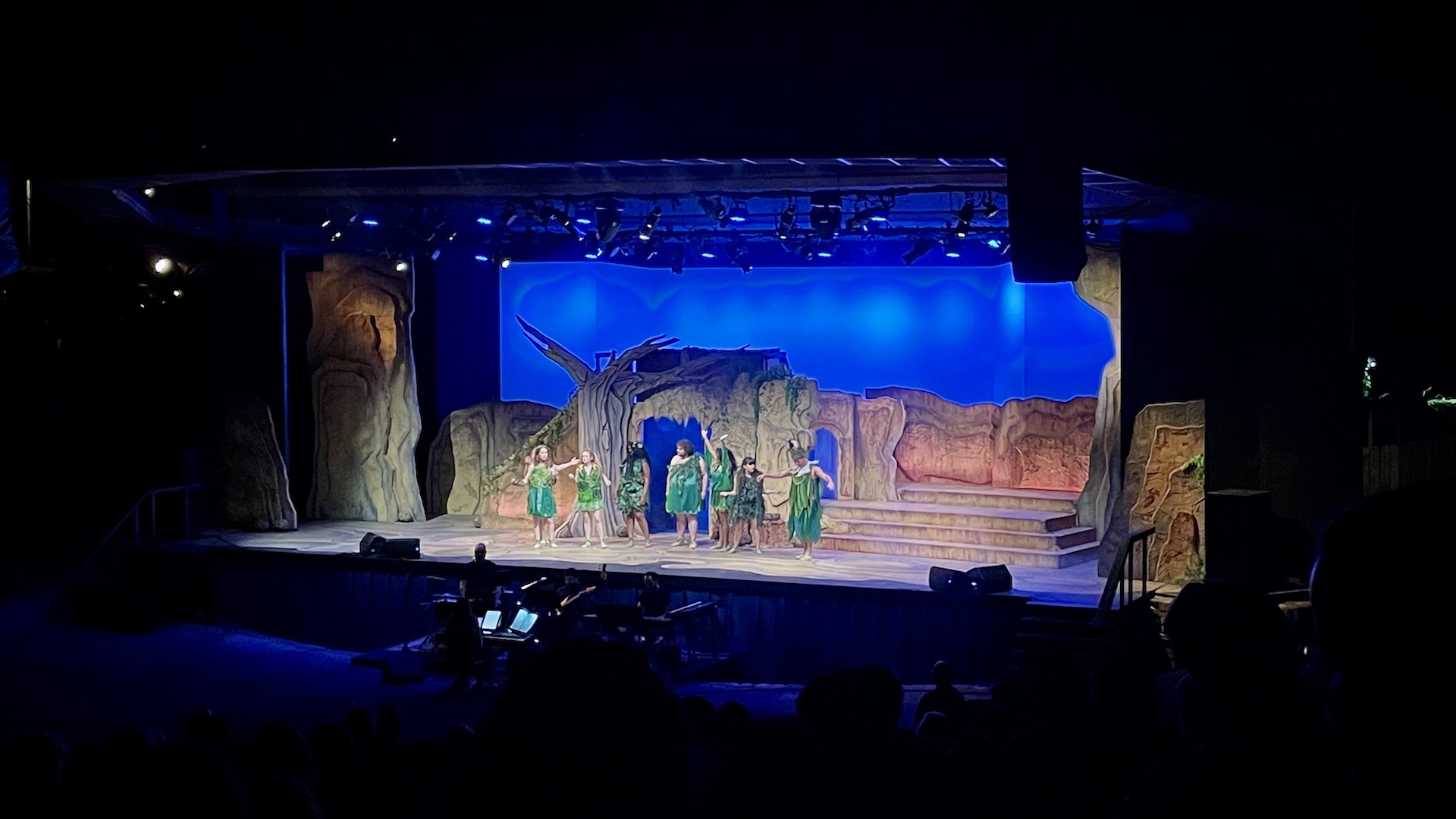

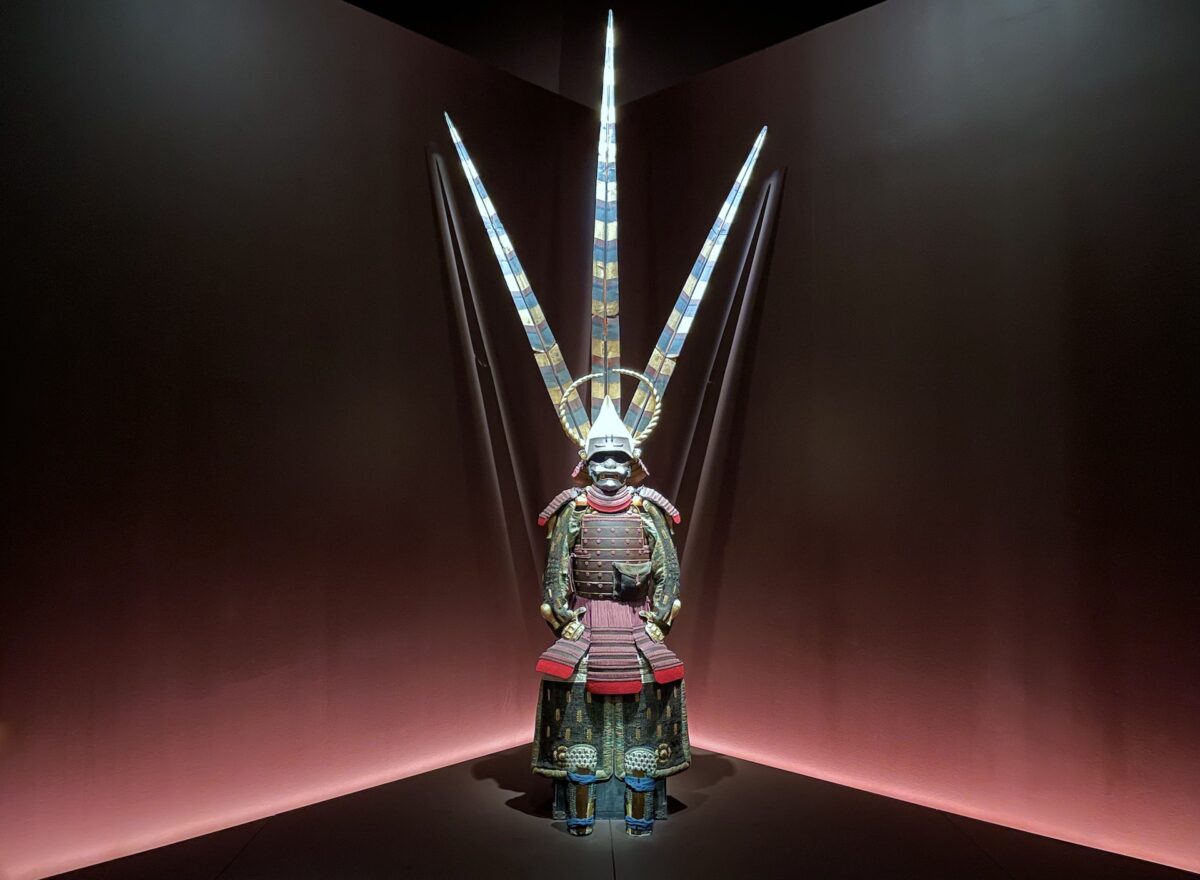

You know that classic monk or samurai pose like the lead photo in this post? They’re upright, firmly postured, yet still seem to be resting. At peace. That’s the sort of month we were striving for here—and we learned a good bit about Samurai and their zazen (or seated Buddhist meditation) during one adventure—but still, we somehow managed to pack it full of busy days and new hobbies.

Who said FIRE would mean lazy days and mid-afternoon drinks? Suppose life is what you make of it, and we seem to make a lot of it—even in this “break” month of August! Fun, friends, and the tail-end of summer. Perhaps zazen will come to us in the coming fall.

For our monthly donation, we are celebrating International Charity Day and having a top charity run-off poll. You can read more about them and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Please keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Somehow, if we’re not traveling, we manage to tie ourselves up in hobbies that blur into work, or just straight up work! Notably, this month, Jenni really buoyed our income by…working! Her pharmacy had the lead pharmacist out on maternity leave and so she stepped in.

Aside from our usual monthly income, here are some interesting anecdotes:

Credits

Several of our credit cards offer statement credits for purchasing with certain companies. This month we used:

- Chris’s AMEX Gold offers a $10 monthly dining credit which he tends to use on local bakery pick up for fresh bread.

- Jenni earned about $38 in Chase offer credits from our car insurance payment (6 month).

We received $48 in statement credits.

Local Sales

We’re still finding occasional success upgrading our old gear or selling off promos via our local Facebook Marketplace/Craigslist. Related purchases appear in their expense sections below, too [for more details].

- Chris sold a new Pixel 9 for $599 (which he received free from a trade-in of an iPhone 12—purchased for just $131!); net: $468.

- Chris sold a new Xbox Series S for $280 (which he bought for just $143 after an AMEX offer & previous Dell gift card; it even came with a $50 gift card for future use!); net: $137.

- Jenni sold her old Windows PC for $60 (which she has upgraded to an iMac for around $80).

- We sold a few more items from our wedding: $10—box of wine glasses, $25—metal forks.

We earned $700 from local sales.

Expense Summary

From our $12,455 monthly budget, we saved and invested about $9,074.

After subtracting our credits and savings—we spent about $3,333 on living expenses.

That’s 70% of our FIRE budget from 2022 ($4,787/month).

Being home certainly brings our expenses down! Let’s break down some of the more exciting details.

Food & Dining

In the ebbs and flows of our food budget, this month was a little lower than recent months. We didn’t dine out too much, and, we didn’t do any major grocery restocking.

Groceries

At $386, this is probably a pretty typical grocery expense for us. Perhaps slightly low since we did some bulk buying last month. But still, we feel like we eat really well—mostly vegetarian, and Jenni is gluten-free.

Restaurants, Fast food, Alcohol & bars

We did have one short trip this month—a few hours north to Washington, DC. While visiting friends, we had some tasty Vietnamese and a gelato visit on a sunny day (~$57). Back home, we took a friend out for his birthday to a classic vegan place (~$69). Lastly, Jenni took her sisters out for drinks on their birthdays (~$27). We had a few small takeout meals here or there to maximize monthly offers, too.

We spent $539 on food & dining this month.

Shopping

The never-ending cycle of upgrades continues…

Electronics & Software

- In a similar deal to the one in “Local Sales” above, we bought a second iPhone 12 for just $91 (discounted second device on the account). This’ll be locked to Metro for some months. We’ll use it for a future trade-in or as an upgrade from Jenni’s iPhone 11 in the future.

- Chris spent a little money on a budding hobby of repairing various Apple products (iPads, iPhones, iMacs, etc). Tools set him back about $21 but will pay themselves off easily in repairs.

- Jenni added an Apple Pencil to her existing iPad Air 3 for $13.

- Jenni upgraded her Windows PC (sold for $60 above) to a 2015 iMac for about $77—already running Sequoia with a nice fast SSD!

We spent $202 on shopping this month.

Amusement

We tried to make good use of our time at home this month. Of course, a lot of our outside entertainment on the river, in the parks, at the city shows were all free. And wonderful!

But, we do spend on some other fun events. This month:

- A special exhibit on Samurai—history, armor, and more ($30)

- A white water rafting trip with Jenni’s sister’s family (including two young nephews!) ($50)

We spent $80 on amusement this month.

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

As mentioned in the income section, Jenni worked a lot this month—and dumped it all into her 401(k). The lead pharmacist—the person who took over her old job!—is out on maternity leave so Jenni has been helping out a lot.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of August 31, 2024.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,005,914 |

| Brokerage | 908,328 |

| Roth IRA | 197,105 |

| Traditional IRA | 23,953 |

| HSA | 59,016 |

| Real Estate | 440,100 |

| Mortgage | (136,141) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 32,940 |

| Net Worth | 2,560,215 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 2.4% for the month.

We were a little behind that with a 1.8% gain.

Overall, our net worth increased by around $46K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

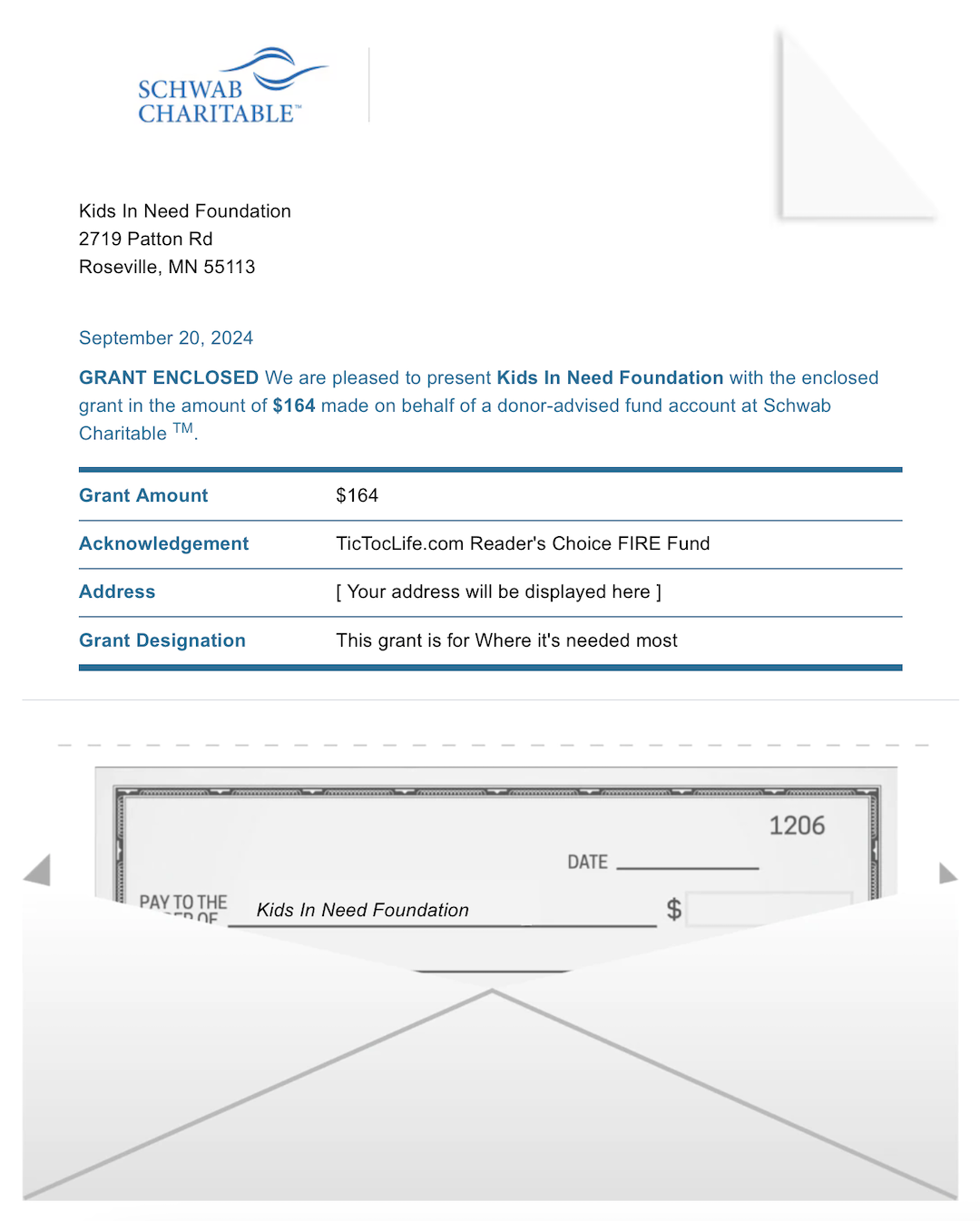

Previous Donation Winner

Because of your votes, at least six additional kids are getting loaded backpacks when they head back to school this year from Kids In Need Foundation. Congratulations to our poll winner who provides kids and teachers the supplies they need to be set up for success at school.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 49 months. We’ve given $6,200 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: heat relief nonprofits.

Charity Round-Up

We recently learned that September 5th is designated as International Charity Day. Created in honor of Mother Teresa’s life, it’s a day dedicated to raising awareness of the power of charitable acts. To bring our own special touch to this celebration, we’ve put together a top charity run-off from our past charity winners that received the highest number of votes. Help us narrow down the ultimate winner from the list below.

As always, each organization has excellent charity ratings to ensure our donation will have the most significant impact. We invite you to learn more about them and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Heifer International

Why? People shouldn’t go to bed hungry. Everyone deserves food security which will help them stay out of poverty. By building up local economies through the donation of livestock and providing food security and nutrition, communities can pull themselves out of poverty.

Where? Kenya, Haiti, Uganda, Tanzania, Nepal

Our Notes: Heifer International is a global organization whose goal is to transform communities to improve economic development. Part of the way they do this is by donating livestock such as cows, goats, and chickens, or funding similar programs. By focusing on building up local economies, their approach is to help farmers and business owners increase their income and assets.

2) Conservation International

Why? Their message is clear, conserving nature secures the critical benefits that nature provides to humanity. Their vision is to have a world where societies are committed to caring and valuing nature for all of eternity.

Where? Globally

Our Notes: Conservation International (CI) is an American nonprofit environmental organization founded in 1987 to protect nature for people. CI works with governments and local communities to find economic alternatives without harming the natural environment. CI focuses on three strategic priorities to protect more than 6 million square kilometers of land and sea across 70 countries. Their current focus is addressing the intense droughts drying up the Amazon Rainforest and leading to out-of-control wildfires.

3) International Medical Corps

Why? Those who are willing to put other needs above their own deserve a lot of recognition. These responders do their job no matter where in the world it is or what the conditions might be. In an emergency or disaster, they continue to provide that care despite the risk being even higher but they need our support to keep going.

Where? 30+ countries all over the world including the United States

Our Notes: International Medical Corps is a global, nonprofit, humanitarian aid organization. Its mission is to provide training, healthcare, and related services to those affected by conflict, natural disasters, or disease. When we first brought this organization to your attention, we all were amid a global pandemic. While COVID is very much still a concern, they’ve been focused on assisting those affected by the fighting in Ukraine, Israel, and Gaza.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

Chris is still working on other posts:

- Inflation bond (I Bond) experience

- Our transition from Intuit’s Mint budgeting app to a different tool

- The big annual FIRE budget post for 2023

- Credit card rewards points breakdown—as suggested by a reader!

We didn’t finish as much writing as we wanted to in August. Part of this is attributed to some new hobbies (briefly mentioned in this post re: electronics) and partly attributed to just packing the month with fun outdoor activities. While we’ll spend a good chunk of September preparing for—and enjoying—a trip to Germany with family, we hope to do a little catch up in the writing department this fall.

On top of that, we’re still struggling with some money centric posts (like a few mentioned above) as we were so reliant on Mint and the related financial data. But we’ll get there.

Thanks, as always, for joining us on this journey. It’s a pleasure to continue the conversation with you—find is in the comments or on social media!

Big fall plans? New investments? Money strategies?

Let us know in the comments or on Threads and X (Twitter)!

2 replies on “A Reflective Month of “Zazen”? (Aug 2024 Update)”

(… feedback, perhaps, rather than a comment with any expectation of being public…) – it’s very bold to suggest but as someone who reads and enjoys your pose each month on a mobile device… would you consider tabbing your hours worked and/or net worth by year…? … with four years’ worth of data, it would spare some scrolling… but I love your work – thank you for taking the time and sharing your experience…

Thanks MM! We made this update a couple months ago; hopefully it’s helpful in the updates since! Cheers!