Sadly, our family suffered a loss this month as Chris’s grandfather passed at the age of 92. Our beautiful Christmas holiday shared the juxtaposition of remembrance and celebration with family. We planned a trip out to Phoenix for the celebration of life and to see Chris’s family. While on the west coast, we booked a trip down to western Mexico in Puerto Vallarta to make use of a soon-to-expire set of Marriott hotel certificates, have some time to appreciate our short lives on this earth, and escape from Virginia’s winter.

For our monthly donation, our theme is surviving winter. You can read more about the three charities we’re considering and vote for your favorite in the poll below!

We track our income, spending, and savings each month to stay on our FIRE path and share it with you. Keep reading to see our monthly updates, tips, and charity reviews.

Budget Update

In the Sankey diagram below, the income on the left matches our expenses on the right.

We’ll run through the income and expense sources for the month and remark on any interesting items.

Income Summary

With the year’s end, typically our income gets a big boost from investment dividends and end of year business distributions. This year was no different. And, Christmas somehow wound up with us receiving more “gifts” than giving!

Dividends

Our 2025 dividend Christmas has arrived! Most of these distributions are from Vanguard funds like VTSAX. This represents an increase of about 21% over 2024’s December dividends. About a quarter of our distributions were automatically reinvested.

We earned $28,237 in total distributions.

Accountable Plan

If you’re interested in the details of how an accountable plan for businesses works, check out this original post.

Chris’s business reimbursed him for the use of our house, utilities, health insurance, and other expenses. This reimbursement covers expenses for the fourth quarter of 2025.

Chris was reimbursed $1,355.

eBay

Another good month for us on eBay. We mentioned selling a stove burner last month—pretty funny!—and, well, we sold the second one we had this month. The second one earned about $22 in profit for picking up some “trash”, looking it up, posting, and shipping it off. We also sold a blanket that was a gift (sometimes this is best rather than not accepting gifts; we already have many) for about $56 after fees. Chris sold off a pair of shoes for $71 which he purchased as apart of a larger deal to bring prices down for the other purchases.

We earned $149 from eBay sales.

Expense Summary

From our $33,253 monthly budget, we saved and invested $28,571 dollars.

After subtracting our credits, savings, and donations—we spent about $4,672 on living expenses.

That’s 98% of our FIRE budget from 2022 ($4,787/month).

Let’s break down some of the more exciting details this month.

Food & Dining

As in recent months, our food expenses are fairly stable as we’ve been home for a longer stretch.

Groceries

Between some pretty fantastic Instacart offers and local end-of-year closeout sales, our grocery expenses were low this month at $440. We’ve been taking advantage of the Chase Instacart promos monthly (about $100 between the two of us), but were able to really double-down with additional stacking promotions. On top of that, one of our favorite local luxury stores had a variety of shelf-stable items and Christmas treats marked down either 75% or straight to $1. Fantastic!

Restaurants, Fast food, Alcohol & bars

Despite the holiday season, our dining out was pretty limited. A lot of our gatherings with friends and family were done at various houses with lovely potluck style get togethers. We did treat each other to one fancy date night that cracked $100, but, with a $50 Resy credit from Chris’s AMEX—the price came down to a much more reasonable below $70. It helped that our Mexico visit was all-inclusive so most of our cost was tips!

We spent $549 on food & dining this month.

Shopping

As in recent months, our food expenses are fairly stable as we’ve been home for a longer stretch.

Electronics & Software

Jenni upgraded her Apple Watch Series 6 to a Series 8. Even used, we managed to find one on eBay with perfect battery health and good condition. We added a case to protect it for a total of $130. We’ll aim to sell of her old watch for around $80 next month.

Clothing

We picked up a variety of clothing replacements and upgrades—primarily from Costco. A special deal allowed us to buy about 20 pairs of high quality, mostly merino wool socks for the two of us at a very low price. In order to maximize the promo, we also bought some underwear and a set of chore pants/shirt for Chris. Jenni also bought a pair of earrings and some other undergarments.

We spent $313 on shopping this month.

Arizona & Puerto Vallarta Travel Summary

We took an 12-day trip to Phoenix, AZ to see family which we combined with an escape to Puerto Vallarta, MX to enjoy a tropical reprieve from December 8 to December 19. We centered it around utilizing five night Marriott hotel certificate in Mexico and visiting family in Phoenix.

Let’s break down our trip budget.

We’ll include all expenses we incurred for the trip—even groceries, restaurants, and amusement. But we’ll skip expenses that we incurred during the trip that were not part of the trip (for example, our utility bill back home in Virginia).

Trip cost table

Let’s take a look at our total trip cost. In the table below, you’ll find four columns:

- Description: a summary of what the expense was for. We’ve included some basic geographical information for things like flights or hotels.

- Cost: our incurred expense in US dollars for the described line item. In some cases, this appears as zero. If a travel currency like hotel points, airline miles, or a credit card reward certificate covers the total expense, we record a zero here. Sometimes, there’s a minor fee in addition to using points/miles for surcharges or taxes.

- Rewards Points/Miles: we maximize our credit card rewards and frequent traveler currencies to cover the costs of our travel wherever possible. You’ll see a short description of the type of certificate or currency that we used.

- Estimated Value: when using a reward from the previous column to cover an expense, we record what we would have otherwise paid for the line item. This gives us a sense of our savings.

The table is generally in chronological order.

We still incurred expenses at home (mortgage, utilities, etc.)—but these do not appear as part of our trip costs.

| Description | Cost (USD, $) | Rewards Pts/Miles | Est. Value (USD, $) |

|---|---|---|---|

| Flight—RIC→PHX (2x, Economy) | 318.00 | ||

| Flight—PHX→PVR (2x, Economy) | 129.72 | 12,000 Atmos Miles | 438.00 |

| Flight—PVR→RIC (2x, Economy) | 208.48 | 21,000 AA Miles | 750.00 |

| Hotel: Delta Hotels Nayarit (Marriott)—5 nights | 711.13 | 5x Free Night Certificate + 32,000 Marriott Pts | 1,967.76 |

| Dining—restaurants, fast food | 7.82 | ||

| Groceries | 11.12 | ||

| Amusement—beach massage | 72.39 | ||

| Tips—room, drinks, shuttle | 57.25 | ||

| Rideshare—to/from Airports | 65.27 | ||

| Phone eSIM (2x) | 8.00 | ||

| Total | 1,589.18 | 65,000 Pts/Miles + 5x FNC | 3,155.76 |

Trip cost discussion

We spent about $1,589 on a 12 day trip for two people. That’s just $132/day (or about $66/person). The portion with family we quite frugal—staying with Chris’s parents and simply visiting with family—but the part in Mexico was quite luxurious at an all-inclusive resort with friends.

Our flight-specific spending was $656 in cash plus 33,000 miles. That’s for three flight itineraries for two people. Had we not used those miles, the costs would have been $1,506—saving us $850. That’s about 2.6c per mile!

Similarly, we booked two rooms for four people at the Delta Hotels Riviera Nayarit. We lucked out and these two rooms ended up forming our very own private villa with the rooms connected. Very lovely!

We paid for one room in cash, minus a contribution—they insisted!—from friends and the second room with Jenni’s recent Bonvoy card signup bonus. The cash rate for the two rooms would have been about $1,968. Our five night certificate and 32,000 points saved us about $194/night.

Summary—

Instead of about $3,423—we spent just $1,589 on this trip by using miles for our flights and a set of hotel certificates to stay at a luxurious all-inclusive hotel on Mexico’s west coast.

Most importantly, we had the opportunity to say goodbye to a beloved family member, spend time with family, and enjoy friendships we’ve had for many years with beautiful views from a tropical winter getaway.

Expense Conclusion

While that covers the big stuff, we still had a few random things or small purchases to mention that might be of interest.

Health Insurance

December marked the first month we paid the widely publicized elevated health insurance cost for one of us—Chris’s. The increase for him is $68.17/month. We expect to see a similar increase for Jenni next month when she makes her first increased rate payment. It’s a very large relative/percentage increase, but in absolute terms, it’s clearly a pretty small increase relative to our budget. We decided to continue the same plans we had in 2025 for 2026.

Health insurance was about $109.

License Renewal

Jenni continues to maintain her pharmacy license which means continuing education classes and an annual license fee. At $120, it’s a significant expense, but also easily worth it to maintain her ability to earn income if desired!

ⓘ Curious about some of the other expenses that we didn’t address? We’ve written about every expense in this month’s diagram either in this post or in the past. Check out our previous budget updates for more details or ask in the comments below!

How Much We Work

We like to keep track of how much time we spend doing work that is paid.

Let’s add this month to the list…

History of Monthly “Hours Worked”

| Month | Chris (Hours Worked) | Jenni (Hours Worked) |

|---|---|---|

| May 2020 | 41 | 108 |

| Jun 2020 | 38 | 96 |

| Jul 2020 | 36 | 120 |

| Aug 2020 | 39 | 48 |

| Sep 2020 | 27 | 76 |

| Oct 2020 | 26 | 104 |

| Nov 2020 | 27 | 57 |

| Dec 2020 | 28 | 57 |

| Jan 2021 | 25 | 102 |

| Feb 2021 | 24 | 104 |

| Mar 2021 | 24 | 106 |

| Apr 2021 | 23 | 85 |

| May 2021 | 17 | 29.75 |

| Jun 2021 | 19 | 66 |

| Jul 2021 | 21 | 30.25 |

| Aug 2021 | 23 | 16.5 |

| Sep 2021 | 26 | 28 |

| Oct 2021 | 22 | 49 |

| Nov 2021 | 21 | 51 |

| Dec 2021 | 64 | 27 |

| Jan 2022 | 32 | 80 |

| Feb 2022 | 29 | 63 |

| Mar 2022 | 14 | 70 |

| Apr 2022 | 15 | 21 |

| May 2022 | 14 | 36 |

| Jun 2022 | 6 | 12 |

| Jul 2022 | 13 | 45.5 |

| Aug 2022 | 15 | 96 |

| Sep 2022 | 12 | 54 |

| Oct 2022 | 14 | 34.5 |

| Nov 2022 | 12 | 72 |

| Dec 2022 | 11 | 16.5 |

| Jan 2023 | 10 | 88 |

| Feb 2023 | 11 | 81.5 |

| Mar 2023 | 12 | 47.5 |

| Apr 2023 | 8 | 1 |

| May 2023 | 16 | 100 |

| Jun 2023 | 10 | 109 |

| Jul 2023 | 12 | 48 |

| Aug 2023 | 16 | 54.5 |

| Sep 2023 | 9 | 20 |

| Oct 2023 | 14 | 22 |

| Nov 2023 | 15 | 22 |

| Dec 2023 | 16 | 12 |

| Jan 2024 | 12 | 61.25 |

| Feb 2024 | 14 | 28.5 |

| Mar 2024 | 16 | 61.5 |

| Apr 2024 | 12 | 22 |

| May 2024 | 8 | 19.5 |

| Jun 2024 | 18 | 19.5 |

| Jul 2024 | 14 | 44 |

| Aug 2024 | 18 | 81 |

| Sep 2024 | 15 | 20 |

| Oct 2024 | 18 | 51 |

| Nov 2024 | 5 | 15 |

| Dec 2024 | 19 | 12 |

| Jan 2025 | 17 | 17.5 |

| Feb 2025 | 4 | 8 |

| Mar 2025 | 14 | 12 |

| Apr 2025 | 3 | 11 |

| May 2025 | 14 | 33 |

| Jun 2025 | 12 | 2 |

| Jul 2025 | 12 | 13 |

| Aug 2025 | 16 | 13.5 |

| Sep 2025 | 12 | 30 |

| Oct 2025 | 13 | 40 |

| Nov 2025 | 12 | 22.5 |

| Dec 2025 | 13 | 16 |

Jenni earned a year-end bonus even as a part-time employee at her pharmacy. That, plus some labor hours, created a nice little 401(k) contribution for her to close out the year. We clocked a little under 30 hours this month together.

Net Worth Update

Net worth is not our primary measurement, and can understand it can be discouraging if you’re working yourself out of debt. We also understand it’s difficult to be transparent with our readers without divulging this information, so we continue to do so.

Account breakdown

Even with the wild swings in the market lately, our investments continue to be pretty stable. From a high level, our assets and liabilities are shown in the data table below as of December 31, 2025.

| Description | Value (USD, $) |

|---|---|

| 401(k) | 1,241,491 |

| Brokerage | 1,093,001 |

| Roth IRA | 266,887 |

| Traditional IRA | 46,263 |

| HSA | 70,940 |

| Real Estate | 454,600 |

| Mortgage | (129,167) |

| Miscellaneous Assets | 25,000 |

| Checking & Savings | 8,907 |

| Net Worth | 3,077,922 |

- Miscellaneous assets include specific investments we’ve made in physical assets (think collectibles) and treasury bonds

- Amounts do not reflect the value of the businesses Chris owns or their assets, which should appear as income to us over future years

- Jenni’s Prius is omitted

The S&P 500 was up just 0.5% for the month.

We were up about 0.4%—basically inline with the market.

Overall, our net worth increased by around $12K this month.

Net Worth History

| Date | Amount | % Change |

|---|---|---|

| July 2020 | $1,555,289 | – |

| August 2020 | $1,597,334 | 2.7% |

| September 2020 | $1,566,393 | (2.0%) |

| October 2020 | $1,568,182 | 0.01% |

| November 2020 | $1,720,113 | 9.6% |

| December 2020 | $1,810,864 | 5.3% |

| January 2021 | $1,860,996 | 2.8% |

| February 2021 | $1,878,154 | 0.9% |

| March 2021 | $1,918,269 | 2.1% |

| April 2021 | $2,010,849 | 4.8% |

| May 2021 | $2,049,213 | 1.9% |

| June 2021 | $2,093,896 | 2.2% |

| July 2021 | $2,092,153 | (0.1%) |

| August 2021 | $2,130,761 | 1.8% |

| September 2021 | $2,070,730 | (2.8%) |

| October 2021 | $2,151,272 | 3.9% |

| November 2021 | $2,095,273 | (2.6%) |

| December 2021 | $2,160,235 | 3.1% |

| January 2022 | $2,055,292 | (4.9%) |

| February 2022 | $2,058,001 | 0.01% |

| March 2022 | $2,134,428 | 3.7% |

| April 2022 | $1,968,069 | (7.8%) |

| May 2022 | $1,975,569 | 0.04% |

| June 2022 | $1,868,397 | (5.4%) |

| July 2022 | $1,975,608 | 5.7% |

| August 2022 | $1,878,352 | (5.2%) |

| September 2022 | $1,735,997 | (7.6%) |

| October 2022 | $1,820,287 | 4.9% |

| November 2022 | $1,920,635 | 5.5% |

| December 2022 | $1,866,513 | (2.8%) |

| January 2023 | $1,953,691 | 4.7% |

| February 2023 | $1,882,656 | (3.6%) |

| March 2023 | $1,969,566 | 4.6% |

| April 2023 | $1,981,934 | 0.6% |

| May 2023 | $1,995,247 | 0.7% |

| June 2023 | $2,092,479 | 4.9% |

| July 2023 | $2,189,821 | 4.7% |

| August 2023 | $2,140,296 | (2.2%) |

| September 2023 | $2,042,865 | (4.6%) |

| October 2023 | $2,015,648 | (1.3%) |

| November 2023 | $2,157,404 | 7.0% |

| December 2023 | $2,261,458 | 4.8% |

| January 2024 | $2,296,269 | 1.5% |

| February 2024 | $2,365,110 | 3.0% |

| March 2024 | $2,434,250 | 2.9% |

| April 2024 | $2,371,284 | (2.6%) |

| May 2024 | $2,423,205 | 2.2% |

| June 2024 | $2,472,353 | 2.0% |

| July 2024 | $2,513,877 | 1.7% |

| August 2024 | $2,560,215 | 1.8% |

| September 2024 | $2,592,558 | 1.3% |

| October 2024 | $2,576,903 | (0.6%) |

| November 2024 | $2,685,615 | 4.2% |

| December 2024 | $2,621,732 | (2.4%) |

| January 2025 | $2,689,706 | 2.6% |

| February 2025 | $2,665,053 | (0.9%) |

| March 2025 | $2,581,708 | (3.1%) |

| April 2025 | $2,588,737 | 0.3% |

| May 2025 | $2,711,140 | 4.7% |

| June 2025 | $2,818,049 | 3.9% |

| July 2025 | $2,836,370 | 0.7% |

| August 2025 | $2,915,960 | 2.8% |

| September 2025 | $3,012,036 | 3.3% |

| October 2025 | $3,067,605 | 2.3% |

| November 2025 | $3,066,024 | (0.05%) |

| December 2025 | $3,077,922 | 0.4% |

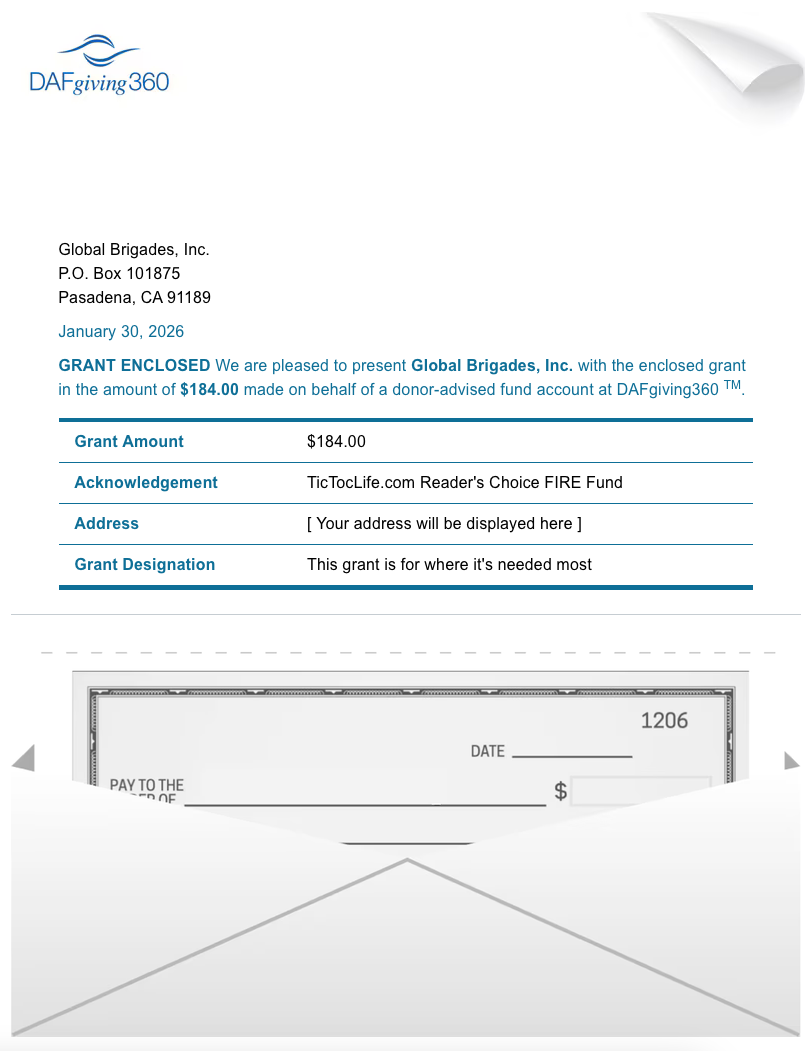

Previous Donation Winner

Healthcare is not a one and done situation. People need ongoing support and proper follow up to be well. Global Brigades, our poll winner this month, provides free services via mobile clinics on a regular cycle. This ensures patients are properly followed throughout the year.

Our Reader’s Fund seeks to leverage the principles of FIRE to build a lifetime of giving.

Thank you for your participation in our polls over the last 5 years. We’ve given $9,000 to deserving charities with your help in deciding which organizations to donate to.

Polls are now open for our next round of candidates: Winter Survival Charities.

Charity Round-Up

This winter has been brutal. Snow and ice storms, with consistent below freezing temperatures, makes living without basic needs that much harder. When it is this cold outside, a focus on survival is key to make it through.

Each of these organizations helps vulnerable people survive the winter months by providing winter gear, shelters, and nutrition. They each have great charity ratings. We invite you to learn more about great work around the world and join us in donating to one of them by casting your vote.

Summaries below include the impact metrics and a link to their Candid profile, which details the nonprofit’s operations and transparency.

1) Penny Appeal USA

Why? Their Winter Relief Programs provide winter essentials for families at a low donation cost.

Where? Afghanistan, Lebanon, Pakistan, Syria, Palestine / Gaza, and The United States.

What? Penny Appeal USA is a nonprofit organization with the mission to tackle the root cause of poverty. Some of their key programs focus on nutrition, access to clean water, domestic support, healthcare, education, and emergency response. During the cold months, they operate Winter Relief Programs. Donations from $50 to $100 provide winter kits containing warm essentials such as blankets, warm outdoor wear and shoes, and bedding items for individuals or entire families. In addition to the above, they are able to distribute food packs containing supplies for nourishing meals and offer shelter for an entire family for a month with higher level donations of $500. In some areas, they provide fuel for safe heating and cooking in their shelters. At smaller scale centers, they distribute hand warmers and jackets for those living outdoors.

2) Muslim Aid America

Why? This global organization has a long history of providing winter care for many communities.

Where? Globally

What? Muslim Aid America is a nonprofit humanitarian charity with the mission to support victims of natural disasters or conflicts, those suffering from homelessness, poverty or disease, or general lack of opportunity. Some of their key programs focus on food security, access to clean water, education and economic empowerment, orphan support, and emergency and disaster relief. During the cold months, they operate a Winterization and Winter Appeal program. These programs focus on surviving the winter by offering food, shelter, and warmth. They distribute warm clothing, blankets, and essential supplies to stay safe and warm. Another winter campaign is to raise funds for heating, insulation support, and other urgent seasonal needs.

3) Winter Walk Inc.

Why? This smaller organization works to raise awareness, break stigma and end homelessness in the United States through community fundraising events.

Where? The United States

What? Winter Walk Inc. is a nonprofit organization that advocates to end homelessness. The winter months are when the unhoused population suffer the most so this is when they host their multi-city winter walks to fundraise. These walks are designed to bring communities together and highlight the needs for this vulnerable population. 100% of the funds raised are passed directly to nonprofit partners providing shelter, food, healthcare, and other essential services for those experiencing homelessness. Throughout the year, they operate the HEAL Program (Homelessness, Education, Advocacy and Leadership). This program holds workshops and storytelling initiatives to education the community about the issue.

Nonprofit poll

After reviewing the list above, please take a moment to vote for which nonprofit you think will put funds to use in the best way.

(Have trouble using or seeing the poll above? Some reader tools or apps may not display it. View this page in a browser or use this link to our Reader Fund page, which has a copy of the poll!)

Thank you for taking the time to vote!

One of our primary goals with TicTocLife is building a stream of giving within the FIRE community, and that starts with knowledge.

Want to hear about the results? Sign up for our free FIRE Insider newsletter! We send it out every few weeks and include the monthly poll results and donation winners. You can see an archive of the FIRE Insider and sign up here!

What’s Next

We mentioned last month we’d have a little project we’d like to talk about this month. Unfortunately, we’ve delayed a little with the loss of Chris’s grandfather. We’ll have an update in February!

In January, we’ll mostly hunker down for the chilliest part of winter while getting some of new year tasks done, planning completed, and so on. Plus, we’ll take a short trip to Florida to escape from the harshest days while using up a few more hotel certificates before they expire.

How’d your December holiday celebrations go?

Let us know in the comments or on Threads and X (Twitter)!