I was reading through the MMM forums the other day and a post caught my eye. It asked: “how do you pick your target FIRE date?” People wanted to know how to come up with their retirement date and how much money they’d need to do so—how to determine their FIRE number.

You might be familiar with the deliberations which sounded something like:

“I could work really hard over the next 10 years and, I think, have enough money to retire! Or, I could work kinda hard for 12 years and make these small modifications and be ready. What do I do?!”

I thought about how Jenni and I arrived at our target retirement date and wealth level. I’ve been working towards the foggy idea of something like FIRE since about 2007. As a couple, Jenni and I didn’t decide to make a go of it until about 2013. At the time, FIRE was becoming a more mainstream topic with a cohesive community and set of ideals around it, including the 4% rule.

How did we decide when to retire and calculate out how much money we’d need to do so? This post will work through how you can determine what is your FIRE number and layout your path to retirement.

Looking back, what changed in our plan over the last several years?

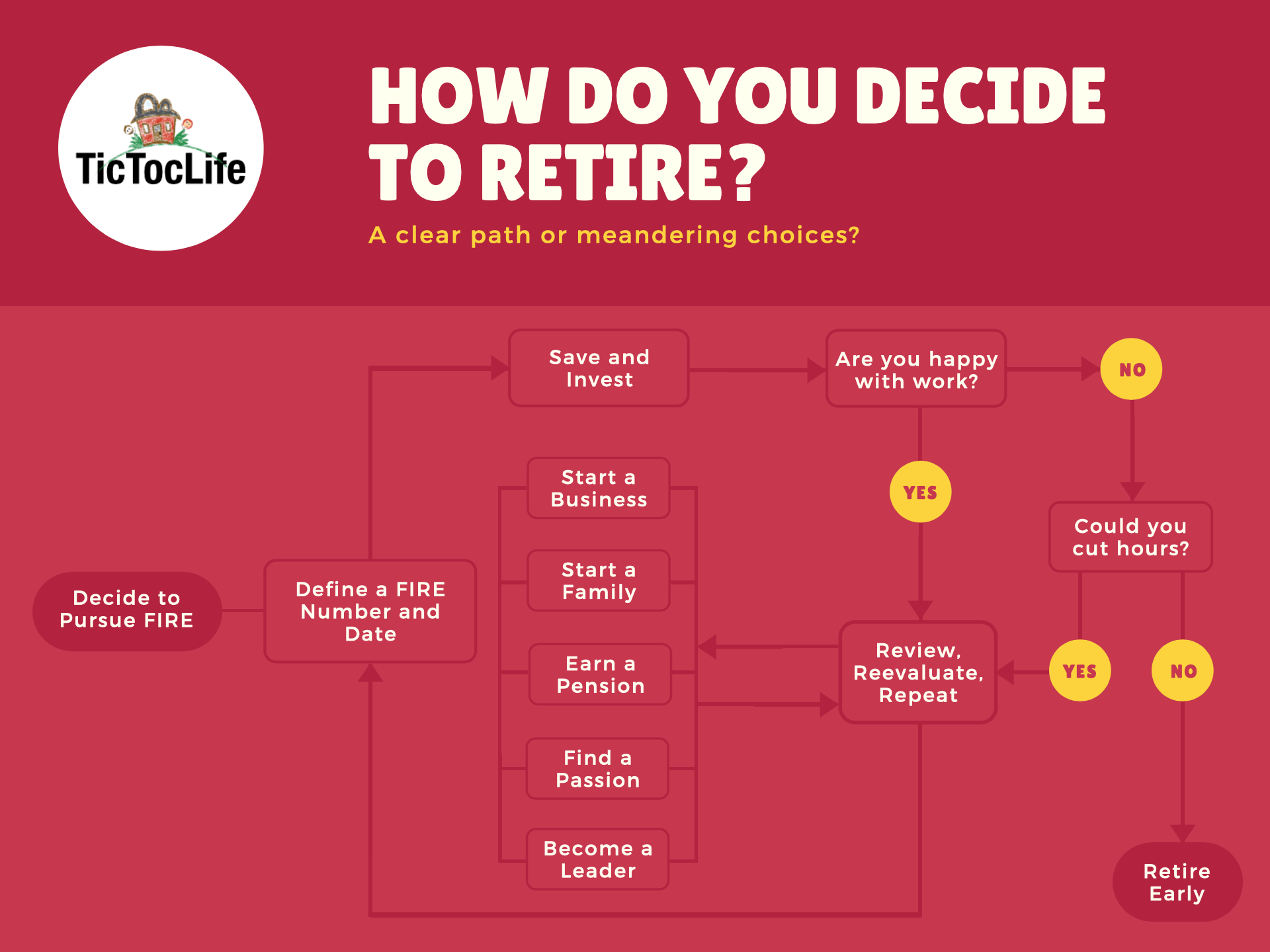

How to Decide to Retire

Your FIRE number is the amount of money you need in order to make a go of retirement. You’ll need to live off this amount of money, in the form of interest, dividends, and appreciation—potentially—for the rest of your life.

In general, dear reader, you should arrive at your FIRE number in a way that you feel comfortable with. While you should certainly have a plan, and attempt to create reasonable projections about your future, understand that your goals could—and probably will—change.

It’s nice to think that you could plop down today and plan out your next seven, ten, or twenty years of income and expenses. That’s many years of building wealth and reaching FIRE. For most people, life will not be quite that static.

What’s important to you will probably change and that will likely affect your retirement plans or even just reaching financial independence.

Be Open to Change

Life throws curveballs:

- Will you get married?

- Might you find a new passion that pulls you to work for lower pay but in a meaningful way?

- Will have you have (more) children?

- Could you decide to settle in the country and buy a farm?

- Will a hobby become a project and business you can’t resist?

- Will you earn a big promotion with stock options that vest in five years?

It’d be great if we could look at last year’s annual expenses and income, then just add 3% of growth to each category and do a little math to come to your FIRE number and date.

But, things will happen in life.

And you need to not fear, or worse, avoid, letting them happen just so you stick to your FIRE plan. Ultimately, the goal of FIRE is to give you the freedom to make decisions and build your happiness.

If those decisions happen to come up a little earlier than planned, why not incorporate more fulfillment and happiness in your life today?

Build a Plan With Milestones

Rather than developing a “point A to point B” direct path from today to retirement, consider leaving things a little more open to change. Set specific milestones that trigger you to reevaluate your FIRE path. Those milestones could be:

- Net worth levels

- $50,000

- $100,000

- $250,000

- $500,000

- and so on

- Expected career path

- Reaching a senior position within your skillset

- Becoming a manager of other people

- Being recognized as an industry leader

- Attaining tenure

- Ownership within the business

- Family-based

- Marriage

- Children

- Spouse promotion

- Children at higher levels of education

- Parents aging

- Financially-driven

- Pension availability at a certain age

- Vesting periods

- Inheritance

- Social security dependency

There’s no “right way”, here. Your milestones depend on what you value, what you think are important turning points in your life. Don’t think of FIRE as a straight line that you plan today and reach at a pre-ordained date far in the future where you’ll traverse a clear path.

Be prepared, even open, and excited for a change. After all, the goal is to be free to accept and strive for fulfillment, satisfaction, and happiness when you can. That will grow your position of financial strength.

Our FIRE Number and Date

Over months of learning more about the system behind FIRE, we did a review of our expenses. We tried to make some predictions about where our spending would go in the future. We talked about travel, kids, careers, and our (just purchased) house.

While we’re naturally pretty frugal, that doesn’t mean we shouldn’t take a fresh look at what makes us happy.

Did we want to add expensive luxuries to our lives? Would we want to own a boat? A beach house?

What sort of future could we envision?

Communicate Openly

For planning purposes, nothing was off the table. We wanted to be honest and open about our spending desires and the sort of lifestyle we envisioned. We continued to live below our means. At this point, our wealth was building quickly.

Our annual income in 2013 exceeded the purchase price of the house we’d just moved into (an amount close to Jenni’s student loan debt!).

We had options and needed to level set with each other.

We decided to focus our milestones on a mixture of net worth and career paths. At each point, we would check in to ensure that we wanted to continue to pursue our plan and make adjustments as necessary.

In a bit of foreshadowing, we were glad we left ourselves to be flexible with our FIRE path. More on that later.

How to Know When to Retire

We needed to develop a plan. Reaching your FIRE number is an exceptionally longterm goal. Most folks looking into the FIRE movement the first time tend to be in their 20s or 30s. For a lot of people, reaching their FIRE number could take another half of the life they’ve experienced!

Keeping the eye on the prize so far out in the future isn’t easy.

To identify our possible FIRE date, we decided to build a predictive spreadsheet that would calculate our future monthly net worths. In this way, we could check-in monthly, see if we were meeting our goals, and keep an eye on the longterm goal. This would also give us a chance to voice any concerns early and discuss potential changes to our direction in life or career.

Tracking Expenses

Building that predictive spreadsheet wasn’t easy, but gathering all the data to input was the toughest part. We needed to calculate our historic expenses and make some guesses about our future expenses. Fortunately, we’d been using Mint.com for this historical expense tracking data so it was just a matter of cleaning up any poorly categorized expenses over the year and collating the spending.

We still use Mint today to track our expenses and produce our monthly income and expense updates (May’s) or annual spending reviews (2019).

Future Income

On the income side, we needed to make some guesses about the direction of both our incomes. That meant we had to be honest about future prospects. We all like to think we’re going to get the big raise or promotion we’re due for, but sometimes reality doesn’t play ball.

We needed to be conservative in an area that most people need to feel optimistic about. If we aimed a little low, we could always update the “income” input and the system would recalculate our predicted future net worth in a favorable way.

Better than having dreams dashed!

Calculating Our Retirement Number

Ultimately, we arrived at a dollar figure that we’d both be comfortable living within based on the years of expense data we had and how we felt about those years.

That amount was $50,000/year in 2013 dollars or $25,000 per person.

Applying the 4% rule to this spending amount meant we needed to have $1.25 million (25 * 50,000) saved and/or invested to make the jump into early retirement.

That became our FIRE number. It didn’t mean we’d have to quit working at that point, but it did mean we’d have the option.

The problem was, our combined net worth at the time, well…it wasn’t much. While our income was growing, we were still saddled with significant debt. The combination of student loans and the mortgage we just took on made for a deep pit of debt to climb out of.

FIRE Number Calculation Assumptions

Let’s get into the details of our spreadsheet’s assumptions created in 2013.

We assumed:

- Maintain a certain level of savings (emergency fund) and checking (liquidity) that would not grow from interest or additions

- Investment accounts would grow at 9.9% per year (update: good conversation about this rate in the comments)

- Inflation would sap 3.0% per year from investment growth

- We would prioritize paying off the student loan (6-7%)

- We wouldn’t accelerate our mortgage payments (3.625%, 30-year)

Our investment assumptions create an effective 6.9% growth per year, helping to adjust our future $50,000/year spend to be in current-year dollars automatically.

That meant that if our spreadsheet landed us on our $1.25m FIRE number in, say, 2025 – we’d have an inflation-adjusted (at 3% per year) $50k to spend. So, we’d have more than $50k to spend in 2025 dollars.

We added all of our assets and liabilities to the spreadsheet:

Assets

- Checking

- Savings

- Brokerage

- 401(k) (which is hopefully full of index funds vs individual stocks!)

- 403(b)

- IRA

- HSA (confused? HSA questions and answers post)

- Real Estate (yes, you can retire early with real estate!)

Liabilities

- Mortgage (and deciding whether to rent and invest or buy a home isn’t always clear cut!)

- Student Loans

While we both had vehicles at the time that were paid off, we did not add them as assets as we don’t consider them in our net worth since they’re depreciating.

FI Number from Start to Finish

In late 2013, as we began in earnest down the FIRE path together, we were working from a combined net worth of $125,518.

Our original spreadsheet suggested we’d be FIRE-ready at our $1.25m goal by August, 2025.

We’d predicted our net worth would grow by about $1.13m over the course of 12 years. We ultimately reached financial independence based on recent annual spending we tracked, in 2018 as we steamed past the millionaire threshold.

Things certainly changed!

Changes to Our Path

Our path did not wind up being a straight shot from decision to transitioning to early retirement as we are now. Instead, we both meandered through different areas of life, setting new priorities and developing new passions.

Business and Self-Employment

I ended up leaving the traditional career path laid out in front of me in 2012 to expand a business I’d begun years earlier. Initially, this was a set back to my part of our FIRE goals.

2013 was the first year where my earnings could comfortably sustain me from the business. My work was mostly in web consulting: digital strategy, design, etc. We’d projected a fairly modest amount of growth, but within a few years, I was turning down less meaningful projects and managing other freelancers.

Eventually, I wound up leveraging a hobby I enjoyed and the capital from the first business to form a second business in e-commerce. It was a great way to deploy the cashflow from the consultancy. Again, this business initially exposed us to risk in our FIRE plans as the capital could be lost if I didn’t meet my targets or it was a flop.

I was lucky enough to find success again and eventually caught up, then surpassed our original spreadsheet’s investment goals.

Student Loans and Management

For Jenni’s part, she managed to pay down her student loans faster than either of us anticipated. She racked up $133k of student loans and tens of thousands of dollars worth of interest that raised the total over $150k.

It was certainly worth it for her PharmD, but it did come at quite the cost.

Her last payment on the set of loans was in February, 2016. Our 2013 spreadsheet prediction was to have the loans zeroed out by January, 2017.

She attained respect and growing responsibility within her field, eventually managing the pharmacy she worked in.

Not Money, but Desire

While our main decision point for FIRE in 2013 was reaching our FIRE number, that wasn’t really the case once we’d actually done so. Instead, we’ve simply dialed back the work we don’t like and dialed up the parts we truly care about—the projects we’re passionate about.

Jenni has made the jump to work part-time within the pharmacy, after exiting her managerial position.

I’ve passed responsibility within business on to others, and let projects go that were about the money rather than supporting a specific mission I believe in.

For example, I’ve been doing work during the pandemic to support cancer patients and their battle with coronavirus. I’ve been working to support colleagues I believe in to help them achieve success, offering a bit of mentorship and guidance.

This is the type of work I’d do with our without pay.

Within the past month, Jenni and I have both limited our work to Thursdays and Fridays. We’re trying to develop routines that support each other and the projects we care about.

For the most part, we’ve stuck to it!

When Will You Retire?

Our 2013 plan to reach financial independence and consider retiring early has had plenty of twists and turns as we’ve navigated the river that is life. We’ve entered each little rapid with an open mind to the possibilities that things could change: our goals and what’s important within our lives may not be what we expected.

That’s allowed both of us to take on meaningful work, and with a little luck, unexpected success.

How have you planned for retirement?

What’s your FIRE number?

4 replies on “What Is Your Fire Number? (Learn How To Define It!)”

you lost me at 9.9% return on your investments

Lost you in that 9.9% is too high or too low?

“According to historical records, the average annual return since [the S&P 500’s] inception in 1926 through 2018 is approximately 10%–11%.”

[source]

Past performance is no promise of future returns, of course.

One should consider including a percentage of bonds following the Trinity Study.

Yeah, I’m afraid I have to agree that you’re putting yourself in some danger with all that optimism. The Shiller CAPE ratio is near where it was right before the great depression, and has only been significantly higher during the dot com bubble. That also means we’re in a situation where the less-than-airtightness of the 4% rule is a serious issue. I think this article is a particularly good way to incorporate CAPE into FI plans, but really all of EarlyRetirementNow is important to read.

Thanks for the feedback, Fred! You’re certainly correct in that things seem a little out-of-whack in recent times. That said, our goal back in 2013 when we made those assumptions was to simply use historical averages. That average hasn’t really changed since then (largely because of the length of time that average is spread over).

If we’d been more cautious for the period of 2013-2020 (where we pulled the trigger to move into our first phase of early retirement in the early stages of the pandemic), we may not have earned the returns we did during that period (actual average returns: 15.44%).

Who knows how this “Great Trench” of 2020 will shake out. Most of the market has recovered to a large extent, but it’s fair to expect lower returns moving forward. It might tempt you to move to safer asset classes. However, that’s a form of attempting to time the market rather than simply time in the market (with a goal of hitting that 9.9% historical average).

ERN and generally having flexibility with withdrawal rates based around certain market criteria is definitely smart. The Trinity Study takes a very “dumb” approach to the 4% rule (which is better defined as a “rule of thumb”, I think). The testing had people taking out their set rate (4% for example) even during the worst dips in the market; not adjusting to try to cut some expense fat during lean times.

Thanks for the thoughtful feedback, Fred!