category remains a bit high compared to our average.

Sporting Goods

A friend stayed with us for a few weeks in advance of our wedding. With that, we purchased a brand new Kent mountain bike so he could just us on local rides. The size is such that, while it worked well for the visiting friend, it should be usable for Jenni moving forward. Her rides on local trails should be much more enjoyable than her preexisting hybrid bike. The bike was $200 via a Facebook Marketplace deal. Chris also spent about $25 on bike parts to repair a different ride.

Clothing

Chris snagged a slick deal on a few suit separates. Some years back, his small collection of work suits was destroyed by moths. While that remedy is hopefully resolved, he was still left without such fancy attire. For a total of just $83, he bought one grey suit jacket and pants as well as a single navy sports coat. While the brand, Jos A. Bank, isn’t known as particularly high end—it’ll certainly suit his needs for the occasional lux night out on the town. The modern cut and pure wool fabric should be pretty timeless. Jenni offered to hem the pants and jacket cuffs with the pieces otherwise fitting well off the rack.

We spent $308 on shopping this month.

Gifts & Donations

Donations

As mentioned on the income side of this post, we received quite a bit of money from friends/family for our wedding. This is despite being very, very clear that we wanted no gifts—their attendance was the gift after all!

Well, we warned them that any gifts would be donated to a charity of our choice. As such, we’re donating it…to you! Well, you’ll at least have the ongoing power to direct the giving. We donated $770 to our Reader’s Choice Charitable Fund this month.

Gifts

May is a big birthday month for our family/friends. We ended up giving away and/or purchasing gifts with the money Jenni received for her birthday from her family. It’s like gift recycling. 🙂 We regifted $200, making a net gift cost of about $50.

We donated or gifted about $825 this month.

One Time Expense (Wedding)

We know, this is the breakdown you wanted to read! But, we didn’t want to blow up this monthly update and have the wedding breakdown takeover. Like our recent proposal/engagement cost breakdown, we’ll have a separate post. We’ll break down all of what we chose to spend on—and what we didn’t!—giving away all the details and our planning process. Soon!

We spent about $6,837 on our wedding.

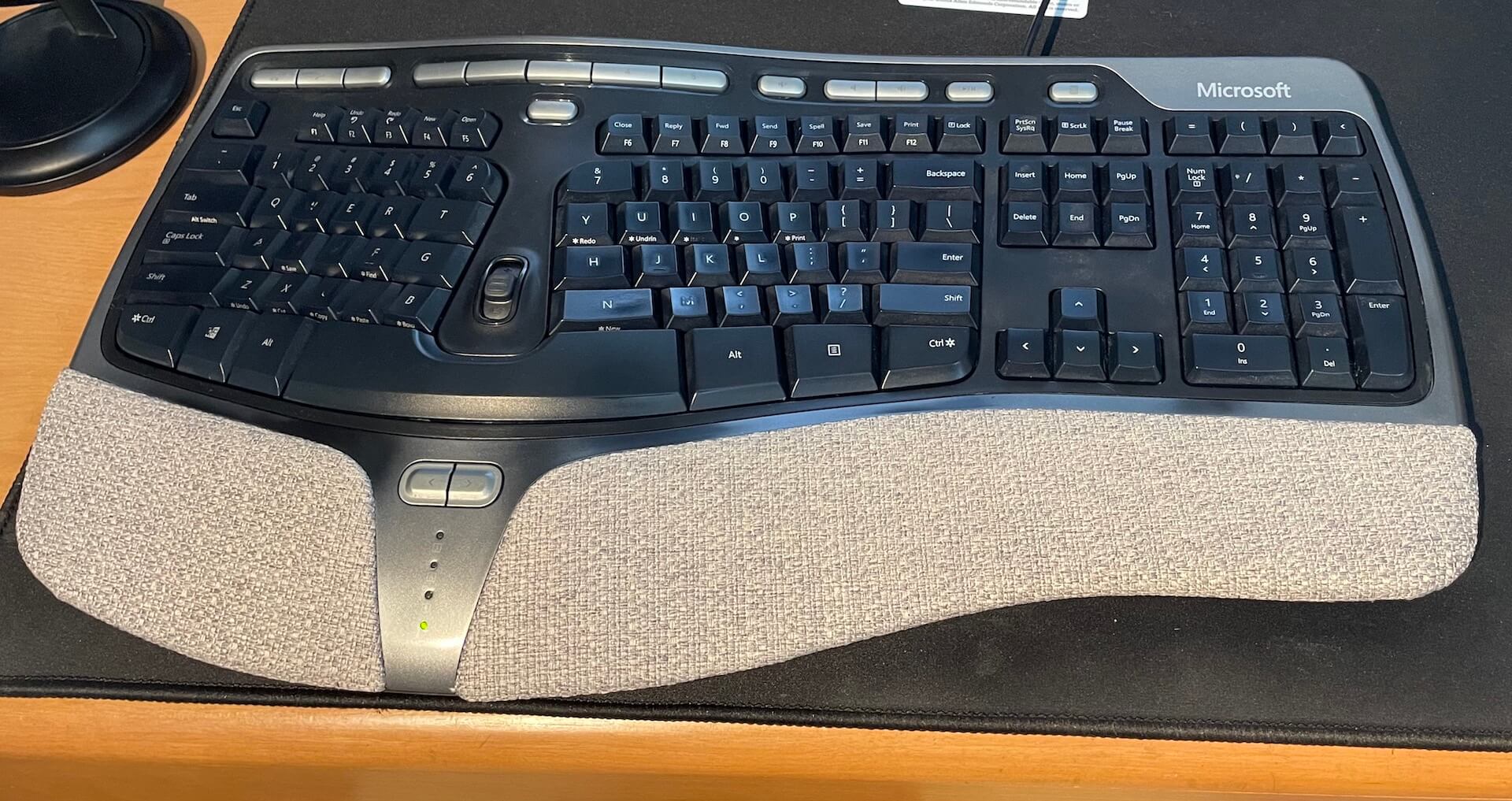

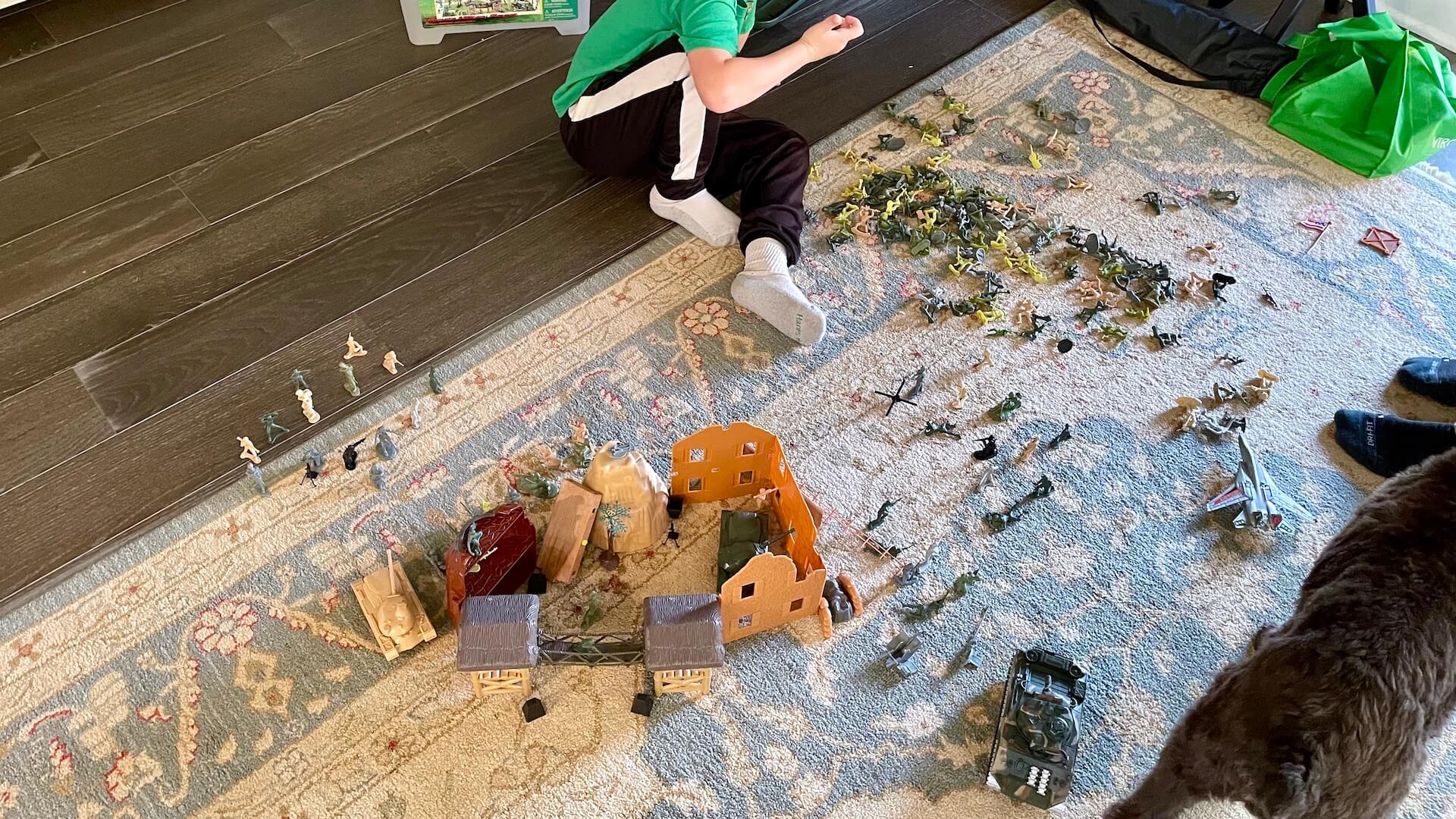

Nothing

We liked this new category last month so we’re going to keep it going! Some of our favorite moments of the month cost us zip. Zero… Nothing!

Everything below; not a penny in additional costs:

In fact, it’s pretty tempting to argue that the keyboard repair increased our net worth! 😀

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Furnishings

Our second-floor hallway has had an 80s or 90s-style textured ceiling light that’s driven us crazy for years. It’s just too little light—even after upgrading the bulb—and poorly aimed. We finally replaced it with a multi-directional light and high-powered LEDs. This small upgrade should improve safety in the hallway and light up our linen closet which is otherwise pretty dark. It is about $55 for the fixture and three bulbs.

Property Taxes

A chunk of our monthly property tax was for Jenni’s Prius during this year’s assessment—about $222. Over the years, asset taxes like this add up—consider the car is worth $6,000. Imagine it was $60,000!

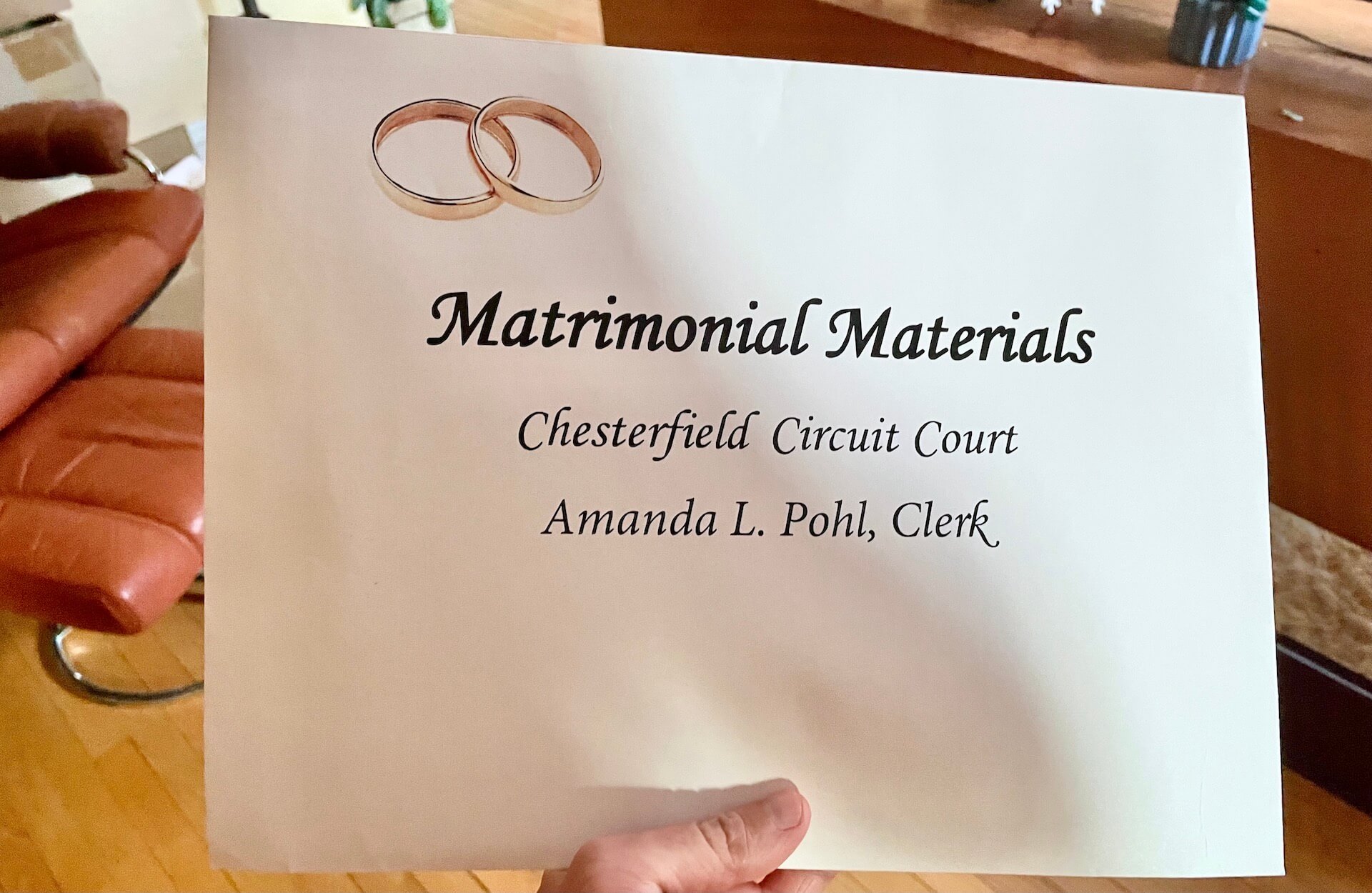

State Taxes

And the happiest license/tax we could have to pay… Our marriage license! For about $55, a county courthouse executed our legal union and mailed us copies. We listed the cost as $35 since Jenni happened to stumble across a $20 bill in the street on the way in with no owner in sight!

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

Jenni’s work responsibilities decreased a bit this month. Our focus has been on our pending May wedding which has eaten up our time.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of May 31, 2024.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 946,102 |

| Brokerage | 852,344 |

| Roth IRA | 192,060 |

| Traditional IRA | 22,984 |

| HSA | 58,896 |

| Real Estate | 437,500 |

| Mortgage | (136,989) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 25,309 |

| Net Worth | 2,423,205 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 4.9% for the month.

And well, we were more than a little behind with a 2.2% gain. But, considering we didn’t lose as much as the market did last month—that makes sense. Our portfolio tends to have a little less risk and therefore variability.

Overall, our net worth increased by around $52K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

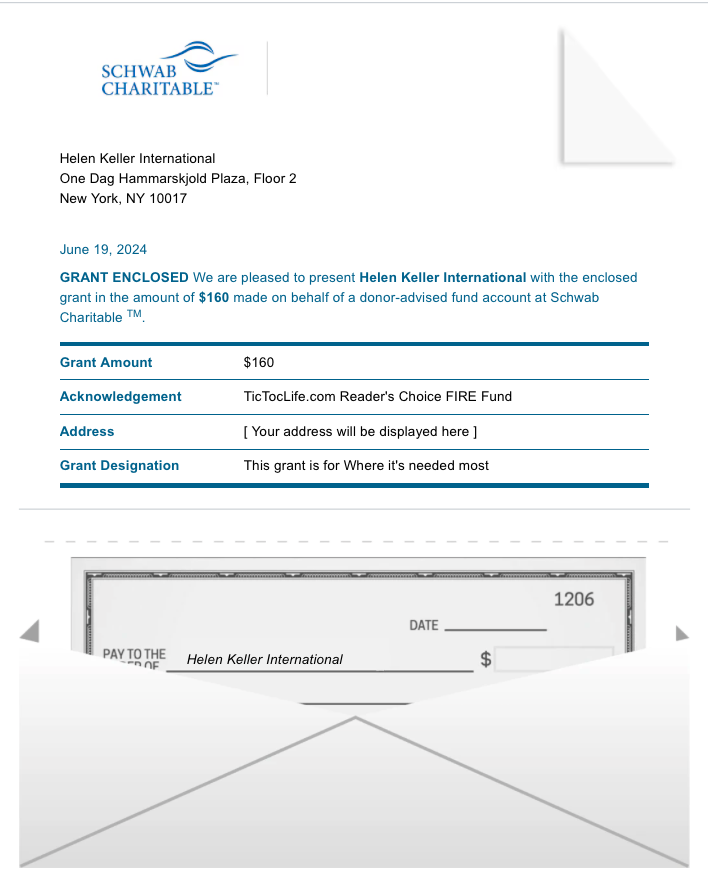

Previous Donation Winner

Last month we ran a little charity competition between the two of us. Jenni wanted to support a very well run local organization fighting addiction. Chris went the route of data-backed effectiveness for saving lives.

Chris’s suggestion of Helen Keller International won out. Their Vitamin A Supplementation program throughout countries in Africa and Asia has significantly reduced childhood mortality and reached millions of children in need. All for just about $1 per dose.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 46 months. We’ve given almost $6,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: LGBTQIA+ community nonprofits.

Charity Round-Up

In June 1969, a series of events unfolded over six days between the NYC police and LGBTQ+ protesters, known as the Stonewall Uprising. This historical moment was the tipping point for the Gay Liberation Movement in the United States. As a result, we designate June LGBTQIA+ Pride Month. We are honoring PRIDE month by shining a spotlight on three charities that raise awareness about the LGBTQIA+ community and actively work for a positive change.

As always, each organization has excellent charity ratings to ensure our donation will have the most significant impact. We invite you to learn more about them and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) He She Ze and We

Why? It’s not easy for a young person to voice who they really are. They need to be believed. Unfortunately, many nonbinary youth families are not supportive and affirming of their gender identity. Family support is the number one protective factor for youth against suicide. This local nonprofit organization is here to support Trans people by empowering families and communities to create life-saving inclusive environments.

Where? Virginia

Our Notes: He She Ze and We is a nonprofit charity protecting Trans youth since 2012. Through their educational support meetings for parents, professional development training for schools and workplaces, and community outreach, they work to provide a more inclusive environment and reduce death by suicide in this population. They are building a network of allies to grow their mission and was recently interview on VPM about their cause.

2) The Trevor Project

Why? For the past 25 years, The Trevor Project has helped respond to the health crisis many members of the LGBTQ community face, suicide. Suicide rate are 4 times higher in this community and they need a place to turn when they need it the most.

Where? United States

Our Notes: The Trevor Project is the leading national nonprofit organization providing crisis intervention and suicide prevention services to the LGBTQ under 25.

Some of their life-saving, life-affirming programs to keep youth safe include:

- Suicide prevention training programs and resources

- Crisis Interventions: 24/7 lifeline, instant messaging or text

- Community Resources: safe space social networking site, ambassadors, advocacy network and more

3) GLAAD

Why? With the lack of voice in the media, the LGBTQIA+ community used to be defenseless against any defamatory new articles and media. That is until 1985, when the Gay & Lesbian Alliance Against Defamation (GLAAD) was founded. A response to a New York Post article on HIV and AIDs started their media monitoring campaign with a small group of writers. Now this organization has chapters across the US and continues to change the culture and shape the media narrative of the entire LGBTQIA+ community.

Where? United States

Our Notes: GLAAD is a nonprofit media advocacy organization ensuring fair and inclusive representation of the LGBT community in the media. In their 2019 executive summary report Accelerating Acceptance, the surveys showed a drop in acceptance of LGBTQ people and that discrimination is increasing. GLADD is encouraged to bring this result around until there is 100% acceptance everywhere.

Some of their services include:

- GLAAD Media Institute: builds core skills and techniques that trigger positive cultural change

- GLAAD Media Reference Guide: for journalists to tell LGBTQ people’s stories fairly and accurately

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

Chris continues to work on posts about our inflation bond experience, our transition from Intuit’s Mint budgeting app to a different tool, and our annual FIRE budget post for 2023. We did manage to publish our engagement story (and budget) post, hurray! Expect a breakdown of our wedding planning and costs, soon!

Aside from that… With birthdays down and our wedding complete, what could June hold but a rest and respite? Well, not quite. In fact, the very tailend of May held a surprise trip for a friend’s 40th birthday—to Montana!

More to come!

Have any big summer trips planned with creative expense reductions?

Let us know in the comments or on Threads and X (Twitter)!

4 replies on “They All Came to Town & We Got Married! (May 2024 Update)”

Huge congratulations! It’s so fun to read about how people get creative to live happy, fulfilling lives without spending a ton— and being generous! I love that you got a bike for your friend that would also work for Jenni moving forward. Looking forward to the wedding post!

We try to keep it all in balance, indeed! Thanks FM. 🙂

Ha, yeah, we got lucky striking the balance with the mountain bike—one that would work for both uses! But, either way, it probably made more sense to just purchase a decent bike than to rent one locally for a week and be out the money (and the bike!) at the end of it. Great fun!

Congratulations you guys! Thanks for sharing your story with us over the years and dedicating so much to helping others. The capital-to-capital trail looks amazing, such a great place to live. Wish I spent that little on a wedding!

Hey Gary! Oh, it’s all been our pleasure. It’s always a joy to share with our readers, discuss, and so on. We’ve forged some great friendships out in the world because of it! As always, thanks for reading, and for participating.

And yes, that trail is fantastic! They keep connecting more pieces together to make it all the more accessible, too! Come visit!