August tends to contain the apex of summer temps in Virginia—which we mostly managed to avoid with another trip to Europe. We spent about a week in Austria and the Czech Republic. This trip gave us an opportunity to see more of Vienna that we haven’t in other recent visits. And, of course, plenty of historic sights, traditional food, and little adventures.

For our monthly donation, our theme is charities delivering joy via handmade cards. You can read more about the three charities we’re considering and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

The vast majority of our income came from investment sales this month. We still earned a bit from our pharmacy and consultancy gigs, too.

Investments

More frequently, we have to make ends meet by selling our existing investments. Our small ongoing incomes and dividends don’t always meet our needs. Of course, this is part of the FIRE plan. This month’s investment sales refill our checking accounts and help offset some future expenses we are anticipating.

Jenni sold $7,510 of stock shares.

Our total income for the month came to $9,162.96.

Expense Summary

From our $9,163 monthly budget, we saved and invested $5,158 dollars.

After subtracting our credits, savings, and donations—we spent about $3,995 on living expenses.

That’s 83% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details this month.

Food & Dining

Another month and another short trip to Europe for us. Surprisingly, this has helped keep our food expenses pretty reasonable lately. Dining out and groceries, at least where we’ve visited, have tended to be less expensive than in Virginia.

Groceries

At $378 our grocery expenses remain quite low compared to our historical average. Food in Austria and the Czech Republic—especially—is pretty inexpensive.

Restaurants, Fast food, Alcohol & bars

At about $194, our total expenses dining out were up a bit over recent months. But, we enjoyed some special meals while abroad. It’s hard to skip traditional schnitzel, strudel, and ghoulish when it’s available!

We spent $572 on food & dining this month.

Travel

We spent the middle of August in Austria and the Czech Republic. Much cooler than Virginia, we got to explore some historical sights, a very old carnival, and lots more.

Air Travel

For this trip, we were a little luxurious with two direct flights for our outbound and return. Dulles (DC) to Vienna and back. The pricing was pretty good relative to other summer flights so paid just a small premium for the direct connections. We covered the cost with Chase points (about 103K).

Hotel

We ended up roughly splitting our trip time between Vienna, Austria and Brno, Czech Republic. So, we stayed in two Airbnbs, one in each city, for most of the trip.

Prior to our return flight, we stayed at the Intercontinental in Vienna which we used one of our annual free night certificates for from IHG. The card which earns that certificate has a $99 annual fee which we accounted for in the trip cost.

We used discounted Airbnb gift cards to save a little money and earn more points. This brought our Airbnb cost down from about $574 to $517 for six nights.

Lastly, we took a brief trip to Virginia Beach for a little getaway and used another IHG certificate to stay near the water for the night. Again, we accounted for the $49 annual fee the card carries as an expense.

We spent $665 on travel this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things or small purchases to mention that might be of interest.

Amusement

Despite the fact that we’ve known each other since we were kids, we’ve never ridden a Ferris wheel together. And, after some discussion, it seemed that Jenni had never been on one at all. So, we took the opportunity to ride a historic one located within Vienna’s very old park and carnival—Prater. The Ferris wheel dates back to 1897 and was the world’s tallest until 1985. Our night ride left us with our own private gondola and amazing views over Vienna. Tickets were about $34 for the two of us.

Austria/CZ Travel Summary

Our 8-day trip to the Czech Republic ran from August 18 to 26. It’s our third trip to this part of Europe this year. We’ve traveled a good bit of Western Europe—which is lovely—but summers in these cooler parts are quite enjoyable, and, much less expensive.

Let’s break down our trip budget.

We’ll include all expenses we incurred for the trip—even groceries, restaurants, and amusement. But we’ll skip expenses that we incurred during the trip that were not part of the trip (for example, our utility bill back home in Virginia).

Trip cost table

Let’s take a look at our total trip cost. In the table below, you’ll find four columns:

- Description: a summary of what the expense was for. We’ve included some basic geographical information for things like flights or hotels.

- Cost: our incurred expense in US dollars for the described line item. In some cases, this appears as zero. If a travel currency like hotel points, airline miles, or a credit card reward certificate covers the total expense, we record a zero here. Sometimes, there’s a minor fee in addition to using points/miles for surcharges or taxes.

- Rewards Points/Miles: we maximize our credit card rewards and frequent traveler currencies to cover the costs of our travel wherever possible. You’ll see a short description of the type of certificate or currency that we used.

- Estimated Value: when using a reward from the previous column to cover an expense, we record what we would have otherwise paid for the line item. This gives us a sense of our savings.

The table is generally in chronological order.

We still incurred expenses at home (mortgage, utilities, etc.)—but these do not appear as part of our trip costs.

| Description | Cost (USD, $) | Rewards Pts/Miles | Est. Value (USD, $) |

|---|---|---|---|

| Flight—IAD→VIE (2x, Economy) | 103,162 Chase Pts | 1,547.42 | |

| Airbnb: Apartment, Vienna—3 nights | 296.07 | ||

| Airbnb: Apartment, Brno—3 nights | 220.62 | ||

| Hotel: Intercontinental Vienna—1 night | IHG Free Night | 290.00 | |

| Dining: restaurants, fast food, alcohol & bars | 184.96 | ||

| Groceries | 164.60 | ||

| Amusement—tickets | 33.91 | ||

| Public Transportation | 164.65 | ||

| Total | 1,064.81 | 103,162 Pts/Miles | 1,837.42 |

Trip cost discussion

We spent about $1,065 on a 8-day trip for two people. That’s about $133/day (or about $67/person). Converting our flight costs to points saved a good bit of money, as did our fancy hotel night certificate in Vienna.

Had we not used those, we’d have spent another $1,837, which would make the trip cost about $363/day!

Jenni used her Chase Sapphire Reserve card for our round-trip flights from the US. This allowed us to pool our Chase Ultimate Rewards (UR) points and redeem those for a value of 1.5 cents per point (instead of the typical 1:1). We were happy to use about 103K points instead of $1,547.

Summary—

We cut about 63% of the cost of this trip by using discounted gift cards and points/certificates instead of cash for our various expenses.

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 18 | 51 |

| Nov 2024 | 5 | 15 |

| Dec 2024 | 19 | 12 |

| Jan 2025 | 17 | 17.5 |

| Feb 2025 | 4 | 8 |

| Mar 2025 | 14 | 12 |

| Apr 2025 | 3 | 11 |

| May 2025 | 14 | 33 |

| Jun 2025 | 12 | 2 |

| Jul 2025 | 12 | 13 |

| Aug 2025 | 16 | 13.5 |

With a trip mid-month, neither of us worked all that much. We kept it just below 30 hours of paid work.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

Even with the wild swings in the market lately, our investments continue to be pretty stable. From a high level, our assets and liabilities are shown in the data table below as of August 31, 2025.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,166,456 |

| Brokerage | 1,033,311 |

| Roth IRA | 234,655 |

| Traditional IRA | 43,613 |

| HSA | 70,301 |

| Real Estate | 459,300 |

| Mortgage | (130,942) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 14,266 |

| Net Worth | 2,915,960 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 1.9% for the month.

We were up about 2.8%. So, we beat the S&P a bit—we’ve lagged a little lately so that’s not too surprising.

Overall, our net worth increased by around $80K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

| December 2024 | $2,621,732 | (2.4%) |

| January 2025 | $2,689,706 | 2.6% |

| February 2025 | $2,665,053 | (0.9%) |

| March 2025 | $2,581,708 | (3.1%) |

| April 2025 | $2,588,737 | 0.3% |

| May 2025 | $2,711,140 | 4.7% |

| June 2025 | $2,818,049 | 3.9% |

| July 2025 | $2,836,370 | 0.7% |

| August 2025 | $2,915,960 | 2.8% |

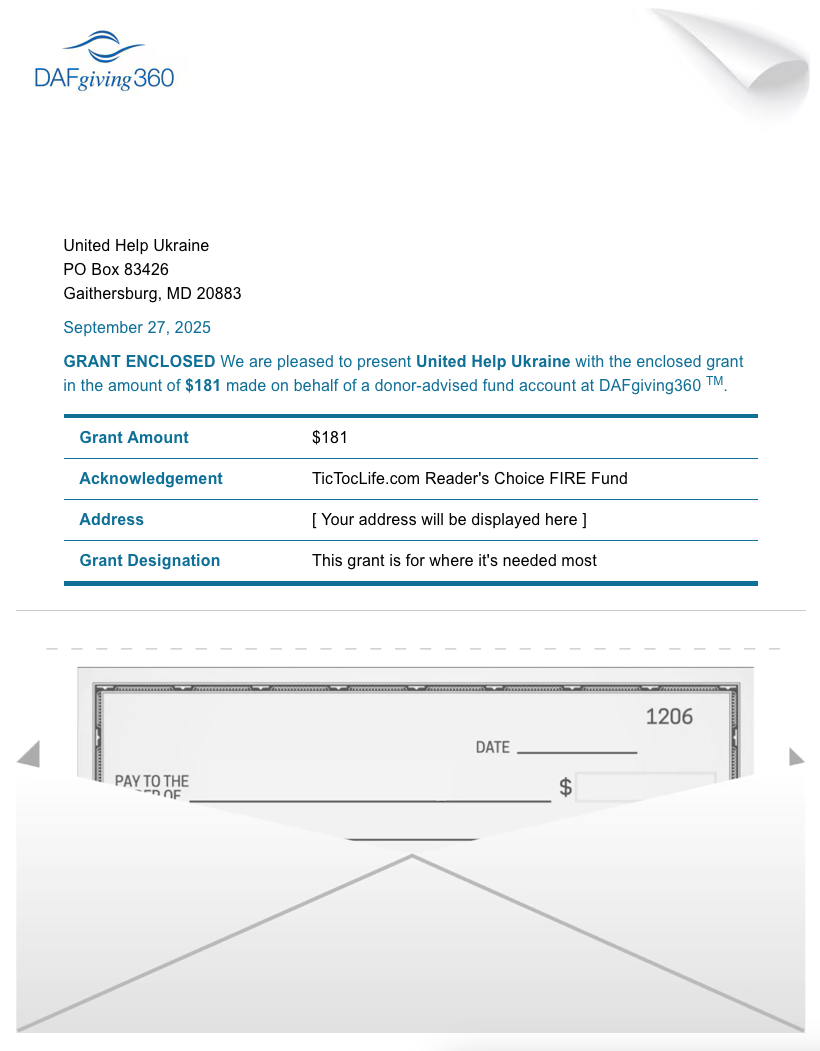

Previous Donation Winner

Having the right education to use first aid and medical supplies correctly is crucial to saving lives. We are happy to support United Help Ukraine in continuing to offer their Defenders Aid Programs, providing this type of training. Through this donation, they may be able to train a few more people to help save a few more lives.

Our recent visits to the Czech Republic also help highlight how much the ongoing war is ravaging the culture and people of Ukraine. On this trip, we visited an event raising funds for Ukraine through cultural exchange in a small festival:

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 4 years. We’ve given almost $8,200 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Joy through handmade cards.

Charity Round-Up

We recently watched an uplifting short video on a day in the life of a mail carrier. She explained the ins and outs of her daily tasks, but also the importance of making personal connections with the people on her route. One thing that left an impression on us was how excited people were to receive a handwritten letter, which she unfortunately delivers very few of each week.

That got us interested in organizations that send simple handmade cards or letters to lift people’s spirits around the world. While it’s a pretty simple gift, there are many positive impacts on the recipient of each handmade message.

Each of these organizations is delivering a little bit of joy and support to people who need it around the world. They have great charity ratings. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Candid profile, which details the nonprofit’s operations and transparency.

1) Cardz for Kidz

Why? Not only are these letters and cards handmade by children around the world, but they are also hand-delivered to sick children and their families stuck in hospitals.

Where? Globally

What? Cardz for Kidz is a charitable non-profit founded by Ike Nwankwo at the age of 14. He developed a passion for helping the sick after spending many years as a hospital volunteer. After his personal experience of being stuck in a hospital bed post-brain surgery, he came up with Cardz for Kidz. This organization works with youth and young adults at churches, schools, and local organizations to make handmade cards. These cards for pediatric patients, traumatized children, and their families are then hand-delivered to the rooms, adding a special touch to these heartfelt cards. They’ve expanded the program to deliver fully equipped mobile gaming carts, directly to hospital rooms across the globe.

2) Bring Smiles to Seniors, Inc.

Why? As the mail carrier shared, the joy of receiving a handwritten card can uplift spirits and reduce feelings of isolation or loneliness, especially in senior citizens.

Where? The United States and The United Kingdom.

What? Bring Smiles to Seniors, Inc. is a non-profit organization solely run by unpaid volunteers. They organize, collect, and deliver handmade cards to seniors in the community made by the youth of that community, regularly. These cards bring joy to the recipients who are homebound or reside in nursing homes or senior communities. Many seniors living in these situations don’t have many opportunities to talk to anyone and can feel very lonely. Each card delivers a personal touch and a message to help make the senior feel remembered and less alone.

3) Soldiers’ Angels

Why? Soldiers give the ultimate sacrifice to their country. Sending our military members cards or care packages to show our support and appreciation is a small gesture, but it can uplift their spirits when they need it most.

Where? The United States

Our Notes: Soldiers’ Angels is a non-profit charity. They send love and support to service members, their families, and veterans around the globe in the form of cards, letters, care packages, and even baked goods. They want each recipient to know they are loved, appreciated, and not forgotten. Their veteran program works at home via VA Medical Centers, distributing snacks and hygiene kits, food vouchers, and transportation to low-income veterans during their appointments. The Women of Valor highlights female caregivers of Post 9-11 victims. This unique program supports the hard-working caregivers via sponsored adoption programs each holiday. The families at home also benefit from this charity via Adopt-A-Family, providing holiday and special occasion support with cards and gifts.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

With September comes some of the most enjoyable time to be in Virginia. Autumn is upon us and we’re hoping to spend a good bit of time with friends, family, and the changing season. Perhaps we’ll have a bit of a reprieve from international travel.

It’s the season for house projects, Virginia’s own carnival, apple picking, and plenty of other fun events. Not to mention—cooler weather! And, it’s not a bad time to run a review of our spending and expenses. The end of the year really isn’t far off. This month marked our biggest life-funding investment sale to date, which is of course, all part of the plan. With our previous labors funding today’s pleasures, FIRE is in full swing.

What’ve you got planned for the changing season?

Let us know in the comments or on Threads and X (Twitter)!