November stretched out and let out a yawn for us as we focused on some of our projects at home—which made for a very cheap month—just $2,780! We visited friends and celebrated Thanksgiving with family. The traditions we’ve formed in Virginia kicked off the holiday season with December and Christmas and New Year’s on the horizon. Oh, and we planned a little trip for next month to get out of the cold!

For our monthly donation, our theme is free healthcare clinics. You can read more about the three charities we’re considering and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Our income remains low as we pull more from checking to meet our budget; Jenni’s entire paycheck went to 401(k). Other notable income…

eBay

After fees and shipping, we made a good bit of money via eBay sales this month. This was mostly stuff from around the house (some upgraded electronics in preceding months, for example). But the most interesting is from selling a stove burner. Yes, just the burner. A pickup with a stove in the bed went ripping by our neighborhood, hit a speed bump, and out popped a pair of the burners from the brand new stove. We waited to see if they’d come back after hustling to grab the burners out from possible traffic collisions, but they never came back by. So, off to eBay they went!

We earned $143 from sales.

Expense Summary

From our $5,109 monthly budget, we saved and invested $2,302 dollars.

After subtracting our credits, savings, and donations—we spent about $2,780 on living expenses. Certainly, that’ll be our lowest monthly spending for the year. We’d spend about $33K/year if we could keep that up!

That’s 58% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details this month.

Food & Dining

As in recent months, our food expenses are fairly stable as we’ve been home for a longer stretch.

Groceries

After months of stocking up on good deals, our grocery expenses dropped a bit this month. We still found some great local deals to stock up on additional items here and there, but overall, we managed to eat through some of our pantry and freezer items, which cut back on our grocery spending this month.

Restaurants, Fast food, Alcohol & bars

A good friend of ours celebrated his birthday at a local brewery, so of course we gifted some drinks to him and other friends—that charge appears as part of our gift expense. But, Chris still partook in a tasty brew. Aside from that, we met with an old friend in northern Virginia for a classic Mexican dinner.

We spent $433 on food & dining this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things or small purchases to mention that might be of interest.

Amusement

One of our favorite traditions that transitions us into the holidays is visiting our local science museum’s massive model train display. This year, Jenni’s parents joined us for the visit and got to witness Chris going full kid as he gawked over all the little displays and details.

Tickets to see were $35 for two; another $35 appears in our gifts spending.

Property Tax

You might have noticed our property taxes jumped this month. No, our city didn’t greatly elevate our home value—rather, it was time to pay our annual property taxes on Jenni’s Prius. This was just shy of $200.

Property taxes totaled about $429.

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more details or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 18 | 51 |

| Nov 2024 | 5 | 15 |

| Dec 2024 | 19 | 12 |

| Jan 2025 | 17 | 17.5 |

| Feb 2025 | 4 | 8 |

| Mar 2025 | 14 | 12 |

| Apr 2025 | 3 | 11 |

| May 2025 | 14 | 33 |

| Jun 2025 | 12 | 2 |

| Jul 2025 | 12 | 13 |

| Aug 2025 | 16 | 13.5 |

| Sep 2025 | 12 | 30 |

| Oct 2025 | 13 | 40 |

| Nov 2025 | 12 | 22.5 |

Jenni earned a good bit of money this month (which went into her 401(k)), but this is mostly due to some overflow from last month’s labor. Still, she clocked almost 23 hours—giving us a total of 34.5 this month.

Net Worth Update

Net worth is not our primary measurement, and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information, so we continue to do so.

Account breakdown

Even with the wild swings in the market lately, our investments continue to be pretty stable. From a high level, our assets and liabilities are shown in the data table below as of November 30, 2025.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,227,249 |

| Brokerage | 1,088,282 |

| Roth IRA | 266,996 |

| Traditional IRA | 46,064 |

| HSA | 72,723 |

| Real Estate | 459,200 |

| Mortgage | (129,612) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 10,121 |

| Net Worth | 3,066,024 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up just 0.25% for the month.

We were down about 0.05%—basically breakeven. That payoff we mentioned last month is still in development; we should have an update quite soon! Keep an eye out; you’ll know :-).

Overall, our net worth decreased by around $2K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

| December 2024 | $2,621,732 | (2.4%) |

| January 2025 | $2,689,706 | 2.6% |

| February 2025 | $2,665,053 | (0.9%) |

| March 2025 | $2,581,708 | (3.1%) |

| April 2025 | $2,588,737 | 0.3% |

| May 2025 | $2,711,140 | 4.7% |

| June 2025 | $2,818,049 | 3.9% |

| July 2025 | $2,836,370 | 0.7% |

| August 2025 | $2,915,960 | 2.8% |

| September 2025 | $3,012,036 | 3.3% |

| October 2025 | $3,067,605 | 2.3% |

| November 2025 | $3,066,024 | (0.05%) |

Previous Donation Winner

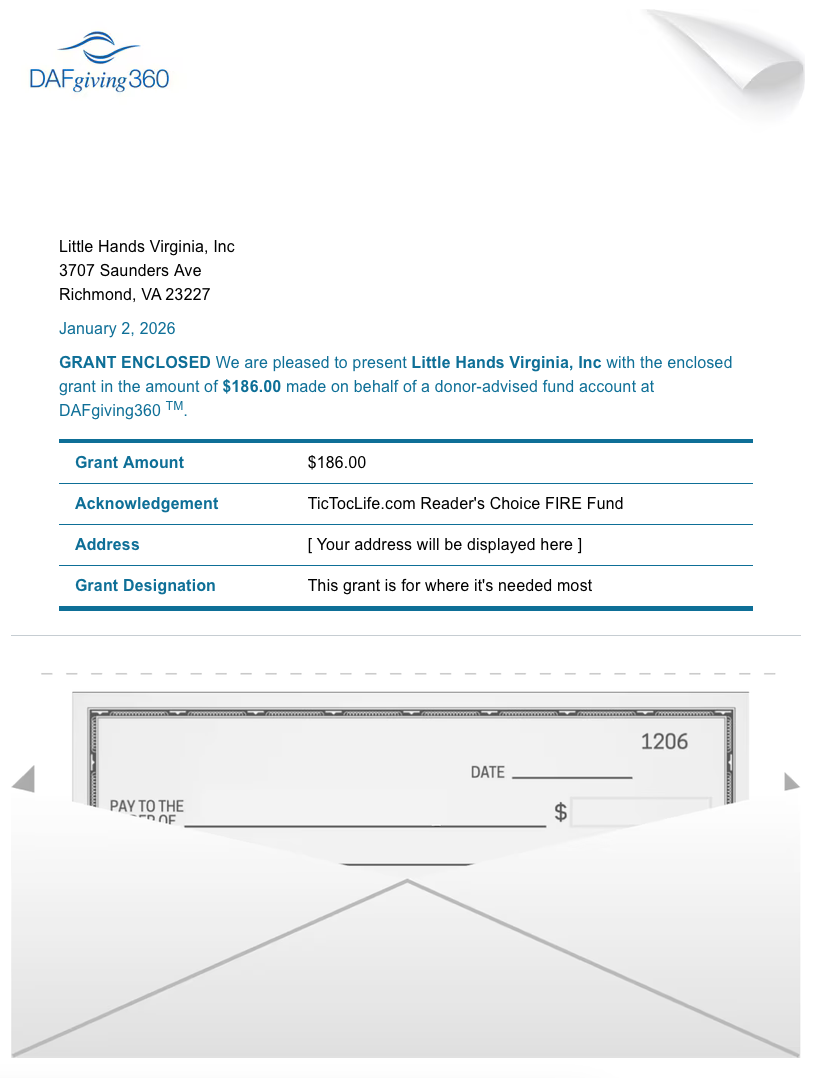

It takes a village to raise a newborn and every little bit helps. Little Hands Virginia, Inc. received our donation this month, which will help new parents get all the diapers and baby gear they need to keep their little ones dry, happy, and healthy.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 5 years. We’ve given $9,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Free Healthcare Charities.

Charity Round-Up

The costs of healthcare are a very hot topic in the United States right now. Even with health insurance, access to care can mean making some very difficult financial decisions.

Each of these organizations helps low-income or uninsured patients gain access to healthcare at little to no cost. They each have great charity ratings. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Candid profile, which details the nonprofit’s operations and transparency.

1) Cross Over Ministry, Inc.

Why? Access to a free comprehensive clinic, complete with specialty care and a pharmacy, allows patients to manage their whole health while they get back on their feet. Jenni volunteered here during pharmacy school and saw the impact this clinic had on the community.

Where? City of Richmond and Henrico, Virginia, USA.

What? Cross Over Ministry, Inc. is a nonprofit organization focused on providing access to high-quality free healthcare. At this clinic, those who qualify can receive a range of care at no cost. They will be assigned a primary care physician and, if needed, be connected to the other specialty areas such as pulmonology, cardiology, neurology, dental, vision, women’s health, OB/GYN, pediatrics, or mental health. Their hospital discharge clinic ensures patients are connected to the appropriate resources after an unplanned stay, minimizing repeat hospitalizations. Pharmacy services are available for uninsured patients. Social Work and Case Management services are also available for those with housing or food insecurities, legal issues, or just navigating government systems. All services are also offered in Spanish. To qualify for services, one must be eligible for Medicaid or be uninsured and below 200% of the federal poverty level. In late 2025, a recommended contribution for services was introduced for those who can afford to pay a nominal fee. CrossOver does not receive direct federal funding or have access to federally funded prescription drug programs. They solely operate on donations, volunteers, and community partners.

2) National Association of Free & Charitable Clinics Inc.

Why? To ensure people are aware of the 1,400 safety-net healthcare charitable clinics and pharmacies in the United States that have been filling the gap in our healthcare system since the 1960s.

Where? The United States

What? National Association of Free & Charitable Clinics Inc. (NAFC) is a nonprofit association focused on making communities healthy through access to healthcare. They are the national voice for the safety-net providers that treat America’s under and uninsured. They provide grants and resources to keep clinics open at little to no cost to those who need them. NAFC is a resource directory for the public to locate clinics nationwide and improve health literacy. They also coordinate emergency and medical relief with their partners during disasters, such as Americares, Direct Relief, and Heart to Heart International. These clinics and pharmacies operate on a volunteer/staff model and receive little to no state or federal funding.

3) Global Brigades Inc.

Why? It is not feasable to set up large health clinics in every rural town. Having full service mobile clinics scheduled to visit every four months plus local community health workers trained to treat immediate needs, makes this program work.

Where? Guatemala, Nicaragua, Panama, Ghana, Greece, Honduras, Belize, and Globally.

Our Notes: Global Brigades Inc. is a nonprofit organization focused on total body healthcare for those in rural areas. They operate a wide variety of free services via mobile clinics on a regular cycle. This ensures patients are properly followed throughout the year. Global Brigades provides their services utilizing medical volunteers and comminity health leaders. They can provide medical, dental, vision, and OBGYN services. While brigades are in an area, they train community health worker (CHW) programs so they are able to respond to the the health need of the community and refer as needed when the mobile clinics are away. CHWs also manage the water, sanitation, and hygiene (WASH) programs set up by Global Brigades. As part of their mission to inspire, mobilize and collaborate with communities to achieve their own health and econmonical goals, Global Brigades support microfinance and micro-enterprise consulting programs. Community banks are estabilished which help the communities develop small business and make investments in their towns.

[Candid] [About]

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page, which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community, and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

As mentioned earlier in this post, we’ve got a big project that’s coming to fruition. It’s still in development, but we’ll have more to share quite soon. Keep an eye out—and, no surprise, that’s what’s occupying our time into December.

Aside from that, we’re booking a short trip to see family in Arizona, along with a pitstop in Mexico on the way back for a reprieve from the cold. You might remember our last visit to Puerto Vallarta a few years ago—hopefully we avoid calling a hurricane on us while we’re there again! We won’t have quite as fancy of a stay, but we will have two good friends joining us on the trip to make it all the more fun.

Lastly, we’ll be celebrating Christmas and the New Year back in Virginia with family and friends. Just how we like it.

Been to Puerto Vallarta? What’s your favorite spots?

Let us know in the comments or on Threads and X (Twitter)!