As the trade war intensified, we spent early April in the Czech Republic. A little dose of Prague’s effervescent beer and wonderful cultural displays as Easter festivities started might’ve been just what we needed! We came home to the economic tug-of-war starting to stabilize and spent most of the latter of half April just catching up with local friends, family, and our at-home tasks.

For our monthly donation, our theme is investigative journalism. You can read more about the three charities we’re considering and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Our income is way down as we spent a large portion of the month traveling.

Aside from our usual monthly income, here are some interesting anecdotes:

Dividends

We earned a small quarterly dividend this month. We anticipate significant dividend payments from our various stock holdings—most of it from Vanguard funds like VTSAX. Our distributions were automatically reinvested in our tax-advantaged accounts.

We earned $257 in total distributions.

Credits

Several of our credit cards offer statement credits for purchasing with certain companies. This month we used:

- Chris’s AMEX Gold offers a $10 monthly dining credit which he tends to use on local bakery pick up for fresh bread.

- We earned about $117 back in credits from our local city related to real estate property tax and redistribution.

We received $127 in statement credits.

Local Sales

Chris sold off a Dell 27″ monitor that he purchased in order to earn an AMEX offer and use up an old gift card credit. The monitor cost him about $90 out of pocket so this was a nice little win.

We earned $150 in local sales.

Interest Income

You may have noticed our interest has cratered this month—and started going down last month. This is because we’ve moved a lot of cash out of savings to cover recent expenses.

We earned $0.80 in interest.

Cashback

We use various online referral platforms, bonuses, etc. to earn cashback on purchases on certain activities. Some of our favorites are Rakuten and Swagbucks. Payouts often represents several months of earnings.

- Chris earned about $63 from RetailMeNot.

- Chris earned about $102 through Ibotta.

We earned $164 in cashback.

Expense Summary

From our $8,262 monthly budget, we saved and invested $344 dollars.

After subtracting our credits and savings—we spent about $7,791 on living expenses.

That’s 163% of our FIRE budget from 2022 ($4,787/month). This is our highest spending month in recent history!

Let’s break down some of the more exciting details this month.

Food & Dining

We spent just over half of April in the Czech Republic which seems to have helped us keep our food & dining expenses down!

Groceries

Our groceries were pretty close to last month’s at $456. We spent about the same ratio of time at home in Virginia and in the Czech Republic so we must be pretty consistent in our shopping! It helps that food seems to be a bit cheaper in Czechia than home.

Restaurants, Fast food, Alcohol & bars

Dining out, we spent about $113. Naturally, this was mostly small, quick bites while we were traveling. Overall, casual food was pretty inexpensive throughout the Czech Republic which helped keep this cost pretty low despite our frequency of visits!

We spent $568 on food & dining this month.

Travel

Last month, we began our 32-day trip to the Czech Republic from March 16 to April 16. Let’s see how the final half of the trip expenses came out…

Air Travel

Anticipating future travel, Chris signed up for a pair of Hawaiian Airlines credit cards. Each carried a $99 annual fee and earn 70K miles as sign-up bonuses. He’ll transfer those to Alaska Airlines which partners with American Airlines with good partner awards.

Our flights back from Prague to Virginia were booked with Flying Blue (Air France/KLM) miles. With our trip ending in Prague, we booked a connection through Paris on the way to Virginia.

We transferred our Chase points to Flying Blue to cover most of the cost. We additionally paid $182.31 in taxes/fees per person. One-way, last-minute flights aren’t cheap but using awards tend to help mitigate the cost. We booked our return only a few days before we left Prague!

Hotel

We happily continued our Prague apartment booking from late March throughout early April. The fully featured one bedroom on the famous “Royal Route” averaged out to just $93/night!

To really take advantage of Easter festivals, we headed back to the eastern side of the country from April 9 to 15. We booked a small but complete apartment for about $85/night.

On the edge of Brno, but on the tram line, it served as a great jumping off point for some more adventure. We used discounted Airbnb gift cards to knock 10% off the rate which also earned a Chase offer of $18!

And for our final stay, we opted to catch one more night in historic Prague right at the Charles Bridge. Hotel Pod Věží was a real treat. Steps away from the bridge and historic sights, the boutique spot came with a delicious breakfast and fairly easy access to the airport for our morning departure to the US.

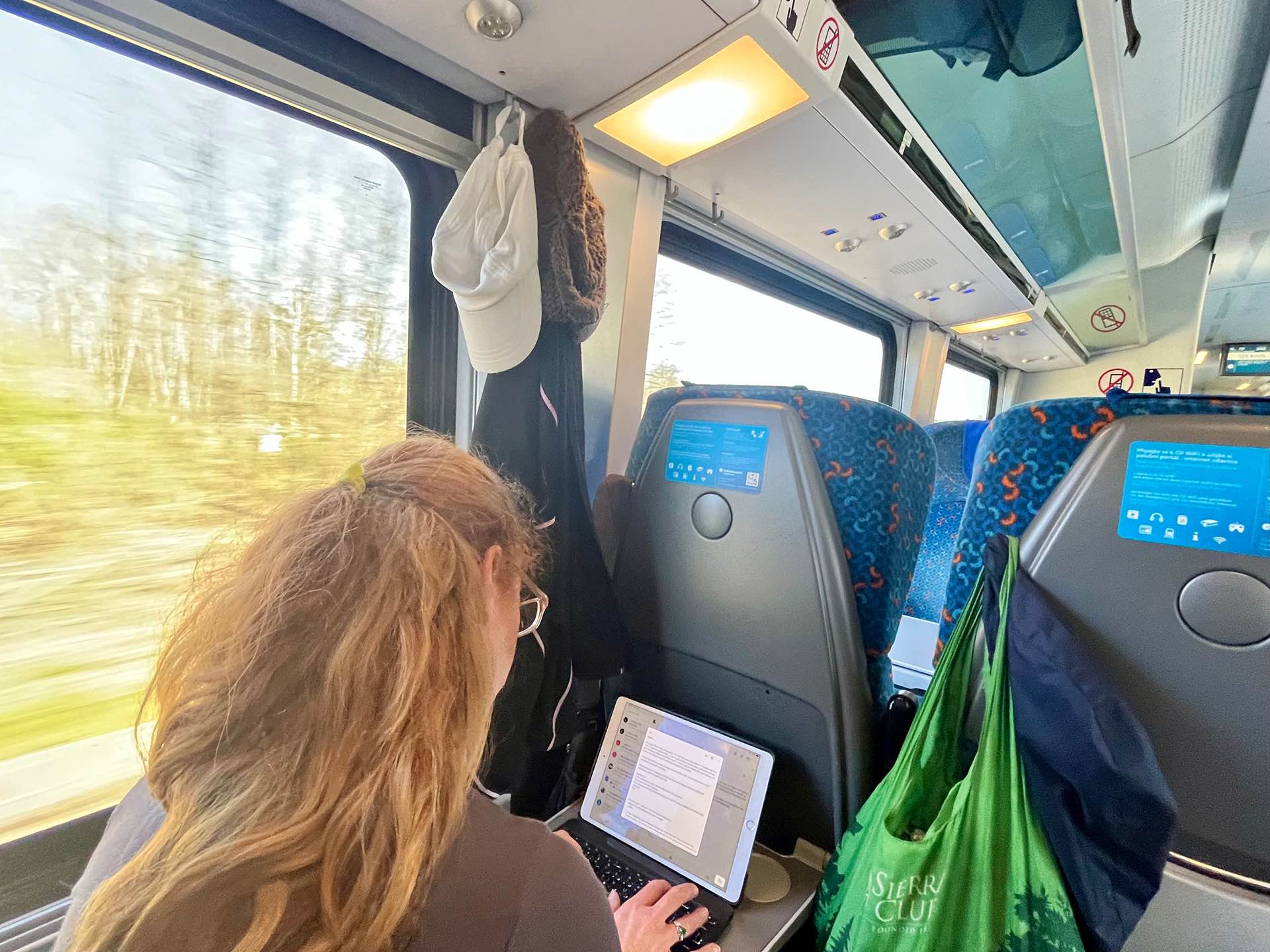

Auto & Transport—Public Transport

Both Prague and Brno have an excellent public transit system. We made extensive use of the systems at about $1/ride to see much of the cities—and of course—our feet!

We also transited between the eastern and western sides of the country via their excellent rail system.

We spent $1,894 on travel this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Health & Fitness

Our medical spending saw a big jump this month. For obvious privacy reasons, we’re not going to go into the details—but we’re both doing just fine. Still, sometimes there’s some significant costs here! And that’s with pretty good insurance. Phew!

Amusement

Throughout our trip we mixed in historical, cultural, and just interesting places to visit and things to see.

That includes:

- $15.50: Brno Castle

- $39.42: Prague Castle

- $33.69: Communism Museum

- $26.16: Museum of Lego

- $25.23: Prague Technology Museum

We love adding in these stops and exhibits. Often, we’re able to find something we can’t really find at home in the US. Some good examples on this trip include the museum of communism and a personal collection of Lego turned into a massive display showcase!

Czechia Travel Summary

Our 32-day trip to the Czech Republic spread from March into April. We loved visiting this beautiful, friendly country that starts to straddle the line between Western and Eastern Europe. While it felt incredibly modern like much of the rest of Europe we’ve been to, it did have some very different experiences for us—like a museum to communism!

Let’s break down our trip budget.

We’ll include all expenses we incurred for the trip—even groceries, restaurants, and amusement. But we’ll skip expenses that we incurred during the trip that were not part of the trip (for example, our utility bill back home in Virginia).

Trip cost table

Let’s take a look at our total trip cost. In the table below, you’ll find four columns:

- Description: a summary of what the expense was for. We’ve included some basic geographical information for things like flights or hotels.

- Cost: our incurred expense in US dollars for the described line item. In some cases, this appears as zero. If a travel currency like hotel points, airline miles, or a credit card reward certificate covers the total expense, we record a zero here. Sometimes, there’s a minor fee in addition to using points/miles for surcharges or taxes.

- Rewards Points/Miles: we maximize our credit card rewards and frequent traveler currencies to cover the costs of our travel wherever possible. You’ll see a short description of the type of certificate or currency that we used.

- Estimated Value: when using a reward from the previous column to cover an expense, we record what we would have otherwise paid for the line item. This gives us a sense of our savings.

The table is generally in chronological order.

We still incurred expenses at home (mortgage, utilities, etc.)—but these do not appear as part of our trip costs.

| Description | Cost (USD, $) | Rewards Pts/Miles | Est. Value (USD, $) |

|---|---|---|---|

| Flight—IAD→VIE (2x, Economy) | 57,933 Chase Pts | 869.00 | |

| Flight—PRG→IE (2x, Economy) | 364.62 | 50,000 AMEX Pts | 1,388.00 |

| Airbnb: Apartment, Brno—11 nights | 1,025.84 | ||

| Airbnb: Apartment, Prague—12 nights | 1,118.68 | ||

| Airbnb: Apartment, Brno—6 nights | 439.02 | ||

| Hotel: Boutique, Prague—1 night | 115.21 | ||

| Dining: restaurants, fast food, alcohol & bars | 176.82 | ||

| Groceries | 534.20 | ||

| Amusement—tickets | 140.00 | ||

| Gym | 38.70 | ||

| Public Transportation | 159.32 | ||

| Gifts | 12.41 | ||

| Mobile Phone (eSIM) | 10.00 | ||

| Total | 4,134.82 | 107,933 Pts/Miles | 2,257.00 |

Trip cost discussion

We spent about $4,135 on a 32-day trip for two people. That’s about $129/day (or about $65/person). We tried to keep our costs low by using points/certificates where we could. We also saved a bit of money with discounted gift cards.

Had we not used those discounts and points/certificates, we’d have spent another $2,010 which would make the trip cost about $192/day!

Jenni used her Chase Sapphire Reserve card for our outbound flights from the US. This allowed us to pool our Chase Ultimate Rewards (UR) points and redeem those for a value of 1.5 cents per point (instead of the typical 1:1). Chase had a booking rate on their portal similar to what we could find with Google Flights so we were happy to use about 58K points instead of $869.

We transferred some AMEX points to Flying Blue (1:1) to book our return flights from PRG to IAD on Air France. That cost us 50K points plus taxes/fees instead of about $1,388—saving about $1023. That gives us a redemption value of just over two cents per AMEX point. That’s pretty good!

Summary—

We cut about 33% of the cost of this trip by using discounted gift cards and points/certificates instead of cash for our various expenses.

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 51 | 18 |

| Nov 2024 | 5 | 15 |

| Dec 2024 | 19 | 12 |

| Jan 2025 | 17.5 | 17 |

| Feb 2025 | 4 | 8 |

| Mar 2025 | 14 | 12 |

| Apr 2025 | 3 | 11 |

With travel and very little in the way of planned work days, we only earned about 14 hours of paid labor this month.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

The market keeps chugging along and so do our investments. From a high level, our assets and liabilities are shown in the data table below as of April 30, 2025.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,012,748 |

| Brokerage | 916,117 |

| Roth IRA | 193,320 |

| Traditional IRA | 37,880 |

| HSA | 62,692 |

| Real Estate | 463,400 |

| Mortgage | (132,696) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 10,277 |

| Net Worth | 2,588,737 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was down about 0.8% for the month.

We were just ahead of breakeven at a gain of 0.3%. So, we outperformed the S&P—which is generally expected on down months with our more defensive investments.

Overall, our net worth increased by around $7K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

| December 2024 | $2,621,732 | (2.4%) |

| January 2025 | $2,689,706 | 2.6% |

| February 2025 | $2,665,053 | (0.9%) |

| March 2025 | $2,581,708 | (3.1%) |

| April 2025 | $2,588,737 | 0.3% |

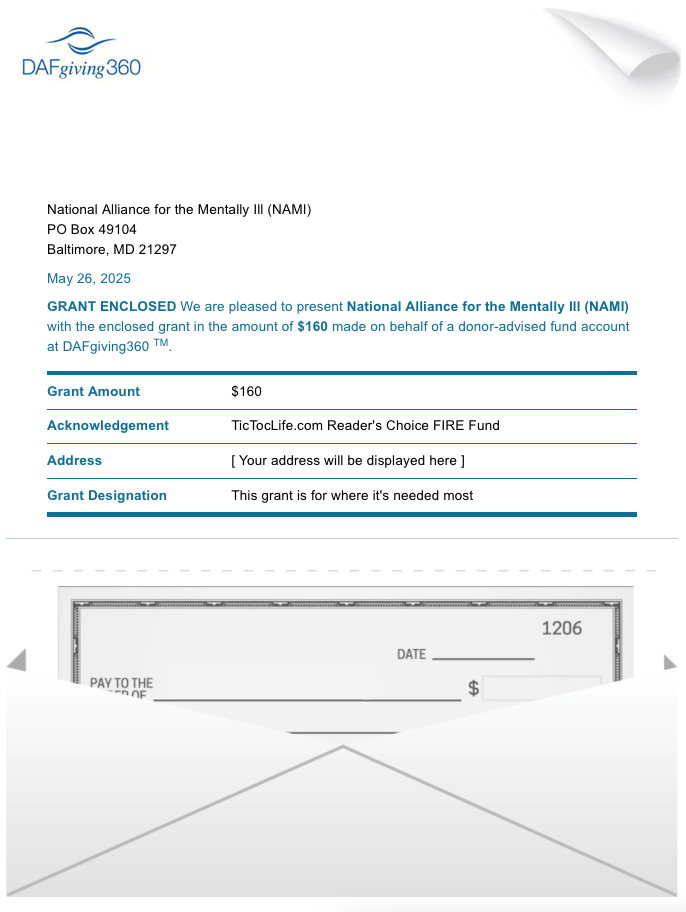

Previous Donation Winner

National Alliance on Mental Illness (NAMI) National was awarded our grant from last month’s poll. We hope that our donation will help keep their NAMI HelpLine open and available to anyone who needs a little extra mental health support this spring.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 4 years. We’ve given over $7,500 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates supporting: investigative journalism.

Charity Round-Up

We’ve been getting more cautious with every absurd headline we read. It’s been getting harder and harder to tell what is real anymore. With ongoing funding cuts to public media outlets and more AI media mixed in, we are getting concerned about how we’ll receive the real news and know that it’s true. That’s why we decided to look into how news is reported and how we can support the freedoms of the press.

It turns out that May 3rd was World Press Freedom Day! It is a day of remembrance for journalists who’ve lost their lives in the pursuit of a story, to remind governments of their commitments to press freedoms, and to reflect on the importance of professional ethics and transparency.

The following organizations support journalism through protections for those in the field, by providing a support network around the globe and hosting media outlets to get the news to people in our communities. Each organization has an excellent charity rating. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Committee to Protect Journalists, Inc.

Why? Because of these numbers. In 2024, CPJ reported that 103 journalists were killed, 361 were imprisoned, and 67 are still missing. Journalists are out there in the thick of it just trying to bring us informative and accurate news about our world. For the past 40 years, CPJ has been there to defend them and fight for press freedoms.

Where? Africa, Asia, Europe, North America, and South America.

Our Notes: Committee to Protect Journalists, Inc. (CPJ) is a nonprofit organization set up to help journalists from all directions. With a global presence, they can act quickly to protect press freedoms and assist journalists who have been attacked or threatened. They track and report on press freedom violations, advocate for journalists who’ve been imprisoned, and try to promote freedom of the press for all. When governments start to silence the press, it’s the people that suffer the most. To help keep their independence, they do not accept any government assistance or grants.

2) VPM Media Corporation

Why? Their radio station is an everyday staple in our household. No matter what time of the day, there is a program bringing us information we can trust. Their variety includes in-depth local and global news, intriguing interviews, heartwarming stories, educational research, and entertaining hilarious game shows. They go above and beyond to ensure their reporting is factual and bring in news from around the globe.

Where? Virginia

Our Notes: VPM Media Corporation is a nonprofit media company composed of radio/podcasts, TV, web publications, magazines, and YouTube channels with a mission to use the power of media to educate, entertain, and inspire. While it’s mainly funded by donations, it does rely on federal funds to keep it free and accessible to all. By providing reliable, relevant, and family-friendly content, VPM helps keep listeners informed and engaged. They have resources for early childhood literacy and education called Ready-To-Learn. Their Science Matters initiative helps us to understand the importance of science and its impact on our future. Documentaries deep dive into historic topics, plus it’s a source of emergency broadcast system notifications.

3) Global Investigative Journalism Network

Why? There is strength in numbers. This extensive network supports journalists around the world by promoting press freedom, accountability, and transparency.

Where? Globally

Our Notes: The Global Investigative Journalism Network (GIJN) is an international association of nonprofit organizations. These organizations help with the training needed to carry out investigational journalism while protecting those working in very dangerous conditions. This also means supporting them with legal or safety issues. GIJN has improved data journalism with new tools and techniques that are available to its members in multiple languages. Donations made to them directly support journalists.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

We think May will hold a quieter, more family-focused month for us. We’ve got loads of Birthdays to celebrate—including one for each of us! And, we’ll reach our first anniversary! It’s amazing how quickly time passes. It seems like our big wedding post was only a few weeks ago.

Once summer starts rolling around, we’ll probably be ready for another trip and an escape from the heat. Virginia tends to turn into a very warm swamp around that time!

Until then, we’re hoping you and yours are keeping your wits about you as the economic future here in the US seems pretty up-in-the-air. So, expect pretty severe changes in the market day-to-day to continue. But as they say…it’s time in the market.

What’s your trick for not watching the markets twists in turns?

Let us know in the comments or on Threads and X (Twitter)!