June continued a little quieter period, mostly at home, for us—which—was really quite nice! Our FIRE life tends to be pretty packed with travel in recent years. Sometimes it’s nice to just be home. Time with family, friends, and keeping up with our various hobbies. Not bad at all!

For our monthly donation, our theme is summertime needs. You can read more about the three charities we’re considering and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Compared to last month’s time at home, we did a little better on the income front. This was mostly due to quarterly dividends coming in, but also, Jenni earned a bit of pharmacy work related income that helped us make ends meet.

Dividends

Our dividends are keeping us afloat lately! We anticipate significant dividend payments from our various stock holdings—most of it from Vanguard funds like VTSAX. More than half of our distributions were automatically reinvested in our tax-advantaged accounts.

We earned $4,592 in total distributions.

Accountable Plan

If you’re interested in the details of how an accountable plan for businesses works, check out this original post.

Chris’s business reimbursed him for the use of our house, utilities, health insurance, and other expenses. This reimbursement covers expenses for the second quarter of 2025.

Chris received $1,266 in reimbursements.

eBay

Chris had some running shoes still in their box that weren’t quite what he wanted. Purchased on closeout last year, they were only around $40. But, now that they’re not available generally—their price jumped on eBay to around $100. After fees and shipping, he did pretty well!

Chris earned about $72 on eBay sales.

Expense Summary

From our $7,099 monthly budget, we saved and invested $4,315 dollars.

After subtracting our credits and savings—we spent about $2,774 on living expenses.

That’s 58% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details this month.

Food & Dining

Being at home, our food-related expenses were mostly down on average. But, we did have Chris’s parents visit for a while so we did go to a few restaurants. And boy, those expenses do stack up!

Groceries

Coming in at about $385, our food expenses for home are quite reasonable for the pair of us. We shop deals, make use of Ibotta cash back, and stack whatever credit card offers are available to us. Chase’s DoorDash promos (for grocery pickup) have been great lately. And, we’ve made great use of their reintroduction of the monthly Instacart credits.

Restaurants, Fast food, Alcohol & bars

Our abnormal higher food costs came in with a few restaurant visits with family. It’s always nice to take visitors out for them to try a local spot—or celebrate Father’s Day in this case—and explore the area. We find that experience to be quite worthwhile but it’s not cheap! We spent about $258 dining out.

We spent $644 on food & dining this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Amusement

With Chris’s dad in town, we celebrated Father’s Day by taking his parents to a special historical war plane tour nearby. The tour travels across the US providing access to a few World War II era planes. In this case, Chris’s dad was psyched to get to explore a B-29 Superfortress. Very impressive! Tickets for four of us were just $20.

Hotel

Our tiny hotel expense—about $7—comes from a small American Express card annual fee. Why so small? Well, it was originally $150. But, we decided to downgrade the card to a no-fee version after maxing out the value in the past year. AMEX offered a prorated refund of that fee when downgrading to the no annual fee version. So, we ended up with a tiny expense. Make sure to downgrade those cards that aren’t worth their annual fee after you get your awesome signup bonuses in the first year!

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 51 | 18 |

| Nov 2024 | 5 | 15 |

| Dec 2024 | 19 | 12 |

| Jan 2025 | 17.5 | 17 |

| Feb 2025 | 4 | 8 |

| Mar 2025 | 14 | 12 |

| Apr 2025 | 3 | 11 |

| May 2025 | 33 | 14 |

| Jun 2025 | 2 | 12 |

Jenni didn’t work as much as last month, despite us being home for the month. Simply put, work hasn’t had much demand for her to fill in! Then again, that’s pretty nice! Some of her labor from last month rolled into an early month paycheck this month. We clocked a total of about 14 hours.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

Even with the wild swings in the market lately, our investments continue to be pretty stable. From a high level, our assets and liabilities are shown in the data table below as of June 31, 2025.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,116,961 |

| Brokerage | 1,004,737 |

| Roth IRA | 222,235 |

| Traditional IRA | 41,838 |

| HSA | 69,257 |

| Real Estate | 467,300 |

| Mortgage | (131,822) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 2,542 |

| Net Worth | 2,818,049 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 5.0% for the month.

We were up about 3.9%. So, we lagged the S&P a good bit—which is generally expected since we did much better in recent down periods due to defensive investments.

Overall, our net worth increased by around $107K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

| December 2024 | $2,621,732 | (2.4%) |

| January 2025 | $2,689,706 | 2.6% |

| February 2025 | $2,665,053 | (0.9%) |

| March 2025 | $2,581,708 | (3.1%) |

| April 2025 | $2,588,737 | 0.3% |

| May 2025 | $2,711,140 | 4.7% |

| June 2025 | $2,818,049 | 3.9% |

Previous Donation Winner

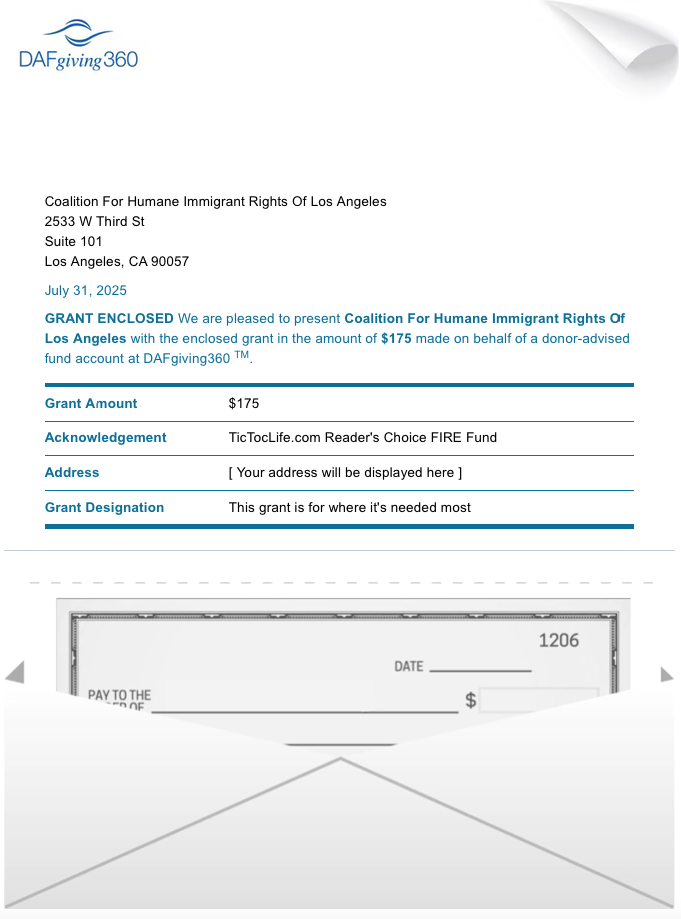

To support the on going efforts for the human and civil rights of immigrants and refugees, Coalition for Humane Immigrant Rights (CHIRLA) has won our monthly donation poll. They have been an effective and trusted organization for the past 35 years and with ongoing support will continue to make sure these voices are heard.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 4 years. We’ve given almost $8,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates supporting: Summertime needs.

Charity Round-Up

Thinking back to summer time as a kid, we have fond memories of swim meets, summer camps and family vacations. The days were long and we played outside until the lightning bugs came out. It was a break from school and time to spend with friends. We were fortunate.

For many, summertime comes with the uncertainty of when the next meal will be or overheating in the sun with no place to cool off. Parents struggle with finding all day childcare and affording any type of vacation.

The following organizations are helping the summertime be a little more tolerable and fun for their communities. Each organization has an excellent charity rating. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Hope For Families (Camp Hope Worldwide)

Why? Kids around the world get to make lasting summertime memories while attending overnight camp at little to no cost.

Where? Richmond, Virginia, Costa Rica, Latvia

Our Notes: Camp Hope is a Christian based nonprofit ministry providing a supportive community for youth both in Virginia and abroad. Their week-long summer camps offer free overnight camp to children experiencing financial hardship who would otherwise not be able to go. Campers enjoy arts and crafts, water events, team building exercises, outdoor adventures, fellowship and all meals.

2) Salvation Army National Corp

Why? Cooling off can be the matter of life and death in the heart of summer. Cooling shelters have been set up to offer A/C, restrooms and drinking water in some of the hottest places in the USA.

Where? The United States

Our Notes: The Salvation Army is a faith based international charitable organization well known for their thrift stores, bell ringing Santas, and their disaster relief efforts. In times of extreme heat, their community centers are turned into cooling centers. Those in need of relief from the sun are welcomed into an air-conditioned area to rest, cool off and use the bathroom. In some communities, free fans are available to those without a/c at home for the young and elderly.

Why? Kids need fuel to have fun and enjoy the summer break. Summer meal programs offer food and even SUN Bucks (a grocery benefit) for kids 18 and under.

Where? The United States

Notes: Share Our Strength is a nonprofit child hunger organization focused on ending childhood hunger through their No Kid Hungry campaign. Childhood hunger has increased over the past few years to 14 million kids. With the rising cost of food and unemployment, it can be hard to pay bills and put food on the table – even more so with the change in food assistance programs. During the school year, kids are offered free lunch and now breakfast thanks to this organization. During the summer, families can bring their children to dedicated free meal sites in their communities. If a household of a school age child is at or under 185% of the federal poverty level and in states that participate, families receive $120 SUN bucks to cushion their grocery needs. All families, regardless of immigration status, are eligible for SUN Bucks.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

We’re on for another trip to Europe in July. We’ll spend it in Central Europe exploring more of a country we’ve come to enjoy quite a bit—the Czech Republic! Inexpensive, full of history, and a bit different from the traditional Western Europe visit—we’re looking forward to more Kolache, beautiful parks, friendly folks, and adventure.

And of course, we’ll celebrate the 4th in Virginia with fireworks, our big local concert band banging out lots of patriotism. What’s ahead for you as summer peaks?

Have you stayed the course in your investments?

Let us know in the comments or on Threads and X (Twitter)!