December was packed with holiday gatherings, a trip to Phoenix to see family (with a few surprise appearances from the FIRE community!), and a sick Christmas.

While we were wrapping up our fiscal year, we continued our donation tradition to one of three nonprofits that helps us all have healthy hearts. You can read more about them and vote for your favorite in the poll below!

Each month, we track our income, spending, and savings to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

If you’d like a more detailed description of our typical monthly cash flow (like our jobs or housing situation), check out our previous budget updates.

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

As usual, December is a wild month. And not at all representative of the year—a $47K monthly budget is beyond a-typical.

Dividends

It’s a dividend Christmas! Every December, we anticipate significant dividend payments from our various stock holdings—most of it from Vanguard funds like VTSAX. A little over a quarter of our distributions were automatically reinvested in our tax-advantaged accounts.

We earned $20,868 in total distributions.

Credits

Several of our credit cards offer statement credits for purchasing with certain companies. Chase cardholders are eligible for statement credits with Gopuff ($10/month). Between the two of us, we can get back about $100 from Gopuff credits. This is the last month of this promotion! We’ll be sad to see the end of thousands of dollars in free groceries in recent years.

Chase also offers $10-15/quarter in Instacart credits depending on your card. We used this to earn about $58. Chris’s AMEX gold earned $10 back for dining.

We received $168 in statement credits.

Consulting

Chris has been earning around $470/month from his ongoing consulting business. In reality, this is slowly drawing down assets and funds within the business. The massive increase this month reflects his desire to max out his 401(k) contribution for 2023 at $22,500.

Consulting earned $22,647.

Cashback

Laurel Road no-fee checking accounts earn a $10 monthly bonus for making direct deposits of at least $2,500/month. Chris also earned about $28 from BeFrugal shopping cashback.

We earned $38 in cash back.

Accountable Plan

If you’re interested in the details of how an accountable plan for businesses works, check out this original post.

Chris’s business reimbursed him for the use of our house, utilities, health insurance, and other expenses. This reimbursement covers expenses for the fourth quarter of 2023.

Chris was reimbursed $1,273.

Local Sales

Chris sold off his old iPhone near Christmas. He went from an XS to an 11 recently, and considering the earnings from the old one, the net upgrade cost about $17.

We earned $180 from local sales.

Expense Summary

From our $46,630 monthly budget, we saved and invested about $43,200.

After subtracting our credits and savings, we spent about $3,262 on living expenses.

That’s 68% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details.

Food & Dining

Our food expenses are still a little wonky—even though we only had one short trip this month.

Groceries

Our grocery spending came to about $329. We’ve been working through some older foodstuffs in our freezer and cabinets.

It’s worth noting that about $168 of our grocery costs was covered by credits from AMEX/Chase for Grubhub, and Gopuff.

Restaurants, Fast food, Alcohol & bars

Our dining-out expenses dropped with us being home most of the month. Restaurants rang in at about $103, alcohol & bars at $48, and fast food at $11.

Our biggest dining out bill came while—perhaps paradoxily—visiting with Mr. Money Mustache, Mr. 1500, and other community members at Culdesac.

(You’ll spot that restaurant visit in the second photo of the Instagram post above.)

These are the social moments and experiences that make the [ever-increasing] cost of dining out well worth it.

We spent $491 on food & dining this month.

Travel

This month, we spent a week in the Phoenix area visiting Chris’s parents. We set the trip for halfway between Thanksgiving and Christmas to celebrate the holidays with family.

Air Travel

Our only travel-specific expense this month was our flights from Virginia to Arizona. A low-cost carrier, Breeze, thankfully runs a direct flight now between the city pairs—and it’s inexpensive! Each roundtrip ticket was just $184.

We spent $369 on travel this month.

Gifts & Donations

Naturally, with Christmas on the calendar, we were involved in several gift exchanges over the month. It’s always fun digging into the interests of kids, most especially, and seeing them light up with a fun gift.

A large chunk of our gift budget wasn’t related to the holiday, though. We attended a friend and neighbor’s lovely wedding on a river in Virginia. Beautiful, and fun, but perhaps more traditional than what Jenni is aiming for (for us!) this year.

We spent $295 on gifts & donations this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Amusement

While we were in Arizona, we wanted to tour Frank Lloyd Wright’s “other” Taliesin. You might recall we visited the original in Wisconsin a few years ago.

Now we’ve seen both sides of the architect’s studio. We spent about $145 on the tour.

Mr. 1500 was in town and joined us for the excursion.

We convinced him to play a few keys on FLW’s piano, too!

Parking

Just like last month, we used an off-airport private parking and shuttle service for our travel plans. $54 for seven days of parking seems reasonable—and cheaper than two Uber trips.

Electronics & Software

Chris has cycled through various knockoff versions of Apple AirPods over the last several years. Some have been better than others. But, he finally bit the bullet when he ran across a deal on a refurbished pair of AirPod 2s. After using a discounted eBay gift card, the total was just $29. And they work perfectly! Sometimes trying to cut corners (like with those knockoffs) ends up being pennywise and pound-foolish.

Health & Fitness

We spent Christmas Day—and the following days—mostly in bed! Unfortunately, we contracted the flu for the holiday. It hit both of us exceptionally hard. Jenni visited urgent care to confirm the flu case and pick up relevant medications. We tested for COVID, too (negative). Our Doctor ($45) and Pharmacy ($45) costs were mostly attributed to this sickness.

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

Our work schedules remain low. Holidays and a bit of travel kept either of us out of working very much.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of December 31, 2023.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 845,659 |

| Brokerage | 798,151 |

| Roth IRA | 162,502 |

| Traditional IRA | 14,708 |

| HSA | 57,848 |

| Real Estate | 416,100 |

| Mortgage | (139,088) |

| Miscellaneous Assets | 51,642 |

| Checking & Savings | 53,936 |

| Net Worth | 2,261,458 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 4.4% for the month. That brings the S&P’s total one-year return to 24.2%. Not bad!

We did just slightly better for the month with a 4.8% gain. Our one-year return was 21.2%.

Overall, our net worth increased by around $104K this month. This is also our highest recorded net worth.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

Previous Donation Winner

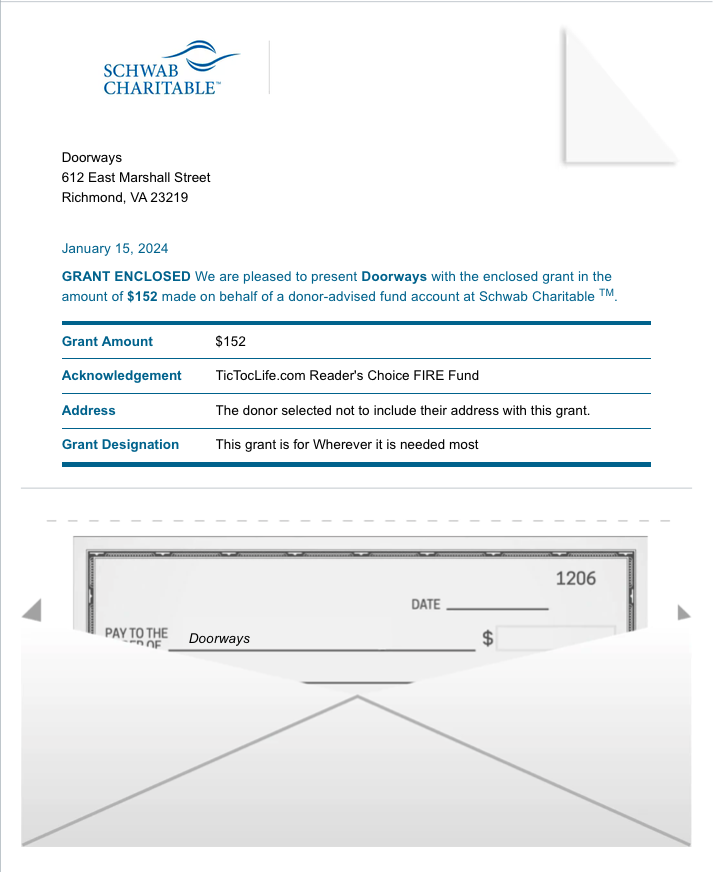

With the never ending need for medical hospitality, we thank you for your votes for The Doorways, as this month’s poll winner. This organization provides accommodations for patients and families in the hub of Richmond’s medical center. They help keep families together while patients undergo extensive medical treatments.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 41 months. We’ve given $5,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Healthy Heart Charities.

Charity Round-Up

We like to stick to a theme for our charity round-up and this time it’s all about the heart! Our hearts are the pump house of our bodies keeping us alive and warm. Yet, the heart is also the center of our feelings toward others. We can forget how important this vital organ is to our body and soul. So, give your heart some love this month by learning about the charities we’ve picked out.

These three organizations have excellent charity ratings to ensure our donation will have the most significant impact. We invite you to learn more about them and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) American Red Cross

Why? January is National Volunteer Blood Donor Month in the United States. The need for blood is higher than ever. Donations are at a record low ever since the pandemic began. Despite the shortage, every two seconds a person is in need of blood.

Where? Globally

Our Notes: American Red Cross is a nonprofit humanitarian organization. They have been working to provide emergency assistance and disaster relief since 1881. We’ve nominated American Red Cross before for their great works in disaster relief but this time we are focusing on their blood donation efforts. They are the nation’s largest blood supplier and can receive whole blood, plasma, and platelet donations from eligible volunteers. Blood drives help replenish the blood banks but often require incentives to attract volunteers.

2) American Heart Association

Why? It isn’t well known that cardiovascular disease is the number one killer of women. American Heart Association helps reduce cardiovascular deaths through research and education. February 2nd is National Wear Red Day in the United States, to show your love for women’s health and increase awareness for heart disease and stroke.

Where? Globally

Our Notes: American Heart Association is a nonprofit organization. Through their research and public service campaigns, they help disseminate medical guidelines for physicians, teach CPR and signs of stroke to the public, and promote healthy living to reduce cardiovascular death.

3) Open Hearts Foundation

Why? ‘We can all do something to help one another.’ This was the takeaway from the founder of Open Hearts Foundation as she found ways to help others even while imprisoned in a Japanese internment camp during WWII. Her family used this philosophy to inspire the organization’s mission to work for the greater good.

Where? The United States

Our Notes: Open Hearts Foundation is a nonprofit charity that inspires others to have an open heart and give what they can. Their mission is to empower emerging and growing nonprofit organizations whose origins and mission are consistent with their philosophy. They provide grants to projects that serve vulnerable women, children, and those in poverty or who have no equitable access. They help individuals do whatever they can to help others through volunteer work.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

With the holiday season nearly over, we’re thinking about what 2024 has in store for us. We’ve not kept up with our yearly themes lately, but that doesn’t mean we’ve not got some ideas for the new year.

We hope to begin to sit down and plan our coming wedding now that much of our travel schedule is behind us. We’ll be exploring local venues, Jenni will be dress shopping, and be wondering how to balance our adventurous spirit and such a tradition.

We just published our big annual FIRE Budget for last year (2022!). 12 months to complete it is just a little better than the 13-14 for our 2021 budget. We’re shooting to have our 2023 FIRE Budget published much sooner, though, so stay tuned!

How did 2023 close out for you?

Let us know in the comments or on Threads and X (Twitter)!

2 replies on “Desert Holidays & Dividend Christmas (Dec. 2023 Update)”

What’s the deal with the $9.87 of 401(k) match? That seems really specific but also really small if you’re bothering to set up a match?

I assume you guys keep working because you find enjoyment in it? It seems like your assets would support your spending if you wanted to live off them?

Hey TJ!

Good question regarding work… Yep, it’s pretty much just because it’s still something we each enjoy. Both of us entered our respective specialties because we were interested in them, which is quite fortunate.

Jenni’s pharmacy work supports folks that are out sick at the local pharmacy as part of a team and system she built. So far, at least, it’s not something she wants to give up. Time will tell…

For me, the only paid client I still have is supporting someone in a role at a university who I originally mentored. So, now, the shoe is on the other foot and it’s been nice to be the haggard old expert who knows how the systems work and just be there for questions. Kind of like Jenni, it’s not something I’m ready to let go of just yet. But soon, I think. Almost happened at the new year, in fact!

In both cases, the money is unnecessary (and, while I can’t speak for Jenni, I specifically told the folks I still work with I’d continue to help them for free if the contract failed while some remaining transition elements are finishing). We have plenty of assets to support ourselves. We also do a variety of pro bono work for causes we deem important, volunteer locally, and so on. Over time, that’s increasing in our lives. Not to mention all the fun stuff and hobbies. I suspect it’ll continue to displace standard “job” type work we do over time.

As for the $9.87… Jenni gets a match from her employer for 401k contributions (a percentage of her contribution), apparently it was some sort of calculation adjustment from the last pay period. Not a specific amount she set! 🙂