We’ve got two big birthdays—and a wedding!—around the corner in May. Woo! April was filled with different activities and tasks supporting those big May milestones. Neither of us can imagine how others manage to put together such big events while working full time! Phew! Thank you FIRE!

For our monthly donation, we’re doing a little birthday competition—we’re each picking a charity and letting you decide where we’ll donate! You can read more about them and vote for your favorite in the poll below!

Each month, we track our income, spending, and savings to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

If you’d like a more detailed description of our typical monthly cash flow (like our jobs or housing situation), check out our previous budget updates.

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

The big income note for this month is our tax refunds. We both earned back a significant amount of money on our state/federal taxes.

Aside from our usual monthly income, here are some interesting anecdotes:

Tax Refunds

Those 401(k)/IRA contributions and a low income generally really help to offset our tax burden! Our combined state/federal refund was about half of a month of our spending!

We earned back $2,491 in tax refunds.

Dividends

One legacy individual stock holding we have made a small distribution this month. Most of our investments are tied up on index funds. These distributions were automatically reinvested in our tax-advantaged accounts.

We earned $243 in total distributions.

Credits

Several of our credit cards offer statement credits for purchasing with certain companies.

- Chris’s AMEX gold earned $10 back for Grubhub which he used on a local bakery pickup.

We received $10 in statement credits.

Local Sales

Chris upgraded his iPhone from an 11 to 12. He sold the old, mint condition, unlocked iPhone 11 locally for $220.

Sales earned $220.

Cashback

- Laurel Road no-fee checking accounts earn a $10 monthly bonus for making direct deposits of at least $2,500/month (last month for this for us!).

- Chris cashed out his Ibotta grocery balance (about $158!).

We earned $168 in cash back.

Expense Summary

From our $4,815 monthly budget, we saved and invested about $1,569.

After subtracting our credits and savings, we spent about $3,246 on living expenses.

That’s 68% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details.

Food & Dining

Food saw a bump in costs this month primarily due to a credit card renewal.

Groceries

Our grocery spending came to about $668. That’s high for us and it’s mostly attributed to a $200 expense Chris attributed from his AMEX Gold card renewal. The $250 annual fee is mostly offset by $10/month in credits to use on both Grubhub and Uber Eats. That’s $240 which tends to go to groceries (bakery for bread, grocery pickup). So, he attributed $200 to grocery expenses. The other $50 went to…

Restaurants, Fast food, Alcohol & bars

Restaurants and fast food came to about $61. $50 of which was from Chris’s AMEX Gold card renewal. Sometimes he uses the credit that the card affords each month towards pickup at a local fast casual restaurant like Chipotle or Pure Green.

We spent $729 on food & dining this month.

Shopping

This category saw an abnormal bump in costs this month.

iPhone “Upgrade” [Electronics & Software]

Chris transitioned from an unlocked iPhone 11 to a new iPhone 12. It’s a minor upgrade, but the price was hard to beat. This was his process:

- Buy Verizon iPhone 12 from Walmart with few dollars/month installment plan (36 months) — about $6 paid in taxes/fees on shipment

- Add minimum data plan (required) at around $60/month on Verizon

- Don’t use provided plan/SIM

- Upon receipt:

- Insert an AT&T SIM we had handy, attempt to activate, then use AT&T’s iPhone unlock online tool to immediately unlock the phone

- Goto Verizon store to pay off the installment plan in full ($99 cash)

- Call Verizon and cancel service plan now with the paid off phone, ask for refund on activation fee ($35) since plan wasn’t used within 72 hours of activation

New phone and it’s unlocked for use on any network! The Tello plan he’s had for months is already transferred and active on the phone now. With a case he already had and a new screen protector for about $4, taxes and prorated service/activation fee, he spent just $132.36 on the new phone.

That’s significantly less than the $220 he sold his old phone for this month!

Chris’ business reimbursed him the purchase cost as part of his higher consulting income this month.

Jenni purchased a replacement Sonicare electronic toothbrush after the existing one physically broke. With plenty of brush heads in storage, she didn’t want to switch brands. That was about $38, bringing our total to about $171 on Electronics & Software.

Clothing

Chris picked up a pair of minimalist shoes that were on deep discount to store away for future use. ~$21 was a great deal!

Sporting Goods

Jenni added a stack of fresh athletic socks and some new tumbler bottles for shakes after each met the end of their wear lives for about $19.

Makeup/Skincare

Jenni restocked some bar soap by Yardley and Neutrogena cleansers for about $7.

We spent $217 on shopping this month.

Nothing

And our most important spending category this month…

Nothing. We spent nothing, as we routinely do, on some of the most fun we had all month! Everything below; not a penny in additional costs:

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Gas & Fuel

As we’ve mentioned quite a bit in recent months, we have a wedding coming in May! With that, we’ve both been traveling around Virginia quite a bit. Whether it’s to see friends for a little celebration or to test out potential venues, we’ve been putting quite a few miles on our roadways. Our gas expenses really reflect this—at least double our normal at about $112!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

Jenni’s work responsibilities decreased a bit this month. Our focus has been on our pending May wedding which has eaten up our time.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of April 30, 2024.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 904,726 |

| Brokerage | 820,016 |

| Roth IRA | 179,597 |

| Traditional IRA | 21,954 |

| HSA | 56,224 |

| Real Estate | 437,500 |

| Mortgage | (137,411) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 63,679 |

| Net Worth | 2,371,284 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was down about 4.2% for the month.

We did a good bit better with a 2.6% loss.

Overall, our net worth decreased by around $63K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

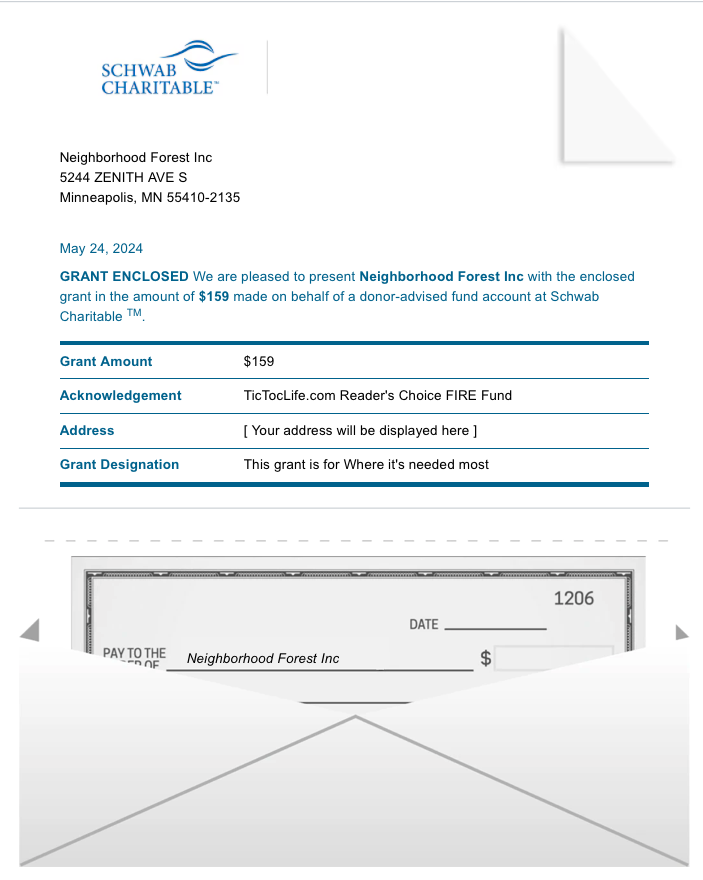

Previous Donation Winner

It was a record year for our donation winner, Neighborhood Forest. They gave out well over 67,000 trees at schools, libraries and youth centers on Earth Day 2024. Each tree planted helps reduce our carbon footprint on this beautiful place we call home and sparks interest in children across the nation.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 45 months. We’ve given $5,700 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates—a special Chris vs Jenni charity competition!

Charity Round-Up

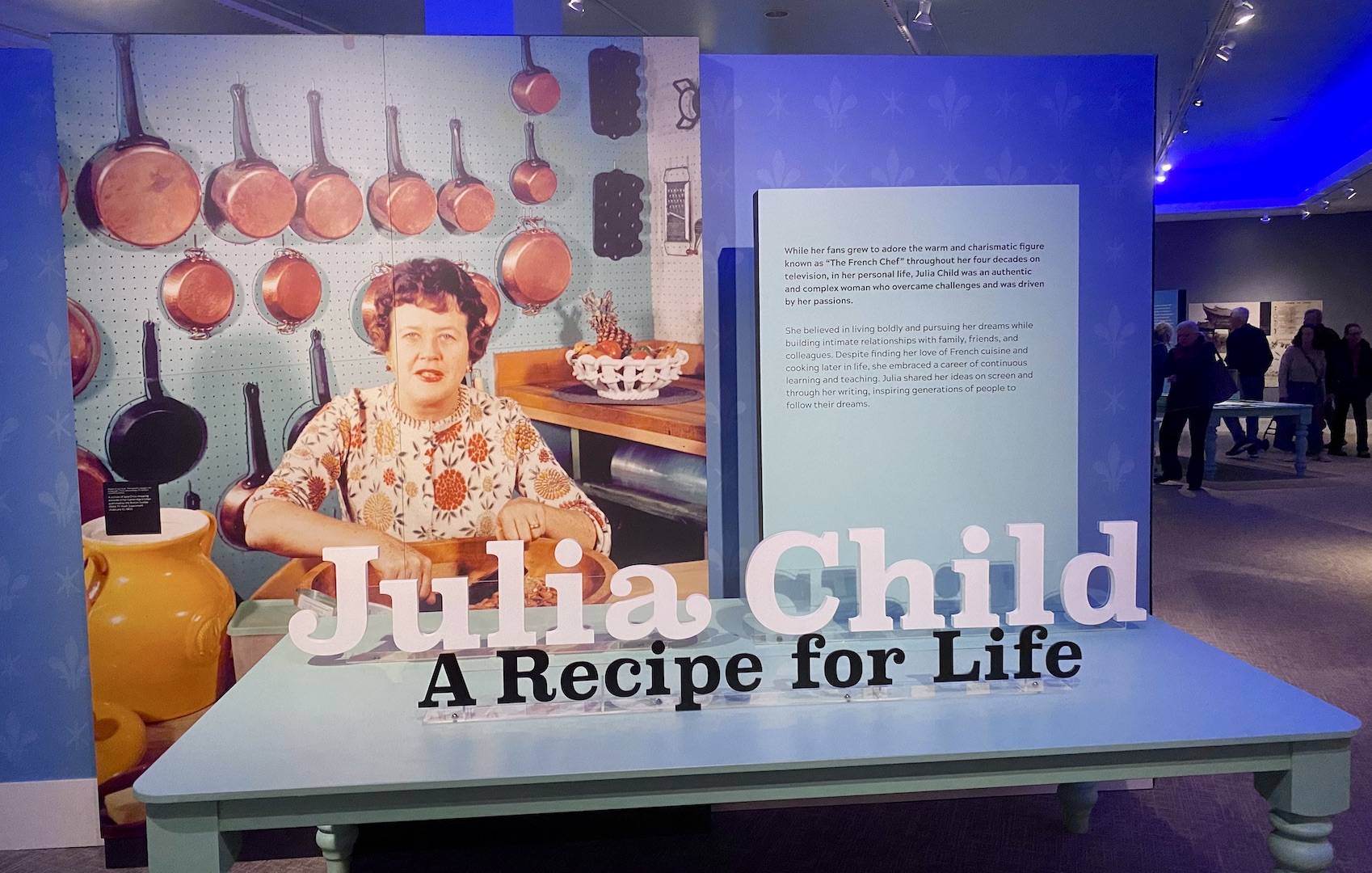

It just so happens that we both were born in May! In celebration of our May birthdays, we decided to have a little friendly competition with this month’s round up. We have each chosen one charity that is of interest to us.

As always, each organization has excellent charity ratings to ensure our donation will have the most significant impact. We invite you to learn more about them and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) McShin Foundation

Why? The opioid crisis is getting just getting worse with more users overdosing from cocaine and methamphetamines being mixed with fentanyl, a very potent drug.

The McShin Foundation is a local Recovery Community Organization (RCO) that offers addiction treatment and support services. They use a peer-oriented social model that helps patients during the most critical period of their recovery, the first 30 days.

Where? Henrico County, Virginia

Our Notes: This is Jenni’s suggestion after reading both Dopesick by Beth Macy and Demon Copperhead by Barbara Kingsolver and learning how Virginia was really at the heart of the crisis from the very beginning. As a pharmacist, she understands the importance of proper counseling, evaluation of potential abuse, and ensuring Naloxone is on hand for anyone taking an opioid medication.

2) Helen Keller International

Why? Helen Keller International is a highly effective charity, especially noted for its Vitamin A supplementation program. This low-cost intervention, at just over $1 per dose, has significantly reduced childhood mortality by nearly 25% and reached millions of children in need. Their work ensures that donations directly support one of the most impactful health interventions, preventing blindness and saving lives in vulnerable populations.

Where? Across Burkina Faso, Cameroon, Côte d’Ivoire, Democratic Republic of Congo, Guinea, Kenya, Madagascar, Mali, Mozambique, Niger, Nigeria, Senegal, Sierra Leone, Tanzania, Bangladesh, Cambodia, Nepal, Philippines, France, and the United States, including states like California, Minnesota, New Jersey, and New York.

Our Notes: This is Chris’s suggested target for this month’s donation. He tends to focus on numbers and effectiveness per dollar. GiveWell’s analysis shows that the program directly saves a life for roughly every $5,000 spent.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

With our wedding on the horizon—mid-May!—we’re both nose down and focused on getting various plans and tasks complete for the big day. We’ve got friends and family trickling into town as the month turns over so we’ll probably be pretty overwhelmed with all the socializing. Still, we’re on track!

As mentioned last month, Chris is working on posts about our inflation bond experience, our transition from Intuit’s Mint budgeting app to a different tool, and our annual FIRE budget post for 2023. We’ll also have a post about our wedding expenses.

Stayed tuned, we’ve got a lot more coming!

What’d you do for your FIRE-y wedding?

Let us know in the comments or on Threads and X (Twitter)!

2 replies on “Racing to Our Wedding Day! (Apr. 2024 Update)”

Sounds like it was a solid deal on the iPhone 12. Was it brand new or pre-owned? How many GB? How much would it have cost if you had bought it outright? (I see fully unlocked iPhone 12s [128GB, pre-owned] going for about $270 on eBay.)

I’m a bit confused. Was the phone ever activated on Verizon? Verizon has the policy that iPhones are locked for 60 days *after* activation. You were able to circumvent that because you never officially activated it. Is that correct??

Also, I thought you had to sign a contract with Verizon to stay with them for 36 months when the purchase was made. I’m surprised they allowed you to break a contract like that.

The AT&T sim you used, was it a prepaid? Could you have used any AT&T sim?

(Sorry for so many questions. I will try to see if I can duplicate what you did there in upgrading my phone.)

Best of luck with the wedding!

Hey TK! [Chris here on Jenni’s account replying from DEN airport :)]

Yeah, it’s complicated with that iPhone. The best deals tend to be! 🙂

There’s a few things going on:

1) It was purchased with an installment plan for *the hardware*. That’s common these days. Sometimes it lowers the price. In this case it was 36 months at 2.75/month. I believe if you just paid upfront, the cost was $299. Whenever you have the hardware under installment plans with the carrier, you can pay off the full balance after entering the installment plan contract. So, that explains how it was $99 out of pocket —- once the phone was received, we walked into a Verizon store and paid the $99 in cash. Now, the phone was no longer under a payment plan which becomes important:

2) In order to get that payment/installment plan price above, you had to signup for VZW’s unlimited monthly service. I think it was $60/mon or some such crazy thing. That’s how they’re really getting people on the cheap phone prices. Hope you stick around for 36 months at $60/mon ($2,160!) because you’re enticed by the $99/2.75 per month phone. On top of that, once you activate the plan there’s an initial $35 activation fee.

3) They ship the phones with an active SIM. I never used it and their policy suggests you can cancel any plan for a refund if canceled within 72 hours of activation. So, you have to hope shipping is fast. Even if it didn’t work out that way for me, you can still cancel service *as long as the phone isn’t under a payment plan* whenever you want. It’s a month to month contract. You’d just be out the $35.

4) So after paying off the phone in store, I immediately called in and had them cancel the service plan. They refunded the activation fee (less than 72 hours) and prorated the few days of service.

5) The last trick, perhaps the most confusing: normally, Verizon has their phones locked for 60 days to VZW service when they’re new. That’s really not so bad. You could pay for their service for two months, unlock the phone, then cancel. Still a decent deal in many cases. But, there’s a little known trick that you can pop an AT&T SIM into a phone, whether it’s an active line or not, which will connect the phone to ATT’s network —- then you can simply request an unlock for *the phone* tied to the SIM in ATT’s online portal. Just be sure you don’t first connect the phone to some other network where it’ll be locked (like if I’d activated it under VZW or popped in a TMO SIM or something first).

So, that’s how I ended up with the phone, unlocked and brand new, for around $120! You’re right about the going price for iPhone 12 unlocked. 🙂

PS: Wedding went great! We’re happy and wed and will have a post about it! 😀