As 2021 was drawing to a close, Jenni and I were celebrating the end of the year in our small ways. My parents met us in Colonial Williamsburg for an after-Christmas celebration. We fixed some tasty treats and admired the colonial history of Virginia. Little did we know that, at the same time, financial wheels were turning behind the scenes that’ll likely have cost us about $15,000 once the dust settles.

How? Well, that’s a story with quite a bit of bad luck, ignorance, and poor choices. Let’s see how our biggest financial mistake of the year came about!

An Investing Strategy for Enough

Years after I made my worst investing mistake fiddling with individual stocks, I finally had my investing goals settled in my head. And I didn’t need to do anything too complicated.

You see, at least in my view, once you have enough — there’s not much point in pursuing more. You wind up risking what you’ve earned and the financial security it provides to incrementally improve a life that you’re already quite happy with.

And if you’re thinking to yourself — no, no Chris! — I could be much happier with a whole lot more! Well, then I’d argue you’re not at that point.

Keep grinding. Reach the level of FIRE you need to be satisfied in the long term.

Sewing crops that’ll yield just barely enough to keep you out of starvation and subsisting year after year is a recipe for a depressive and dissatisfied life. One where you’ll likely return to the rat race we all want to escape. But this time, in even worse condition.

More than enough

Jenni and I have, arguably, overdone it. We’re sitting on $2M+ (at least, that might still be the case? — I don’t know, I hear murmurs of the stock market in turmoil — though that’s usually overblown!). And we live a pretty happy $40-50K/year lifestyle.

A little quick back of the napkin math suggests we’re at about half the typical 4% safe withdrawal rate. Readers have pointed it out before.

Why keep earning more?

Well, aside from Jenni’s responses in that comment thread…we’re not exactly financial geniuses!

Getting to where we are is some combination of luck stumbling through life, a tiny bit of hard work, and sheer persistence.

My hope for this blog has always been to merely share with you our experiences, especially our foibles, in hopes that you might be able to avoid those very same expensive pitfalls.

Financial expertise

Reader Vincent recently sent along an email with some investing history and questions about their financial strategy.

His key final question:

Consequently, I want to ask, are you recommending people put their money in index funds as against individual stocks?

And while I’ll send along a more detailed response to Vincent, the simple answer is: no. Neither Jenni nor I are investing wizards or financial experts.

We make a lot of mistakes.

I don’t know if investing in individual stocks will be better for you or if index funds will win out.

Bitcoin or NFTs could result in the highest return.

Bonds might result in the lowest return.

And these trends could cement themselves in the long term or just for next week!

I don’t know how you value your ability to sleep at night with whatever proportion of your life savings invested into a bunch of ones and zeros flashing by on a computer screen will make you happy.

Your risk tolerance might be very different from mine, or, anyone else.

But, I do hope we can continue to share our thought processes and financial decision-making in a way that might leave you a little richer and a little more content at the end of the day.

This brings me back to our biggest money mistake of the year and that none-too-complicated investing strategy I developed…

Investing Allocations

Jenni and I each have our own 401(k)s, brokerage accounts, IRAs, HSAs, etc. Over the years, we’ve developed similar investing strategies. Following typical FIRE investing principles, much of our net worth is invested in diversified index funds.

There are names you’re familiar with like VTSAX or VTI to own a stake in a wide range of US companies.

Add some VXUS or VTIAX for international exposure.

A dash of VBTLX for bonds.

And of course, there are still a couple of legacy individual stocks from my younger years I’ve yet to get rid of.

But there are also quite a few dollars invested in funds that change over time. You might even call them actively managed (*gasp!*).

You see, actively managed mutual funds and their high load fees are very well known to rarely ever beat the average market return for the typical investor. That’s been true even over the market’s volatility and strong rise in recent years.

This is practically gospel in FIRE circles — thou shalt invest in passive index funds! Maybe even shoot for the classic Bogleheads’ three-fund portfolio!

So what in the world were we doing throwing hundreds of thousands of dollars at an actively managed fund?

Target Date Funds

If you’re not already familiar with target date funds, they often operate as a fund-of-funds that is adjusted over time to match, well, a target. In this case, as the fund’s date gets closer, they tend to adjust to more conservative portfolios.

For example, a 2050 target date fund might consist mostly of stock with just a little bonds. That’s because someone investing to retire in 2050 probably has many years to weather the volatility and risk of stock investments but would like to capture the higher average return over time.

By 2050, as the investor should be retiring, they’ll need to protect their nest egg. Typically there’s a strong shift to bonds and other “safer” investments as the date closes in.

This is what makes target date funds actively managed even as they often consist of passive index funds. Fund managers transfer the fund’s assets around to match the glide path from high risk, high return to low risk, low return as the target date approaches.

That all sounds pretty great for folks like us who need to shift to more conservative portfolio allocations as we kick work to the curb and enter early retirement!

Why bother trying to do all that rebalancing yourself when the experts can handle it for you?

It sure seems like that’s worth the 0.13% fee that a fund like Vanguard’s 2020 target date fund offers (for comparison, VTSAX’s is 0.04%).

That’s a whopping $195/year (vs. $60 with VTSAX) on $150K invested and saves me hours of anguish, research, and work rebalancing.

And here’s where we get to our problem.

A Surprise Windfall

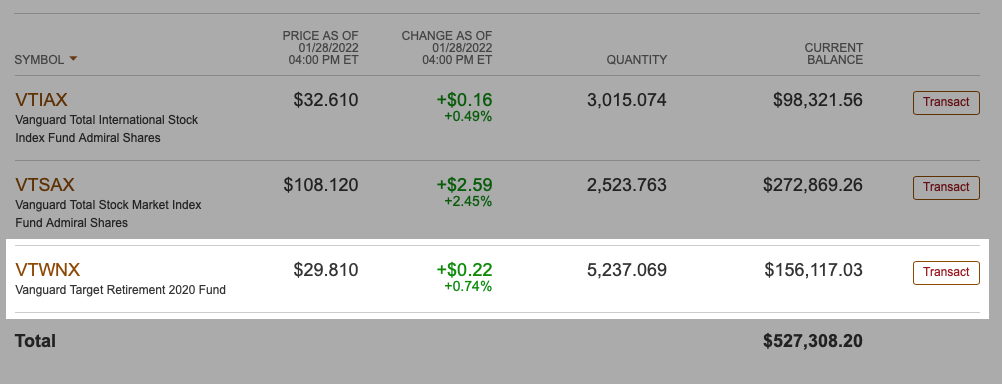

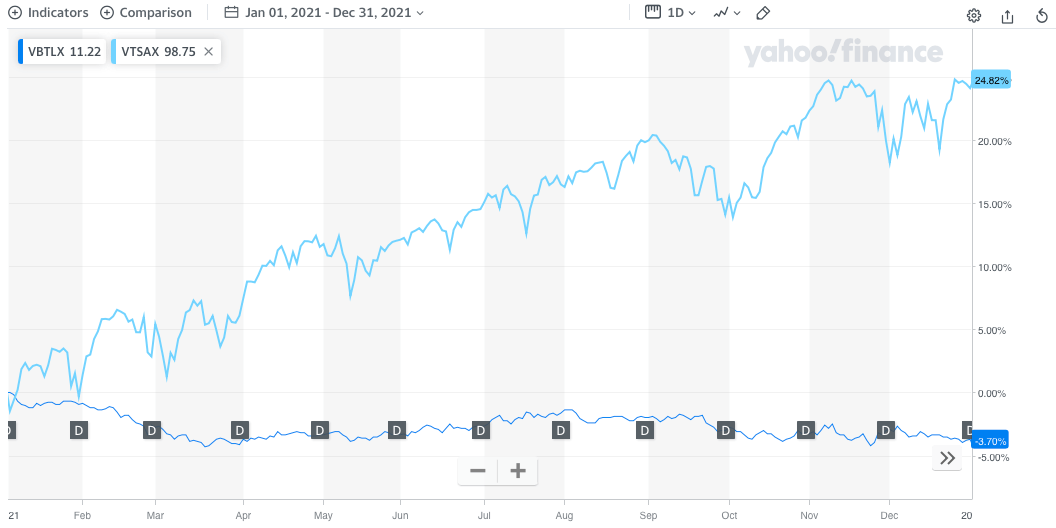

At the end of 2021, I received a surprise distribution in my Vanguard account that was way bigger than any recent year.

And mind you, this is just one account. Between all of our accounts, we received a whopping $86K worth of distributions in December 2021.

Looking back at our December 2020 budget, that’s an increase of about $69K!

The vast majority came from different Vanguard target date funds like VTWNX in the account above.

As you can see from the transaction table in the screenshot, these distributions come from a mix of dividends and capital gains (whether short or long term).

Now, of course, most people would be celebrating a surprise windfall of nearly seventy grand.

But realizing additional income you don’t intend to use is terribly inefficient when it comes to financial planning.

The tax implications of a windfall

The sudden influx of income will create some pretty severe tax implications for us.

In reality, here’s what the windfall means to us:

- The large distribution from our investments (10-15% in several target date funds) is mirrored by decreased share prices — our net worth is unaffected

- We mostly hold these funds in taxable accounts — those distributions equal taxable income

- A big bump in taxable income means we won’t qualify for certain tax credits (like Jenni’s ~$2,400 in health insurance credits)

- This didn’t free up cash flow for us to use in other ways — the funds were almost all reinvested immediately through our DRIPs

- The automatic dividend reinvestment compounds our problem in the future

Ultimately, all of this income should fall into the 15% capital gains tax bracket.

Our regular income will probably be just above the 0% cutoff of about $40K for each of us individually.

| Tax-filing status | Single | Married, filing jointly | Married, filing separately | Head of household |

|---|---|---|---|---|

| 0% | $0 to $40,400 | $0 to $80,800 | $0 to $40,400 | $0 to $54,100 |

| 15% | $40,401 to $445,850 | $80,801 to $501,600 | $40,401 to $250,800 | $54,101 to $473,750 |

| 20% | $445,851 or more | $501,601 or more | $250,801 or more | $473,751 or more |

So, that means we’re looking at a tax bill of nearly $13K just for December’s dividends!

Tack on the loss of certain credits and we’ll break $15K of unexpected taxes pretty quickly!

But a windfall can cover the taxes!

You may be thinking, “yeah, Chris, but a surprise $86K worth of income is a good problem to have — you can pay those taxes without issue from it!”

And, sure, you’re correct.

We can afford the taxes. We’re happy to pay what we owe.

But of course, we also don’t want to pay more than we need to and tax planning is part of efficient financial planning.

Remember, this $86K is a distribution from the asset we own — primarily those target date funds.

It’s effectively like if you transferred $86K out of your savings account to checking and were taxed upon $86K.

Remember, our net worth is unaffected.

We didn’t suddenly gain $86K overall, it was just distributed from the investment. It’s not a distribution of profits like a traditional dividend from individual companies tends to be.

This is because the root of this massive windfall appears to have come from the very rebalancing that I discussed as a benefit of target date funds above.

Why were distributions so high from target date funds?

Remember, target date funds need to maintain a certain ratio of different asset classes in the fund.

Let’s pretend it was a simple 50:50 stock:bond ratio.

If stocks double over a period of time but bonds trade sideways, your ratio would reach 75:25 and you’d be very overweight stocks.

How do fund managers resolve this?

They sell stocks and buy more bonds!

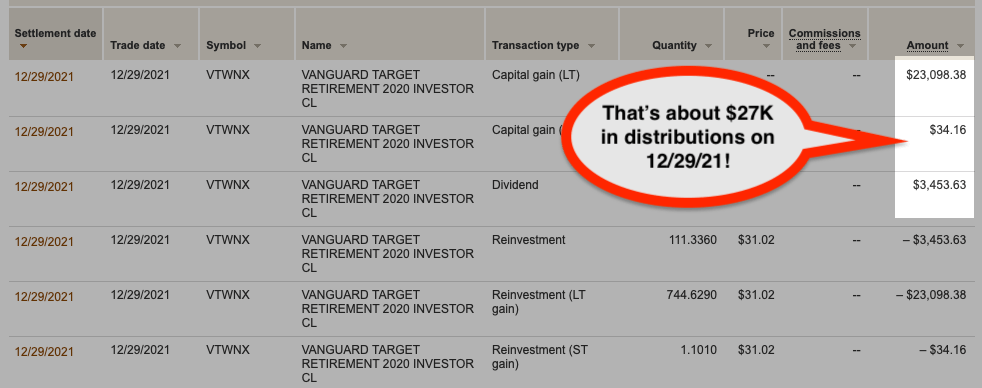

And 2021 was certainly a year where stocks and bonds diverged pretty widely!

Check out this chart of VTSAX vs VBTLX:

So, while no doubt fund managers have lots of tricky ways to try to avoid severe rebalancing — once things go too far, they’ve got to sell.

Those transactions flow through the funds and back to the owners eventually.

That would seem to explain the big distribution, right? Rebalancing?

Well, probably not.

2020 had a similar disconnect between large stock price increases and bonds trading in a narrow range. Yet, we didn’t experience such a massive distribution. 2021’s was dozens of times larger!

There’s a lot of speculation around the web, including on Bogleheads, about how this happened. It seems to be that some internal changes within Vanguard (though this problem wasn’t limited to just Vanguard funds) triggered a flow of assets from one fund to another.

Ultimately, the reason doesn’t matter all that much. It’s the outcome that does.

And, how we can avoid it in the future.

Don’t Put That in Taxable Accounts!

The too long; didn’t read version of this article is this:

Don’t put investments that are likely to generate large dividend distributions into taxable accounts.

Now, I knew that before this problem arose. I didn’t think of the target date funds as distribution-heavy. The key here is the rebalancing needed to maintain this fund of funds.

It’s that “active management” part of target date funds.

If we kept these funds in our 401(k)s, IRAs, or HSAs, which are tax-deferred, the distributions would NOT be immediately taxable. We’d maintain our tax credits and not blowup our income for the year!

It’ll be difficult for us to unwind this problem since selling the funds as they exist now, even if we just watched to switch to something simple like VTSAX, would be a taxable event itself.

What we’ll probably do to try to ameliorate this issue is prioritize selling our target date funds as our income continues to drop in early retirement.

We’ll suffer the consequences of this mistake, now, through some higher taxes today than what we’d likely pay in the future. It’s unfortunate, but, we’ve planned for an early retirement that has room for plenty of mistakes.

It’s my hope that sharing mistakes like this can help you better avoid such failures in your own financial planning. Don’t repeat our mistakes!

Now, if only we can internalize the point that our readers were making earlier — we’ll avoid another mistake — waiting too long to really bring to fruition the life we want as time passes by!

Readers, did any of you get caught up in this target date fund problem as well? Let me know in the comments! I’d love to hear your stories. What was your biggest financial mistake of 2021?

12 replies on “How a NYE Windfall Made Our Biggest Money Mistake of 2021”

Ouch! That hurts.

Automation, which you get with a Target Date Fund, can make life a little bit easier, but you obviously give up a lot of control when you do this.

You’ve learned that lesson the hard way, and it’s a bummer that this all went down with no warning.

With a simple index fund portfolio like you’ve got, a spreadsheet can make rebalancing (which you would only do maybe once a year) really easy. I’ve even made a sheet you can use (see link in Website name).

Cheers!

-PoF

Hey PoF!

Thanks for coming by! Hope 2022 is treating you and the family well!

You’re right; the typical Bogleheads three fund style portfolio, or what’s recommended in the original 4% rule study, can be rebalanced quite easily.

It’ll be tough to unwind things, but, it can be done. After all, I spent years unwinding a portfolio filled with individual stocks in energy and commodities!

Thanks for the useful spreadsheet resource too!

This is my first time on your site thanks to POF Sunday Best so I am not entirely sure of your retirement goals but it is hard to see this event as a mistake. In fact, when you are dependent on your portfolio for income you will probably welcome these distributions. Perhaps the only mistake is to use DRIP. It may preferable to turn off all DRIP so that you can be in control of what is invested where for your asset allocation planning/rebalancing as well as save some of the cash for taxes. This also helps with wash sale rules for tax loss harvesting.

It’s a touchy subject about tax credits and subsidies and net worth versus income. They are typically based on income but do high net worth individuals or families actually need/deserve them? Tough issue as no one wants to pay more taxes. However, I wonder how our country won’t be bankrupt in the future if something doesn’t change. We fall in the same boat so hopefully no big changes anytime soon.

Enjoyed your post. Thanks for what you do!

Hey Introvert! Welcome to our FIRE tale, then!

You’re right, dumping the reinvestment automation (DRIP) would be smart. I forgot the make mention of that in the article; I’ll have to make an edit. That’ll help alleviate some of the lack of control here.

There’s a little bit of contemplative wisdom in your last question/thought there… You make a good point about taxes on income vs net worth. I know the topic has come up politically more recently with the potential for a ‘wealth tax’.

I can understand both sides of it. There’s already indirect wealth taxes (property tax), so there’s precedent. I think it’d be quite difficult to tax unrealized capital gains and what not, though it could be done. Who knows what’s in store for our future.

May you live in interesting times they said…ha!

Hope to see you around more!

I feel your pain. I bought a front loaded (5.75%) mutual stock fund from American Funds 30 years ago, reinvested all the dividends/cap,gains for the past 25 years. I received a $48,000 capital gains early Christmas present this year. Now I only buy low cost Vanguard index funds for my taxable portfolio.

Surprise capital gains are not exactly what I wished for wrapped up under the tree! 😉 Sorry to hear.

No doubt we’ll discover some serious issues down the road with low cost index funds, but hey, for years — seems like they’re the smart money!

You have to pay the tax eventually. Tax-deferred means you are assuming your tax rate in there future is lower than now. That bet is not always true for everyone.

Agreed! All else being equal, we’d have eventually paid these taxes anyway.

But, at least in our case, our planning (in so far as our projected spending) would suggest our tax rate in the future will be quite low, if not near zero. So this is definitely a loss if that turns out to be true.

Tax planning is one of my weak points–good reminder to do some homework in 2022! Sorry about the windfall (haha)!

Right? Weird situation to be upset about! Ha.

Yep, change of year – a reminder to do some rebalancing work!

Thanks for being so open about your experience. I suppose this is another reason for me to avoid using target date funds, especially in taxable accounts.

If I could go backward, I’d probably have stuck with a simple three-fund style portfolio and ignored the target date funds. Live and learn!