Minus a few birthdays within our family, May turned out to be a month for us to relax and catch up on our life in Virginia. Without any big travel plans, we did well getting back into our workout routines, seeing friends/family, and generally taking a break. Lastly, we quietly celebrated our one-year wedding anniversary!

For our monthly donation, our theme is empowering underserved communities. You can read more about the three charities we’re considering and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Despite a pretty lazy month at home, our income didn’t jump much. With extra time, we didn’t pick up much in the way of work for once! Jenni still clocked in some hours though, which is where most of our income came in this month. We fell pretty far short of our expenses!

The only interesting income element to point out is just how much our interest income has dropped. This is mostly due to spending down our more liquid savings in recent months.

Expense Summary

From our $4,856 monthly budget, we saved and invested $1,584 dollars.

After subtracting our credits and savings—we spent about $3,262 on living expenses.

That’s 68% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details this month.

Food & Dining

With much of may at home, our food expenses started to return to normal. But, we did have a few fun times out!

Groceries

Our groceries were down a bit—about $364—as we’re back home and doing a good job catching good deals and using coupons. Our local Kroger started requiring Buy One, Get One purchases to actually mean purchasing two items—which sort of sucks! We’ve always used those deals to get 50% off a single item. Fortunately, our local Publix—which has some crazy good weekly BOGOs—still knocks 50% off a single item. We’ve made great use of Chase’s reintroduction of the monthly Instacart credits, too.

Restaurants, Fast food, Alcohol & bars

Our big dining out expense this month—about $50—came via a local Lebanese food festival. So many tasty treats! And savory surprises! What a great way to spend an evening with a friend—sampling foods we don’t typically have, enjoying live music, and seeing lots of cultural exhibitions.

We spent $416 on food & dining this month.

Amusement

Aside from our home, Amusement ended up being our largest spend category this month! That’s a real sign of retirement! Ha. So, what’d we get up to spending about $640 amusing ourselves?

We’ll let Jenni share her experience with the American Sailing Association (ASA) 101 course—

My two-day ASA sailing course with SailTime on a Colgate-26 keelboat showed me the ropes (or I should say the lines) of sailing a monohaul sailboat—tacking and jibing, rasing the main, and triming the jib. I learned how to tie knots, follow the rules of nautical navigation, dock in a harbor, and communicate with a crew of three while safely sailing in a busy bay.

After years of being just a passenger on my Dad’s Hobie Cat, I wanted to test my skills as a sailor. I am happy to say that I passed the written and hands-on tests and successfully navigated the open waters with gusts up to 15-20 mph. I can’t yet capitan a sailboat alone, but I will be able to sail with my Dad this summer.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Occasionally, we love to post the things that cost…nothing! So much of our day-to-day involves just taking advantage of our free time to catch local events, family gatherings, and time in nature. All this tends to be free. Or, at least, has very low incidental costs (bringing food to a family event, driving a car, etc.). One of FIRE’s greatest benefits is simply having the time to attend all these free things.

We got up to quite a few of these types of events throughout May:

First Fridays

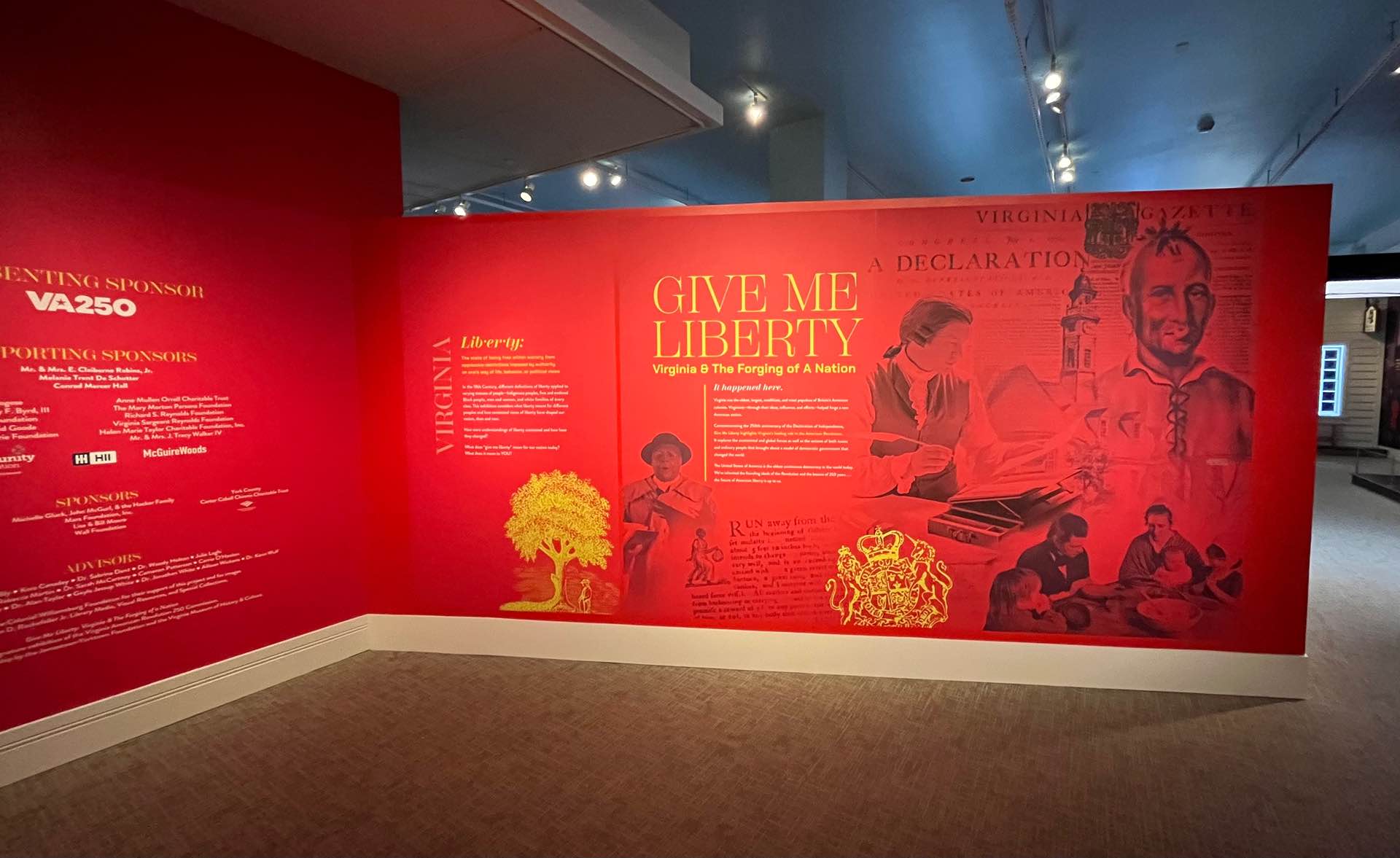

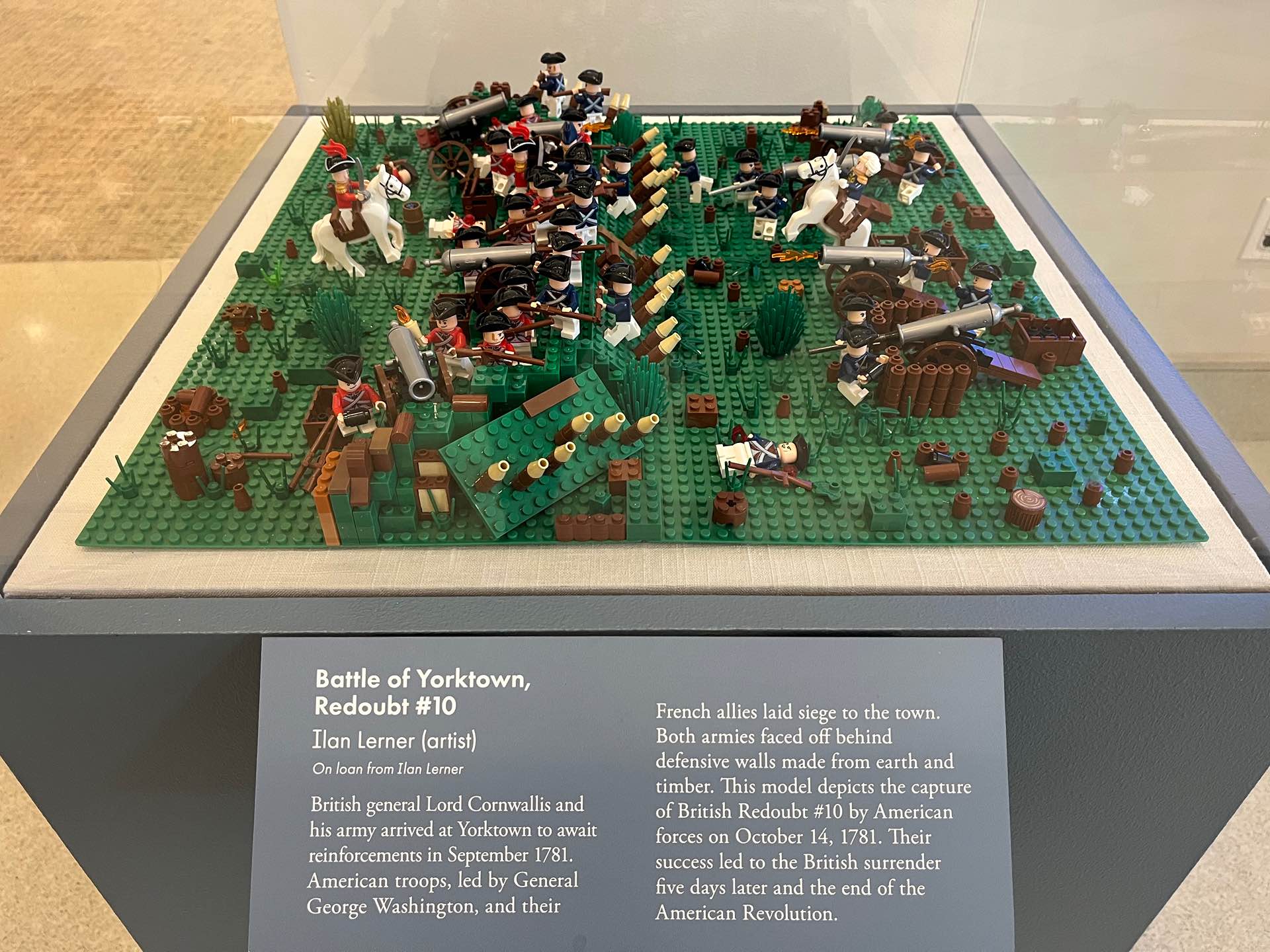

Our local history museum has free access on the first Friday of every month. The special exhibit for the season celebrates the 250-year history of the USA.

Cost: calories to walk there.

Riverrock

One of the city’s big events is a massive festival celebrating all things outdoors called Riverrock. Biking, bouldering, kayaking, air dogs, and so much more! We love seeing all the events and challenges. Not to mention, it puts the city on lovely display.

Cost: calories to bike there, snacks we brought.

Garden Gathering

The Fine Arts Museum near us also has Friday events. We kind of treat it like our backyard with its lovely gardens, water features, and wonderful views. Fridays tend to bring hundreds of people, music, picnics, and lots of fun!

Cost: calories to walk there, picnic supplies we brought.

Family & Awards

One thing we love being able to do is family activities that might otherwise conflict with normal work schedules. Since we’re usually home during the workday, we’re often able to attend nephew or niece events at school or help with appointments and so on. This month, we got to attend a little graduation award ceremony!

Cost: gas for the drive to school.

Mother’s Day Concert

Our amateur concert band does a great job of coming to various local events and putting on a great performance. We love catching them! For Mother’s Day, they performed at a local historic museum with some lovely weather to support them.

Cost: gas for the car (though we could have biked!) and picnic supplies.

And while there were some incidental costs for these various events and gatherings, it’s mostly just things you’d do anyway—like eating. You could fill up your FIRE time with all sorts of expensive stuff, and there’s nothing wrong with that if it fits your budget. But, some of the most fun and fulfilling things often come without a price tag attached!

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 51 | 18 |

| Nov 2024 | 5 | 15 |

| Dec 2024 | 19 | 12 |

| Jan 2025 | 17.5 | 17 |

| Feb 2025 | 4 | 8 |

| Mar 2025 | 14 | 12 |

| Apr 2025 | 3 | 11 |

| May 2025 | 33 | 14 |

With no big travel plans or other events this month, we both worked a little more than normal—clocking in 47 hours between the two of us.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of May 31, 2025.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,070,098 |

| Brokerage | 964,123 |

| Roth IRA | 203,197 |

| Traditional IRA | 39,862 |

| HSA | 66,846 |

| Real Estate | 464,900 |

| Mortgage | (132,260) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 9,374 |

| Net Worth | 2,711,140 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 6.1% for the month.

We were up about 4.7%. So, we lagged the S&P a good bit—which is generally expected since we did much better in recent down periods due to defensive investments.

Overall, our net worth increased by around $122K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

| December 2024 | $2,621,732 | (2.4%) |

| January 2025 | $2,689,706 | 2.6% |

| February 2025 | $2,665,053 | (0.9%) |

| March 2025 | $2,581,708 | (3.1%) |

| April 2025 | $2,588,737 | 0.3% |

| May 2025 | $2,711,140 | 4.7% |

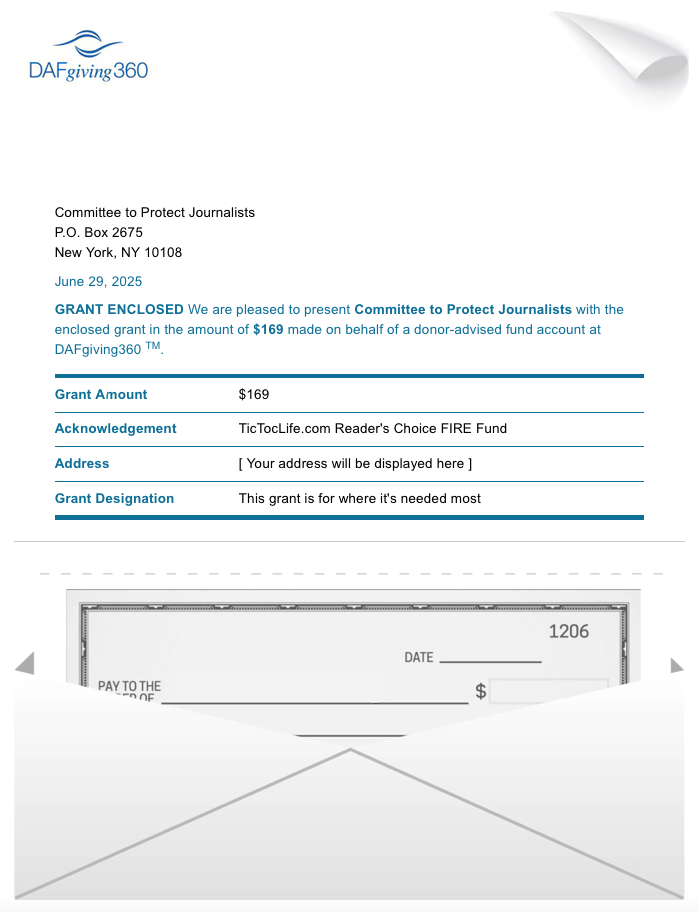

Previous Donation Winner

On behalf of all of the journalists around the world, we thank you for your dedication and strength! You go out in this scary world and bring us your reporting so that we may be properly informed about what is going on. We are happy to support the Committee to Protect Journalists with our grant this month. May you all stay safe and continue to promote freedom of the press for all.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 4 years. We’ve given almost $8,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates supporting: Underserved Communities.

Charity Round-Up

We decided to go with a very broad theme this month to try to bring light to a variety of areas that need charity. Our theme is organizations that are empowering underserved communities through direct support or advocacy.

The following organizations are fighting for equitable opportunities for vulnerable populations facing economic, social, or legal disadvantages. Each organization has an excellent charity rating. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Village Enterprise Fund, Inc.

Why? By teaching the skills necessary to start successful businesses, this group helps alleviate extreme poverty and equip those in rural Africa to become self-reliant.

Where? Democratic Republic of the Congo, Ethiopia, Kenya, Rwanda, Uganda

Our Notes: Village Enterprise Fund, Inc. is a nonprofit organization working to resolve poverty in rural Africa. Through partnerships with governments and nonprofits, like DREAMS for refugees, USAID Nawiri, World Bank Kenya Social, and UN Women’s Economic Empowerment, they’ve developed entrepreneurial programs to alleviate poverty. Youth, women, and refugees in communities are taught the skills and provided the resources to start climate-smart businesses. Participants graduate through the program and start to become financially self-reliant and help their communities too. This type of aid doesn’t just help the individual but can have a lasting impact on generations to come.

Here are a few examples of their impact:

- 110,975 businesses started

- 353,980 entrepreneurs trained

- 2.2 million lives changes

- 88% increase in income

- 481% increase in savings

2) Three Dog Night Charities

Why? Because no one should sleep outside and a tiny home is still a home. This organization, along with Eden Village of Kansas City, is building tiny homes for the chronically homeless with a supportive community model to help people get back on their feet.

Where? Kansas, Missouri

Our Notes: Three Dog Night Charities is a nonprofit organization formed by a small group of volunteers in Kansas City. They knew their nightly efforts of bringing food and necessities to homeless camps were just a start and wanted to do more. Together with Eden Villages, they have found a way to do more! Tiny furnished homes with a supportive community to help find a way to end their chronic homelessness. Individuals in the city who’ve been chronically homeless or have a disability making it hard for them to live alone without support are eligible to apply. While it isn’t rent-free, the $350 rent covers the cost of utilities, laundry, activities, and other resources provided. Eden Villages are popping up all over the country, including Richmond, Virginia. So far, a total of 10 communities have been built or are in the works of obtaining the land and establishing the funds to get started.

3) Coalition for Humane Immigrant Rights (CHIRLA)

Why? As an effective and trusted organization with a strong track record, they are fighting to advance the human and civil rights of immigrants and refugees.

Where? Imperial County and Los Angeles County, California, Mexico, Washington, DC

Our Notes: Coalition for Humane Immigrant Rights (CHIRLA) is a nonprofit advocacy organization for immigrants and refugees. Their focus is on policy change, legal aid, and community organizing to empower immigrant communities. Over the past 35 years, they’ve had dozens of legislative wins protecting the rights of immigrants and refugees, including the California DREAM Act and DACA. These policies allowed children and young adults to have an education. They also passed CA Driver’s Licenses for Undocumented Immigrants, making the roads safer. They provide low-cost or free legal services to become lawful citizens and DACA renewals. CHIRLA has become one of the largest and most effective advocates for immigrant rights, organizing, educating, and defending immigrants and refugees in the streets, and in the courts. Right now, they have their hands full with ice.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

June holds—hopefully—another pretty quiet month for us. Chris’s parents are visiting for about a week, so we’ll spend some time prepping for that and making plans. We’re thinking about a visit to Europe for July which means more travel planning. And, we’ll make good use of the warm weather to get into nature and onto the river.

A lovely, fairly relaxing month ahead we hope. Putting the “R” in FIRE!

What’s your trick for not watching the markets twists in turns?

Let us know in the comments or on Threads and X (Twitter)!

3 replies on “Sailing Into Summer (May 2025 Update)”

Hi Chris,

I just found your blog, and have really enjoyed binge-reading your monthly updates! I’m similar in age to you and Jenni, and your website has been such a great resource for my own early-retirement planning.

I had a question for you: On the “Income” side of your Sankey budget diagram… obviously “Paycheck” is from yours/Jenni’s W2 income. Is “Checking” just pulled from your liquid savings (ie, the “Checking & Savings” in your Account Breakdown)?

In particuar, I’m curious how you guys maintain that liquid bucket. Do you just direct all of your stock dividends there (and call it a day)? Or do you also supplement it with selling stocks? Also, do you have a target number that you like to keep that bucket at?

In my mind, that bucket would serve as an Emergency Fund, so I was a little surprised to see it so low (based on recommendations for 6+ months of funding).

Happy July!

Kristen

Kristen,

Great to hear from you and thanks for the insightful comment!

Yep, you’re more or less on track. If our expenses are greater than income for a given month, you’ll see the balance made up for via checking. And similarly, if our income outweighs expenses, you’ll see the net flow into our checking.

In years prior, it tended to be that our income was still outweighing our expenses. Jenni worked more. I had a greater ongoing business income. These things were generally associated with our labor hours, but not always (especially with regard to my business income). But these days, our months tend to be “negative” — which of course — is how it’s supposed to work with FIRE!

Even as our net worth continues to grow, our monthly budget tends to be negative. Our assets grow but we spend more than our income.

“Checking” does represent our multiple checking and savings accounts. Dividends in our non-tax advantaged accounts, now that we’re not growing our assets as much, do flow through to checking. Our 401(k)s, IRAs, etc still auto reinvest. We’ll be able to live off our brokerage accounts until we’re older when it’s generally easier to withdraw from the tax advantaged accounts.

You may have noticed previous months, yes, our “cash” cushion tended to be quite a bit larger. 20-30k, often. Somewhere in that 6 month budget rule of thumb you mentioned, in fact. Now that we are in spending mode, we’re setup for quick transfers from our investments to checking (same bank) for a large portion of our assets. So, if it’s a week day, we have access to significant assets during the business day if needed. For weekends, we’ve got some assets in checking and significant credit access (plus cash advances). I can’t think of much—short of something like a ransom on a weekend—that we couldn’t handle. Most big bills come with reasonable payment terms. 🙂 That said, a 6 month emergency fund is a great rule of thumb when building your assets.

And as a little peak behind the curtain—our liquid assets reached a new low just recently of around $5K! We’re actually actively selling in the market today/tomorrow to pump those assets up.

Thanks again for the comment! Hope to see you around here more. And good luck on your journey!

Thanks Chris! That makes a lot of sense… and really worked out great that you are able to convert some stock to cash now that the market is so high.

Looking forward to next month’s update!