Fireworks and flights—our July was full of explosive fun! We celebrated the fourth at home before taking a trip to the Czech Republic to knock out some adventures we missed on a previous trip. Ferry rides along castle views, an underground ossuary, and a soviet-era bunker rounded out the wide-ranging trip. Check out more of the adventure below!

For our monthly donation, our theme is support for Ukraine. You can read more about the three charities we’re considering and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

Our income cratered again as we spent a time abroad and enjoying the summer in Virginia. So, most of our expenses were balanced by investment sales and our cash account balances.

Dividends

We had just a trickle of dividends this month, but, every little bit helps. We anticipate significant dividend payments from our various stock holdings—most of it from Vanguard funds like VTSAX. Most of our distributions were automatically reinvested in our tax-advantaged accounts.

We earned $304 in total distributions.

Investments

Sometimes we have to make ends meet by selling our existing investments. Our small ongoing incomes and dividends don’t always meet our needs. And, this is part of our FIRE plan!

Jenni sold $2,232 of investments.

Expense Summary

From our $4,437 monthly budget, we saved and invested $600 dollars.

After subtracting our credits, savings, and donations—we spent about $3,771 on living expenses.

That’s 79% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details this month.

Food & Dining

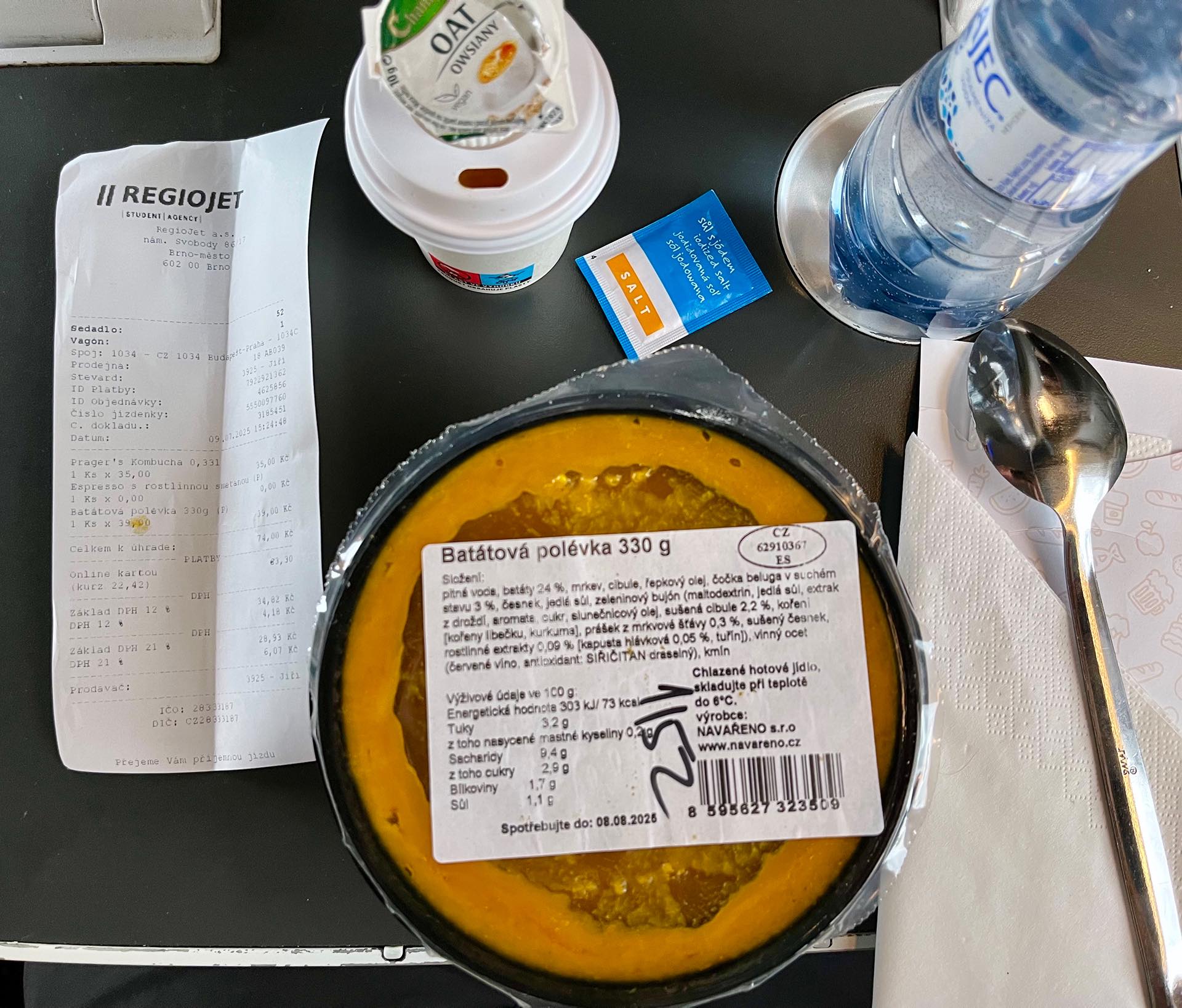

Despite a trip abroad, our food expenses remained quite reasonable. We overstocked in recent months on good deals so we’ve been eating lots of frozen and dry grocery we had. On top of that, food in Czechia just isn’t very expensive!

Groceries

At just $356, our grocery expenses were exceptionally low. Between cheap food in Czechia and an overfilled pantry at home, we just didn’t need to buy much. Add to that, DoorDash and monthly Instacart credits from Chase—and we’ve got most of our fresh food expenses covered for cheap.

Restaurants, Fast food, Alcohol & bars

At just about $92, our total expenses dining out were quite low. Almost all of this was while abroad. Dining costs are just that much lower in Czechia, as we did have some lovely meals out here and there.

We spent $448 on food & dining this month.

Travel

We spent the middle of July in the Czech Republic enjoying cooler temps and a little adventure. We missed a few highlights on our last trip to the country some months ago we just had to check off!

Air Travel

Our outbound flights to Vienna were crazy cheap at about $276/person. The deal involved a stop in Lisbon on Portugal’s TAP airline—one we’re quite familiar with! We covered the cost with Chase points (about 37K).

We didn’t book return flights in order to remain flexible with our dates. We wound up booking the return flights while on the train to Prague. These were booked with Capital One miles which we transferred to Flying Blue (Air France/KLM) miles. From Prague, we booked a connection through Paris on the way to Virginia.

This was about $186 in taxes/fees per person plus 26K miles. One-way, last-minute flights aren’t cheap but using awards tend to help mitigate the cost.

Aside from the flight costs, Jenni picked up a new Capital One Venture credit card with a $95 annual fee. It’s a great travel card for us and paid for part of this month’s trip through their points system.

Hotel

Having enjoyed Brno on our last trip, we stayed at an Airbnb in town close to the tram line for the whole time. We used discounted Airbnb gift cards to save a little money and earn more points. The stay was about $564 for 7 nights.

We spent $1,034 on travel this month.

Expense Conclusion

While that covers the big stuff, we still had a few random things small purchases to mention that might be of interest.

Amusement

We went out and experienced lots of fun sights and attractions while in the Czech Republic. One standout was the 10-Z Bunker in Brno. This awesome underground Soviet-era bunker was built under a historical castle on a hill overlooking the city. The nuclear-ready bunker served the city for decades and, apparently, could still be rapidly repurposed for an emergency! Tickets were about $24.

We also visited an amazing, and somewhat recently discovered, bone ossuary under an old cathedral in the main city square. Tickets were about $15 for the two of us.

Public Transport

Brno has an excellent public transit system. We made extensive use of the system at about $1/ride to get around the city. We also transited between Vienna and Brno (about $46) as well as Brno and Prague (about $29) via their excellent rail system. We utilized a public ferry at a nearby reservoir (about $16) to explore several stops and enjoy a beautiful day on the water.

Electronics & Software

In a first for him, Chris purchased virtual currency for a video game he and his friends have been playing lately. Path of Exile, an addictive Diablo-like ARPG is free to play. But, he preordered the sequel for $30 which also offered up $30 worth of in-game currency to use in the current game.

Czechia Travel Summary

Our 8-day trip to the Czech Republic ran from July 9 to 16. It’s our second trip to the country this year, and, clearly we enjoy it. It offers a pretty novel experience relative to the rest of Western Europe. And, does so on a budget.

Let’s break down our trip budget.

We’ll include all expenses we incurred for the trip—even groceries, restaurants, and amusement. But we’ll skip expenses that we incurred during the trip that were not part of the trip (for example, our utility bill back home in Virginia).

Trip cost table

Let’s take a look at our total trip cost. In the table below, you’ll find four columns:

- Description: a summary of what the expense was for. We’ve included some basic geographical information for things like flights or hotels.

- Cost: our incurred expense in US dollars for the described line item. In some cases, this appears as zero. If a travel currency like hotel points, airline miles, or a credit card reward certificate covers the total expense, we record a zero here. Sometimes, there’s a minor fee in addition to using points/miles for surcharges or taxes.

- Rewards Points/Miles: we maximize our credit card rewards and frequent traveler currencies to cover the costs of our travel wherever possible. You’ll see a short description of the type of certificate or currency that we used.

- Estimated Value: when using a reward from the previous column to cover an expense, we record what we would have otherwise paid for the line item. This gives us a sense of our savings.

The table is generally in chronological order.

We still incurred expenses at home (mortgage, utilities, etc.)—but these do not appear as part of our trip costs.

| Description | Cost (USD, $) | Rewards Pts/Miles | Est. Value (USD, $) |

|---|---|---|---|

| Flight—IAD→VIE (2x, Economy) | 36,826 Chase Pts | 552.40 | |

| Flight—PRG→IAD (2x, Economy) | 372.82 | 52,000 CapOne Pts | 1,174.00 |

| Airbnb: Apartment, Brno—7 nights | 563.74 | ||

| Dining: restaurants, fast food, alcohol & bars | 92.07 | ||

| Groceries | 145.05 | ||

| Amusement—tickets | 39.10 | ||

| Public Transportation | 112.49 | ||

| Total | 1,325.27 | 88,826 Pts/Miles | 1,726.40 |

Trip cost discussion

We spent about $1,325 on a 8-day trip for two people. That’s about $166/day (or about $83/person). We tried to keep our costs low by using points for some our flight expenses.

Had we not used those, we’d have spent another $1,354 which would make the trip cost about $335/day!

Jenni used her Chase Sapphire Reserve card for our outbound flights from the US. This allowed us to pool our Chase Ultimate Rewards (UR) points and redeem those for a value of 1.5 cents per point (instead of the typical 1:1). Chase had a booking rate on their portal similar to what we could find with Google Flights so we were happy to use about 37K points instead of $552.

We transferred some Capital One points to Flying Blue (1:1) to book our return flights from PRG to IAD on Air France. That cost us 52K points plus taxes/fees instead of about $1,174—saving about $801. That gives us a redemption value of about 1.54 cents per Capital One point. That’s pretty good!

Summary—

We cut about 50% of the cost of this trip by using discounted gift cards and points/certificates instead of cash for our various expenses.

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more detail or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 18 | 51 |

| Nov 2024 | 5 | 15 |

| Dec 2024 | 19 | 12 |

| Jan 2025 | 17 | 17.5 |

| Feb 2025 | 4 | 8 |

| Mar 2025 | 14 | 12 |

| Apr 2025 | 3 | 11 |

| May 2025 | 14 | 33 |

| Jun 2025 | 12 | 2 |

| Jul 2025 | 12 | 13 |

With a trip mid-month, neither of us worked very much. A lazy summer, no complaints! We clocked a total of about 25 hours.

Net Worth Update

Net worth is not our primary measurement and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information so we continue to do so.

Account breakdown

Even with the wild swings in the market lately, our investments continue to be pretty stable. From a high level, our assets and liabilities are shown in the data table below as of July 31, 2025.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,127,447 |

| Brokerage | 1,014,220 |

| Roth IRA | 224,077 |

| Traditional IRA | 42,344 |

| HSA | 70,174 |

| Real Estate | 464,400 |

| Mortgage | (131,383) |

| Miscellaneous Assets | 20,000 |

| Checking & Savings | 5,091 |

| Net Worth | 2,836,370 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up about 2.1% for the month.

We were up about 0.7%. So, we lagged the S&P a good bit—which is generally expected since we did much better in recent down periods due to defensive investments and sold some stock.

Overall, our net worth increased by around $18K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

| December 2024 | $2,621,732 | (2.4%) |

| January 2025 | $2,689,706 | 2.6% |

| February 2025 | $2,665,053 | (0.9%) |

| March 2025 | $2,581,708 | (3.1%) |

| April 2025 | $2,588,737 | 0.3% |

| May 2025 | $2,711,140 | 4.7% |

| June 2025 | $2,818,049 | 3.9% |

| July 2025 | $2,836,370 | 0.7% |

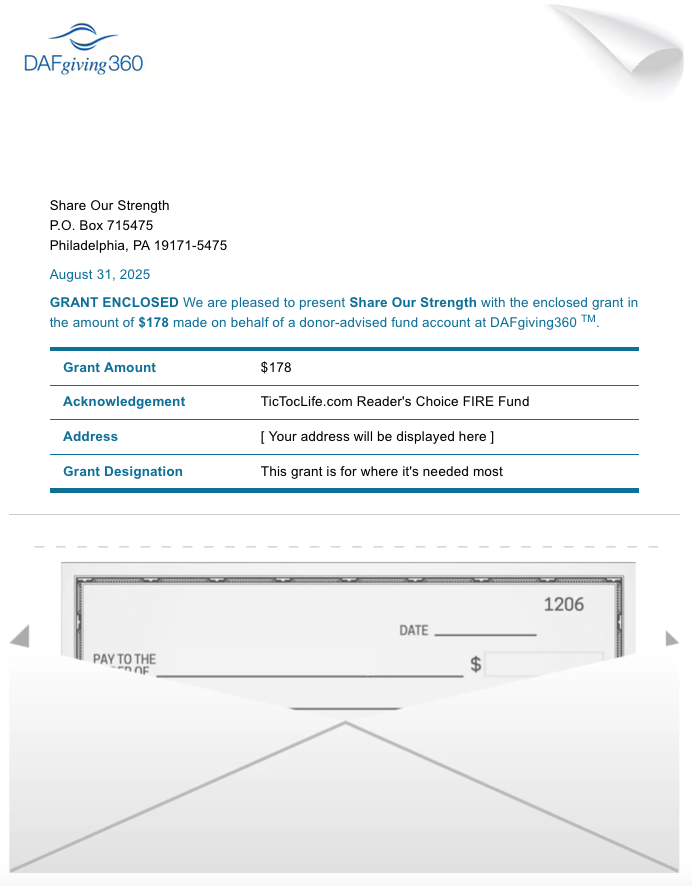

Previous Donation Winner

Summertime is almost at an end, at least for the kids going back to school. While it is sad for some, many will welcome the end of summer knowing they won’t have to worry about mealtimes as much. Our donation this month goes to No Kid Hungry by Share Our Strength. They’ve been helping families supplement summertime meals with food assistance programs and SUN Bucks grocery benefits.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 4 years. We’ve given almost $8,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates supporting: Ukraine.

Charity Round-Up

While we traveled through Central Europe, support for Ukraine was all around us. We saw Ukrainian artisans fundraising at the markets, street art depicting a Ukrainian burnt out car, refugees working at restaurants, and the yellow and blue Ukrainian flag flying around town. It reminded us that the war wasn’t very far away from us and the importance of bring the war to an end. So in honor of Ukraine’s Flag Day on August, 23 and their Independence Day on August 24, we nominate the following charities in support of Ukraine’s independence.

Each of these organizations are raising awareness and advocating for Ukraine to remain free and supplying essential live saving supplies. They have excellent charity ratings. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Guidestar profile which details the nonprofit’s operations and transparency.

1) Hope for Ukraine, Inc.

Why? We all need access to a reliable source of energy. Almost everything we do relies on power and without it, we suffer in many ways. Solar power generators are providing a long term solution for families living without.

Where? Ukraine and Ghana.

What? Hope for Ukraine, Inc. is a humanitarian non profit started in 2016. They support Ukraine by providing everyday and first aid essentials, distribute hot meals and food supplies. They have a focus on restoring childhood education and happiness. Their Solar Energy Resilience Program provides a long term solution for those without access to power. Solar power generators have been distributed to families on the frontline. These units provide 8 hours of power for families to cook, use appliances and power their phones and lights. This is a gap step measure but power will not likely be properly restored for 5-10 years to these areas.

2) Nova Ukraine

Why? Often you need more than just a first aid kit to treat a patient. Medical teams need access to advanced technology they are used to in hospitals and clinics. Beyond caring for those wounded in battle, air strikes or from falling rubble, there is still every day emergencies needing attending to.

Where? Ukraine

What? Nova Ukraine is a humanitarian non profit international charity formed in 2014. Their current projects include educational support, advocacy for Ukraines independence, and delivering medical supplies. In addition to their Rapid Response Team supporting survivors and treating victims on the spot, they have mobile medical and dental care units. These mobile services bring hospital services to those in need. Many hospitals have been completely destroyed and equipment damaged. Having access to ambulances, wound VACs, X-Ray machines, and portable ultrasound machines, has been a literal lifesaver for the people of Ukraine. Their dental care units focus on urgent oral health and dental pain for those suffering from pain.

3) United Help Ukraine

Why? Having access to medical supplies is essential but knowing how to use them is key. One of the many Defenders Aid Programs focuses on supplying first-aid tactical medical supplies and training. This educational component ensures supplies are having the most effect.

Where? Ukraine

Our Notes: United Help Ukraine, is a medical and humanitarian non profit charity formed in 2014 by people who came together in support of Ukraine at rallies and events in Washington, D.C. One of their Defenders Aid Programs is Tacmed Ukraine. It is a tactical medicine project aimed at providing first aid and medical training to the defenders and combat medics fighting for Ukraine’s freedom. They supply specialized backpacks filled with first aid essentials and tourniquets, then teach basic medical skills for any soldier to be able save lives on the spot. Over 10,000 defenders have been trained in these tactical medical techniques and tools and more than 50,000 backpacks have been distributed.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

Yet again, we’re set for a trip to Europe in August. Yep, it’s a lot lately! But, for good reason—it’s a great place to visit! The timing works, for us too. We’ll have to share a little more about our experience when time is available to do so.

Things are pretty smooth sailing for us after all these months of moving our paid labor hours down and really taking advantage of the freedom FIRE offers. We’re glad to have this time to adventure in life!

Has AI got you concerned about your investment future?

Let us know in the comments or on Threads and X (Twitter)!